Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Consumer Price Index (CPI) measure of inflation increased by 0.3% in April compared to March, slightly below the consensus forecast of 0.4%. Core inflation (excludes food and energy prices) also rose by 0.3%, in line with expectations. On a year-over-year basis, prices climbed by 3.4% in April, down from 3.5% in March. The figures are still well above the levels needed to give the US Federal Reserve the confidence to cut rates soon.

- In May, US business activity growth accelerated to its fastest pace in over two years, according to provisional Purchasing Manager’s Index (PMI) survey data from S&P Global. The service sector led the upturn, reporting its largest output increase in a year, while manufacturing also showed stronger growth. The pickup in activity is positive, however the report also showed a surge in prices for a range of inputs, which could precipitate more goods inflation.

- The Conference Board’s Consumer Confidence Index rebounded by 4.5 points in May to 102.0, surpassing the consensus estimate of 96.0. Although confidence is still below its peak earlier in this cycle and pre-pandemic levels, it remains consistent with continued economic expansion.

- U.S. stocks rallied throughout most of May, with the S&P 500 index reaching new all-time highs on 5/21/24. The recent surge was driven by certain economic data points perceived by investors as soft enough to suggest potential for further interest rate cuts, but not weak enough to raise concerns about a near-term recession.

- Interest rate movements remain extremely volatile. After rising to nearly 4.75% in April and then falling to 4.30% in May, the yield on the 10-year Treasury climbed to around 4.62% in the final weeks of May. The swings illustrate ongoing market uncertainty around how the Fed will manage interest rates.

- Less than 6 months after approving Bitcoin Exchange Traded Funds (ETFs), the Securities and Exchange Commission (SEC) approved a rule change on 5/23/24 that allows exchanges to list spot Ethereum (2nd largest cryptocurrency next to Bitcoin) ETFs. The rule change doesn’t mean there will be immediate listings of Ethereum ETFs, given each product still requires individual approval from the SEC.

