- The U.S. Non-farm Payroll report showed 531k jobs added in October, beating estimates of 455k. This was the biggest monthly gain since July. Job gains in August and September were revised higher as well.

- President Biden has nominated Jerome Powell to serve a 2nd term as the Federal Reserve Chair and Fed Governor Lael Brainard as Vice Chair. The move was generally welcomed as it should result in less uncertainty around major changes in U.S. monetary policies.

- Pending home sales in the U.S. rose 7.5% in October, reaching the highest level this year, indicating strong housing demand in the near-term. Homes are also still in short supply, which has kept existing home prices elevated.

- The S&P 500 experienced its worst single day return in 2021 so far on the Friday after Thanksgiving, dropping 2.27%. Concerns over the coronavirus variant Omicron mounted as the World Health Organization labeled Omicron a “variant of concern”. More data is needed to determine the efficacy of existing vaccines against the variant which should guide markets long-term.

- The news also slowed the upward pressure on yields as investors sought safety in Treasuries. The 10-year Treasury yield dropped from 1.65% to 1.48% to close the week.

- The U.S. and other countries will begin releasing oil reserves over the coming months in an attempt to combat rising energy prices; however, the initiative may be futile given OPEC+ countries’ ability to reduce their much larger share of output.

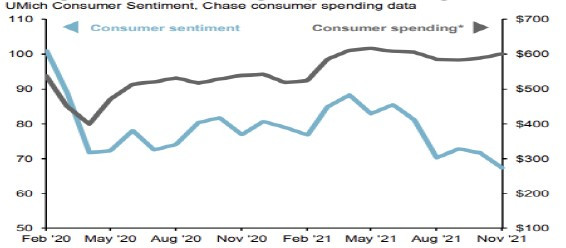

Consumer sentiment has weakened as inflation is resulting in higher prices for goods and services. Still, with an improving labor market and environment where consumers’ balance sheets are in good shape following federal stimulus, spending trends have remained strong. JPMorgan’s Chase credit and debit card data show spending through 11/24 is up 13.8% compared to last year and discretionary spending (excluding food) increased further compared to October.

The Baltic Dry Index, which measures changes in the cost of transporting various raw materials, is showing cost pressures for shipping have eased to a 5-month low. While this could be a result of improving supply chains, there is still a large hurdle in terms of turnaround times for ships to unload at West Coast ports. This is in part due to challenges in finding truckers to take the goods out of the ports, which could mean less inventories for the upcoming holiday season.