Our current stock allocation remains in a Slightly Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Federal Reserve raised rates again by 0.25% in early May, bringing the Fed Funds rate to 5.00-5.25%. Since March of 2022, the Fed has raised rates a total of 5.00%, making this the fastest rate hiking cycle on record.

- The Conference Board’s Consumer Confidence index fell in May, down four of the past five months. This brings confidence levels to the lowest point since November; however, according to the Conference Board’s measure, this level of sentiment is not historically consistent with recessionary conditions.

- Chinese Industrial Production in April rose just 5.6% vs expectations of 10.7%. Retail sales also missed the mark, up 18.4% vs 22% expected. The data has been underwhelming for some investors expecting a quick and robust recovery in China.

- Yields on U.S. Treasury bills expiring on June 1st rose above 7% as investors sold issues maturing around the Treasury Department’s ‘X-date’ (when the government would potentially run out of funds to be able to pay all obligations). Uncertainty around principal and interest payments on those Treasury bills led investors to sell, causing yields to rise.

- Japan’s stock index, the Nikkei 225, hit a 33-year high on 5/29 and is up roughly 20% year-to-date. The gains may be a result of continued accommodative policy by the Bank of Japan (versus tightening policies amongst other major Central Banks), rising levels of stock buybacks, and investors increasing diversification away from the U.S..

- Commodity prices, measured by the Invesco DB Commodity Index Tracking Fund (ticker: DBC) are down just over –23% in the past 12 months as of 5/31, sitting at 52-week lows. Commodities such as oil, natural gas, wheat, and copper have continued to face pressure from weaker demand in China and Europe, slowing global economic growth, and a reversal from the Russia/Ukraine war supply shock.

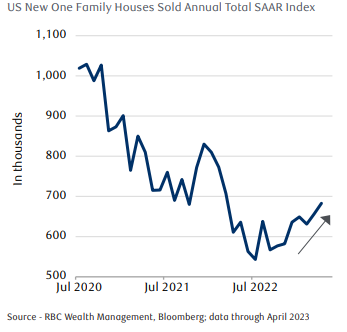

April new home sales unexpectedly rose in the U.S., hitting the highest level since March 2022. Softening home prices may be bringing more buyers to market. Although mortgage rates are almost double the rates available at the end of 2021, homebuyers appear to be shifting to new home construction, given the lack of inventory of existing homes for sale as existing homeowners prefer to keep their low rate mortgages.

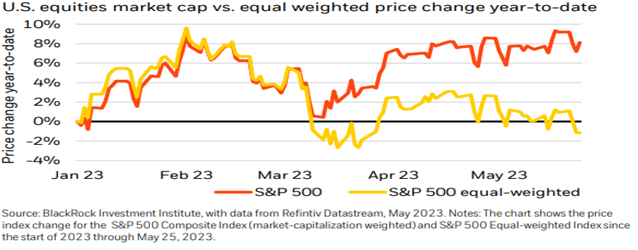

The S&P 500 is up approximately 10% year-to-date (red line). The bulk of those gains have been driven by a few large technology companies that have heavier weights in the index. Recently, that’s jumped further as a result of some stocks benefiting from Artificial Intelligence (AI) optimism. When an equal weighting is applied to the companies in the S&P 500 index (represented by the yellow line), the index would be down a little over 1% for the year, highlighting the lack of participation amongst most stocks in this year’s rally.

At the time of this writing, the White House and Congress appear to have reached a deal to temporarily suspend the debt ceiling through January 2025. The bill is expected to be passed in the House and Senate this week, with President Biden officially signing the extension by Monday. If this all comes to pass and the U.S. can fund all its obligations without any credit downgrades from rating agencies, there should be at least some uncertainty removed from the markets. Consequently, stock and bond prices may be driven a bit more by economic growth, inflation, and corporate earnings. However, we will continue to monitor the impact the Fed still has in driving market volatility. Although the Fed has been expected to pause its rate hikes following the latest increase in May, less encouraging inflation reports and better than expected economic data in the U.S. recently (e.g. job creation, wage growth, consumer spending) are calling that into question. Perhaps another rate hike at the upcoming Fed meeting on June 14th is on the table, which may pressure both stocks and bonds. We’re watching for positive price movement in areas other than the few large-cap technology companies that have been driving most this year’s market returns. Broader stock participation in future rallies would be a sign of a healthier market and increase confidence that a new cyclical bull market is underway.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.