Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Federal Reserve has revised its projection for the federal funds rate at the end of 2024 to 5.1%, which is higher than the previous estimate of 4.6% in June. This adjustment indicates the Fed’s intention to maintain higher interest rates for a longer period. The Fed continues to rebut the idea of swift rate cuts in 2024.

- If Congress fails to pass annual appropriation bills or a stopgap funding measure before Oct. 1, there is a possibility of a partial federal government shutdown. However, the economic consequences of such a shutdown are significantly less severe compared to those associated with the debt ceiling.

- The Conference Board’s Consumer Confidence Index dropped to a 4 month low this month. Consumers are citing concerns over higher interest rates and price inflation, particularly in food and gasoline.

- The S&P 500 is down –6.30% since its year-to-date high point on 7/31/23 and is sitting at the lowest levels since this June. Still, the index is up 12.44% for the year and ~20% from the October 22 low.

- Higher interest rates and relatively strong economic growth have contributed to the U.S. Dollar hitting a multi-month high. The Dollar strengthened against a basket of currencies for a 10th consecutive week. While there are growth concerns in the U.S., the environment in Europe and China has been even more difficult, making the U.S. look better on a relative basis and helping the Dollar appreciate.

- Oil prices have risen further as markets factored in the influence of Saudi Arabia and Russia’s decision to extend production cuts until the end of the year. WTI Crude Oil crossed above $90/barrel, highlighting concerns about limited supply.

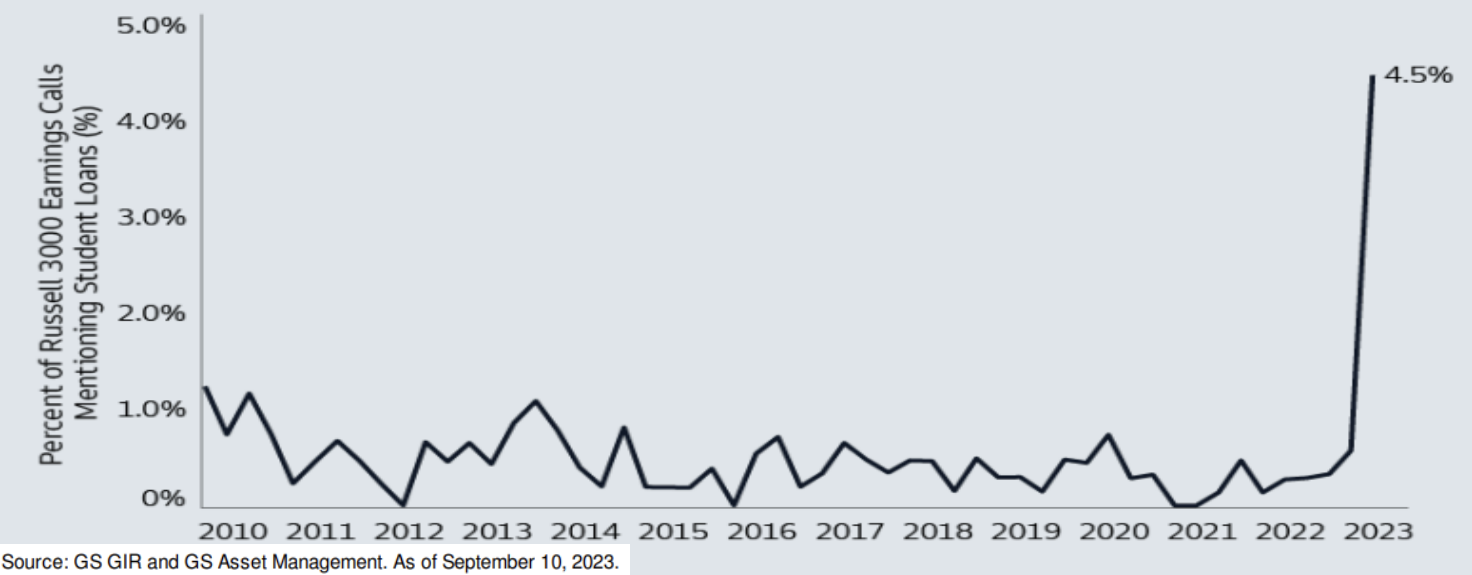

Companies mentioning student loan repayment in 2nd quarter earnings calls have jumped from below 1% to 4.5%. The increase hits on a concern that the resumption of student loan repayments could be a headwind on consumer spending. Although there will likely be some impact, our belief is that it will be mild and digested over time as some borrowers may not immediately resume payments and others may qualify for the repayment plan proposed by the Biden administration.

