Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- January retail sales fell by 0.8%, marking the largest decline since last March and indicating a slowdown in consumer spending. However, it’s common for retail sales to drop at the beginning of each year. Despite colder-than-normal weather, last month’s decrease was smaller than the average January decline since 1993.

- The Eurozone’s Service PMI (measuring non-manufacturing business activity) rose into expansionary territory for the first time since July of last year. The stabilization is a positive sign for Europe’s economy, which has had a slower post-pandemic recovery compared to the U.S.

- The Conference Board’s CEO Confidence Index rose seven points to 53 in Q1, marking the first time it has exceeded 50 in two years and signaling increased optimism among executives. This boost in confidence suggests a potential rise in capital spending in 2024 and bodes well for corporate profit expansion.

- Artificial intelligence (AI) optimism persisted in February as chipmaker NVIDIA surpassed consensus estimates for revenue and earnings-per-share. This led to a 15% surge in the stock price, propelling its market capitalization to increase by over $200 billion, marking the largest one-day gain in history.

- The bullish sentiment and momentum that started in the 4th quarter of 2023 continued through February, with the S&P 500 surpassing 5,000 level for the first time in the history of the index.

- Roughly a year from the 2023 banking turmoil that resulted in multiple bank failures, investors were reminded that issues remain. Regional Bank stocks (ticker: KRE) fell just over 11% from 1/29/24—2/7/24 driven by declines in New York Community Bancorp stock after the company cut its dividend and announced heavy losses tied to commercial real estate loans.

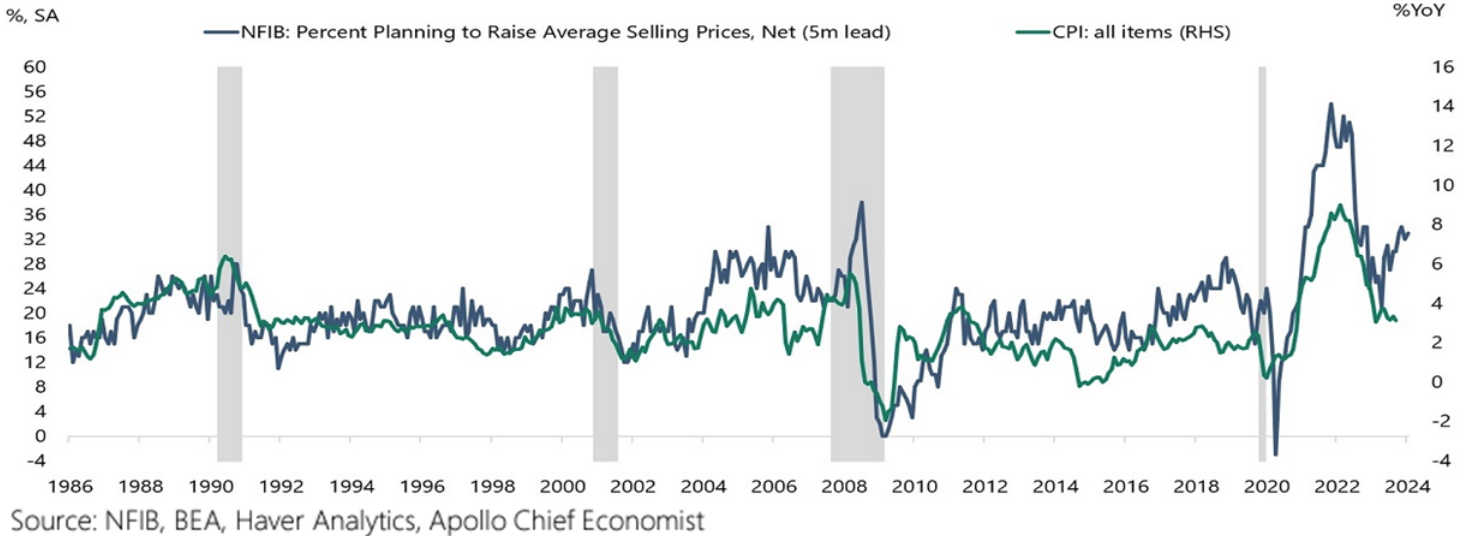

The NFIB (National Federation of Independent Business) survey of small businesses shows that the percentage of business owners planning to increase selling prices over the next three months has been climbing. This suggests that although inflation has been declining, there is a risk that higher prices will continue to impact consumers. Perhaps more importantly, any elevated inflation data could add to the Federal Reserve’s hesitancy in cutting rates.

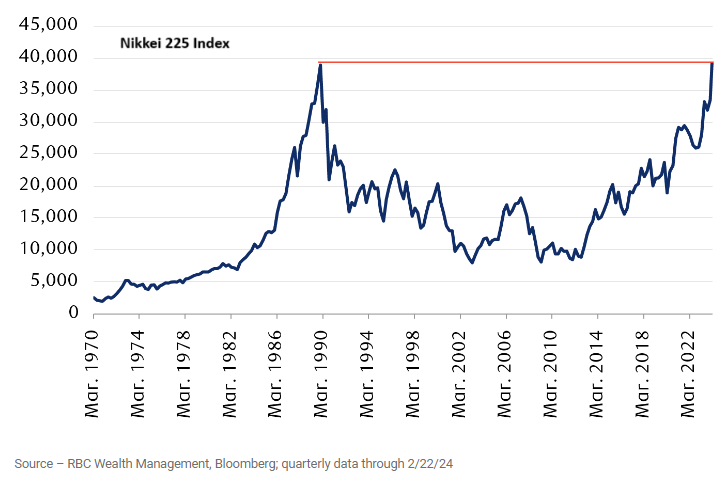

Japanese stocks have experienced a significant upward trend over the last 18 months. The Nikkei 225, an index of 225 stocks on the Tokyo Stock Exchange, recently reached its highest level in 34 years. We believe inflation and favorable corporate governance policies are driving this growth. Additionally, investors may be turning towards Japan amid geopolitical tensions and slowing growth, which are perceived as challenges for China.

The likelihood of a partial U.S. government shutdown occurring on Friday March 1st has increased significantly, but so far any related market volatility has been minimal. A partial government shutdown shouldn’t have a material impact on the economy, and thus stock investors can ignore the political drama for now. Things could change if the discourse adds to the probability of another ratings agency downgrading U.S. debt, in which case we should expect Treasury yields to rise further and that would likely pressure stocks. However, we don’t expect that will be the main catalyst driving higher yields. A more likely scenario is that inflation does not calmly retreat lower and instead experiences some periods of persistence. The Fed has already taken note of some recent inflation reports and pushed back on the market’s overly optimistic expectations for interest rate cuts. Better than expected earnings growth in the fourth quarter and Artificial Intelligence optimism has kept the market momentum up, but we are watching for waning sentiment. Another consideration in the first quarter of this year is the end of the Bank Term Funding Program (BTFP) on March 11th. This was the Federal Reserve’s emergency lending program put in place last year following the failure of Silicon Valley Bank, to help support the banking sector and prevent stress from any ‘bank runs’. The program was successful in that objective and the Fed has now determined it’s no longer needed. Still, regional banks are continuing to deal with a very challenging environment and losses on bad commercial real estate loans may need to be realized. We believe the market will be able to handle any regional bank woes, and it may ultimately provide opportunities for bigger banks or opportunistic real estate buyers. We are mindful though that any unexpected uncertainty can have a bigger impact on the downside for markets, especially when valuations are elevated.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.