- U.S. Gross Domestic Product (GDP) rose by 2.0% in the 3rd quarter, the slowest increase of the recovery. The Delta variant, decreasing government benefits, & supply chain issues weighed on GDP, but output from spending & manufacturing is expected to ramp back up and lead to a stronger 4th quarter result.

- Core Capital Goods Orders, a proxy for overall business investment rose 0.8% in September, beating estimates of 0.4%. This emphasizes demand for goods amongst U.S. businesses is still healthy and increasing.

- Bank of England Governor Andrew Bailey has signaled that the British central bank is ready to raise interest rates this year or early 2022 due to inflation risks. They would be one of the first of the world’s largest central banks to hike rates post-pandemic.

- Commodity prices have continued to trade higher due to declining production and rising demand, resulting in dwindling stockpiles. The S&P GSCI Commodity Index, a broad based measure of commodity prices has now surpassed pre-pandemic levels.

- The U.S. Dollar strengthened to a 1-year high this month due to rising interest rates, expectations for Federal Reserve tapering, and demand for the ’safe-haven’ currency as stock market volatility picked up throughout September into early October.

- Shipping and transportation stocks have been posting strong earnings amid high demand for shipping and trucking services. Following a –10.35% decline from May to September, the Dow Jones Transportation Average rebounded in October, up 11.73% through 10/28.

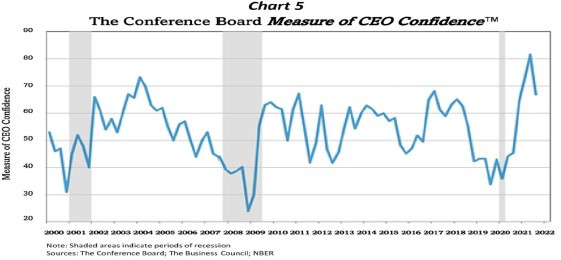

The Conference Board’s Measure of CEO Confidence survey gauges CEO’s assessment of economic conditions and optimism around spending, employment, etc.. CEO confidence reached an all time high a few months ago. Levels have since moderated, but remain very high, showing corporate leaders may be encouraged to increase capital spending on expanding operations, some of which may help resolve supply shortages.

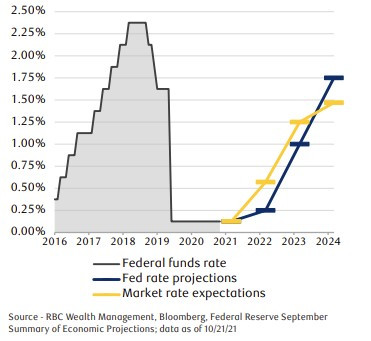

Market indicators have priced in the expectation for approximately two 0.25% rate hikes by the end of 2022 and another two hikes in 2023. This is well ahead of the Federal Reserve’s plan of one hike in 2022 and up to three in 2023. Market expectations for faster rate hikes are likely driven by higher anticipated inflation forcing the Fed to act sooner, despite their pledge to allow inflation to ‘run hot’ and remain accommodative until the labor market more fully recovers.

Recent data is beginning to show that some of the headwinds facing the consumer and economy are beginning to fade. U.S. retail sales data in September increased above expectations and consumer confidence, which has declined for the past 3 months according to the Conference Board’s Consumer Confidence Index, rebounded in October. Heading into the holiday season, households are sitting on approximately $1.7 trillion in savings, which represents 9.4% of disposable income. This is still above the pre-pandemic level of 7.4% and highlights excess capacity to spend. This bodes well for on-going strength in consumer spending, which represents roughly 70% of overall GDP in the U.S.. The struggle will be businesses’ ability to keep inventory levels high enough to meet the demand through supply chain issues. Measures are being taken to attempt to relieve the constraints. Companies such as Walmart, FedEx, and UPS will be increasing their operations and the ports of Los Angeles and Long Beach, the largest ports in the U.S., will begin running operations 24/7. Beyond the potential for increased consumer spending, companies may also benefit further from escaping corporate tax hikes. Goldman Sachs estimates that an increase of the corporate tax rate from 21% to 25% was being priced into Earnings Per Share (EPS) and if government officials can’t come to an agreement, leaving rates at 21%, it could boost expected EPS by 5% in 2022. Beyond those potential tailwinds, the risk most top of mind in the market is higher and persistent inflation that could lead to the removal of the Federal Reserve’s accommodative policies, i.e. quantitative easing and low interest rates, sooner than expected. The economy is still recovering and equity valuations remain high, so markets remain more susceptible to volatility if Fed policy missteps choke off growth.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.