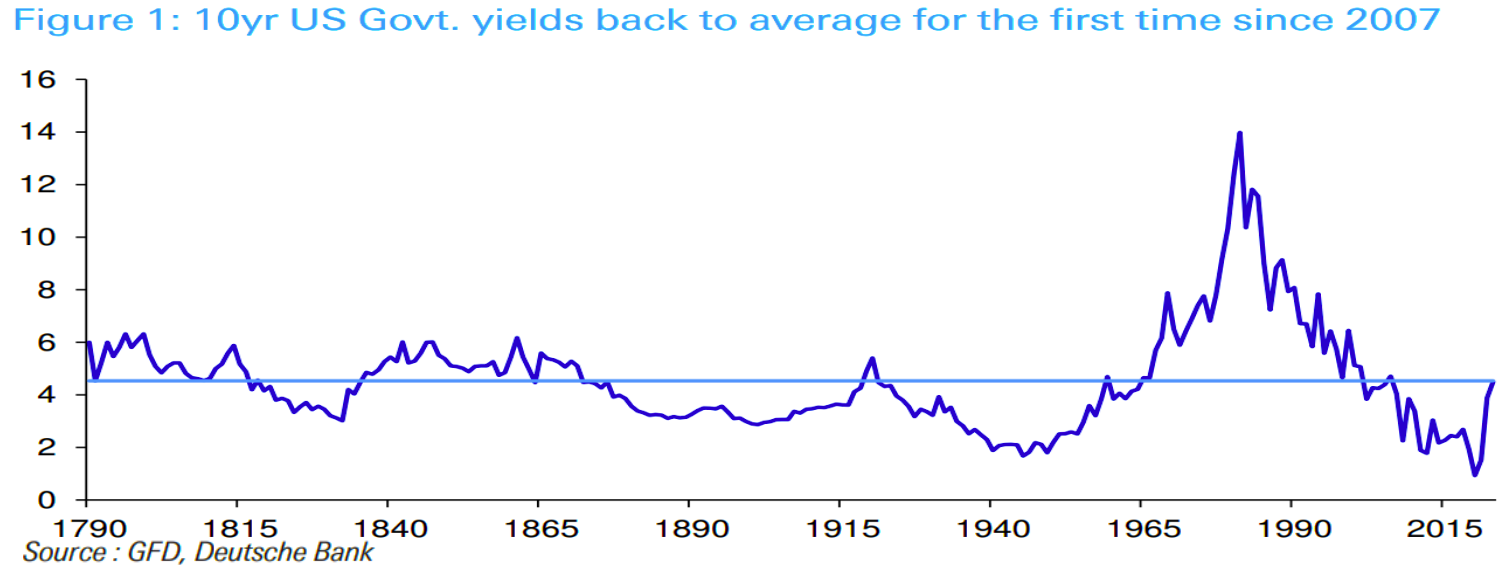

Interest rates have continued to trend higher through September. The yield on the 10-Year Treasury reached 4.6% and is at the highest level since 2007. The rise has been dramatic, but we are just getting back to what has been the long-term historic average. Certain areas of the economy may struggle to adjust in the near-term, but interest rates at these levels should not be viewed as overly restrictive through a longer-term lens.

The hurdles driving market volatility are starting to add up; Fears of a government shutdown, more union strikes, rising oil prices, student loan payments, and higher treasury yields. All happening during September, which has historically been the weakest month of the year for stocks. However, investors are still weighing those negatives against the positives that remain in place such as employment and credit markets that have held up better than expected. As a result, the decline in stocks has remained relatively mild so far. And while a potential government shutdown should have less of an impact on volatility compared to the risk of a U.S. default like we had with the debt ceiling standoff earlier this year, it could still muddy the waters for markets. If there’s a government shutdown, the agencies that release some of the economic data e.g. The Bureau of Labor Statistics, may not report the latest figures. Without up to date jobs and inflation figures for an extended period of time, the markets could have a difficult time trying to anticipate whether the Fed will be getting more restrictive or more accommodative in the future. Adding to that, the union strikes could also skew whatever economic data is available. So while a brief government shutdown could be a non-event, a prolonged shutdown could increase uncertainty around how the economy is performing and would likely weigh on market sentiment.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.