- Following two straight quarters of negative growth, U.S. Gross Domestic Product (GDP) rose in the 3rd quarter at a 2.6% annualized rate. Increased energy exports added to strength and while consumer spending contributed, there were still signs of inflation and higher rates weighing on demand.

- Pending home sales in the U.S. declined by -30.4% in September compared to last year. Affordability has dropped as the average rate on a 30-year fixed rate home loan has risen above 7%, the highest since 2002.

- British Prime Minister Liz Truss resigned after just 44 days in office. This was the shortest stint for a British Prime Minister in history. Rishi Sunak was appointed as the new Prime Minister and is viewed as being more fiscally responsible than Truss.

- After reaching a new high of 4.25%, the yield on the 10-year Treasury took a breather and retreated back to around 4% in the final days of October. The brief stabilization in interest rates along with better than expected earnings so far, helped the S&P 500 rise 9.06% from its recent low point on 10/12/22.

- In an effort to improve the ongoing energy crisis in Europe, the region’s leaders are moving towards the support of price caps on natural gas. The details on how the price controls will work still need to be determined, however gas prices have already fallen in response to the announcement.

- The Bank of Japan remains one of the only major central banks maintaining ultra-low interest rate policy. The yen has been on the decline as a result and despite the government’s attempt to prop up their currency, the yen has fallen to a 32-year low vs the Dollar.

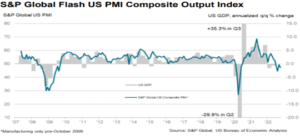

U.S. business activity contracted for a 4th consecutive month in October. The S&P Global U.S. Composite PMI Output Index, tracking manufacturing and service sectors, fell to 47.3 from 49.5 in September. A reading below 50 indicates contraction. As weakness gains momentum, the Federal Reserve may take note of the impact higher interest rates are having on the economy.

Valuations across many areas of the stock market have declined this year. Based on the next 12 month’s expected earnings, price-to-earnings multiples for both growth (e.g. tech companies) and value stocks (e.g. banking sector) have fallen below their 10-year median. Earnings releases and forward guidance from companies over the next couple of quarters will help determine if these levels will prove to be attractive entry points for future returns.

The markets continue the be heavily influenced by central bank rhetoric and expectations around interest rate policy. Following a slew of higher than initially expected rate hikes over the past several months, markets got some ‘positive’ news recently as a few central banks were less aggressive than expected or simply met expectations. The Reserve Bank of Australia only raised rates 0.25% in October versus 0.50% expected, the Bank of Canada raised 0.50% instead of 0.75%, and the European Central Bank raised 0.75% as expected. And although expectations remain firm that the Federal Reserve will hike another 0.75% in the upcoming meeting on November 2nd, some dovish commentary from Federal Reserve members have sparked hopes for slightly less aggressive moves in December and into 2023. To the extent markets have rallied in anticipation for a less aggressive Fed, caution is warranted. This optimism can be quickly unwound like markets saw in August and September if economic data does not show what the Fed is looking for; Specifically inflation levels coming down. This will likely continue to be the biggest driving force for markets through the end of the year, but other concerns are percolating. Ongoing threats of a strike among U.S. railroad unions are renewing fears of potential supply chain issues and China’s recommitment to zero-COVID policies should continue to dampen global demand. The cross-currents are keeping the market environment choppy and searching for footing. There have been some improvements though and so far earnings have kept the market from sliding meaningfully below the June lows. Still, we’re looking for more confirmation to consider this latest rally sustainable.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.