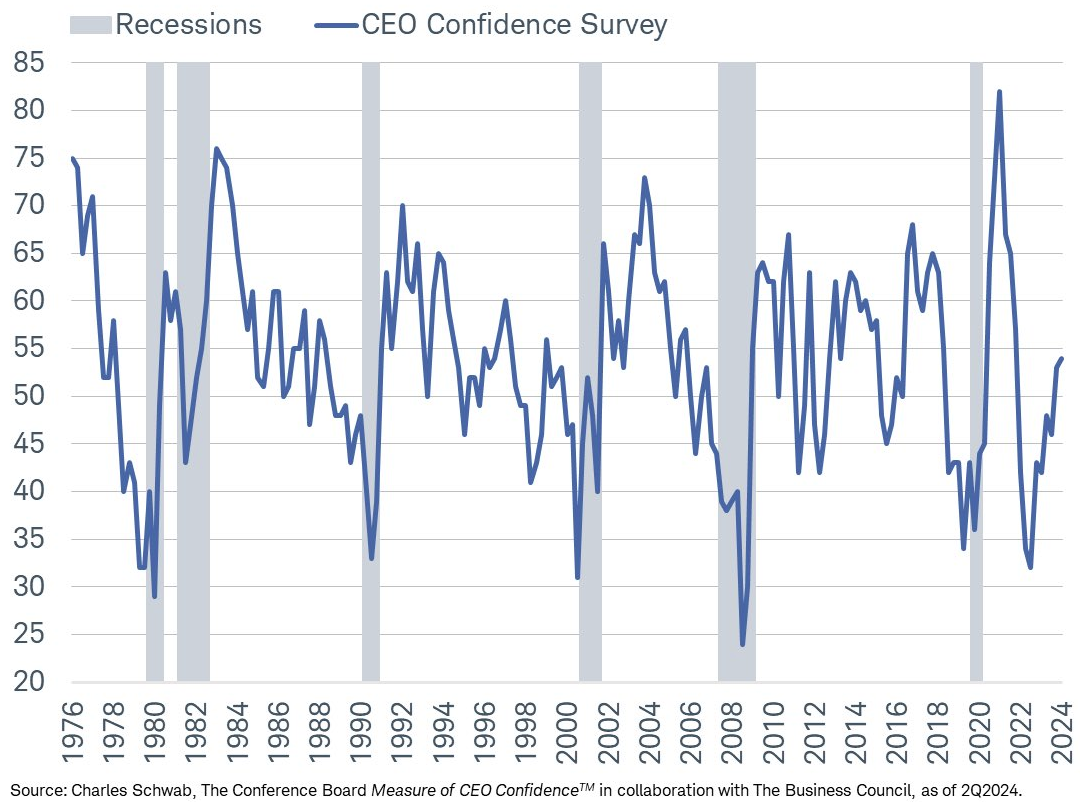

In addition to higher consumer confidence levels, CEOs are also reporting some optimism despite higher interest rates and stubborn inflation. After 2 years of pessimism, the Conference Board’s CEO Confidence Index has moved higher in the 2nd quarter of 2024 and has been above 50 for the 2nd consecutive quarter. A reading above 50 reflects more positive than negative responses from the CEOs that are surveyed. This sentiment along with resilient earnings growth could bode well for future business spending, Mergers & Acquisitions, and stock repurchases.

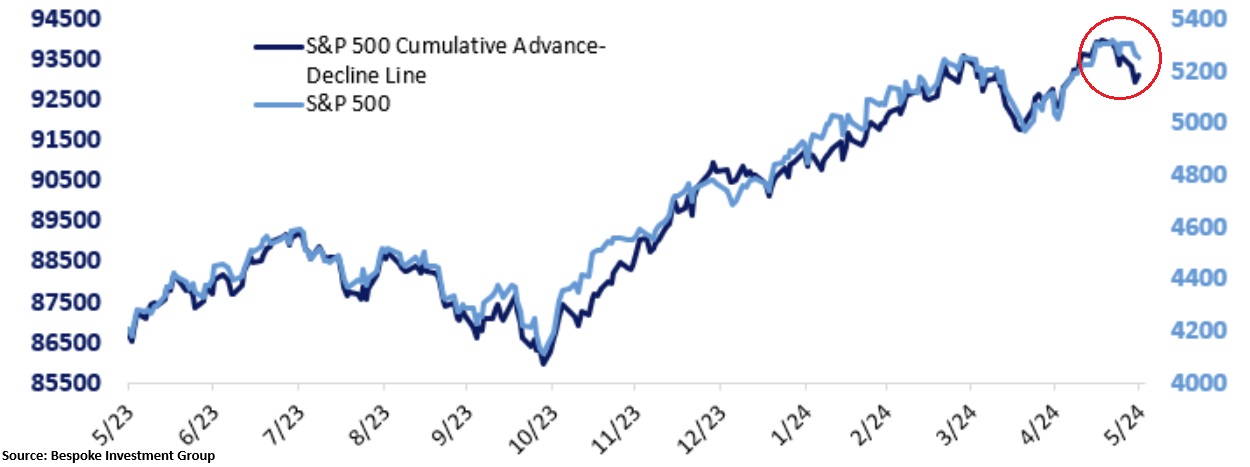

The stock rally since last October’s lows has been supported by strong breadth. The cumulative advance-decline line, a breadth indicator that plots the difference between the number of advancing and declining stocks in the S&P 500, has largely mirrored the index’s price. Technical analysts use breadth to confirm market moves. The belief is that rallies driven by a wide range of stocks are more sustainable and reflective of broader market sentiment. In the past week, breadth has weakened more than the S&P 500 index’s price, meaning less stocks are participating in the rally now. Although this doesn’t necessarily mean the market is in store for a downturn, additional caution is warranted.

The market volatility from April largely subsided through May, with the S&P 500 reaching new all-time highs. This rally has been driven by a combination of stable earnings and ongoing optimism around Artificial Intelligence. The first-quarter corporate earnings season is concluding, with most S&P 500 companies having reported generally favorable results. According to FactSet, topline S&P 500 earnings grew by 6% year-over-year, outperforming analysts’ expectations. Corporate earnings are expected to remain on an encouraging track, supported by rising employment and wages that bolster consumer spending, the primary driver of economic growth. The market is focused on those optimistic narratives, despite a less accommodative Federal Reserve that is maintaining high interest rates and some unexpectedly high inflation reports. We’re also seeing some weakness in certain economic reports, but the market has not reacted significantly. The market appears to be pricing in expectations for a slowdown that stops short of recessionary levels, which would provide the Fed with more flexibility to cut rates if necessary. However, risks remain, particularly the potential for a broader resurgence of inflation, which could force the Fed to raise rates further, or a significant deterioration in economic growth. While there has been a wave of “risk on” sentiment, some asset prices might have been pushed too far. Unless inflation measures begin to bolster confidence again that prices are coming down further, we expect the volatility seen in April to pick back up. Volatility could also be exacerbated if Artificial Intelligence momentum, which has helped push markets higher and potentially overlook some fundamental headwinds, loses its luster.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.