- The Federal Reserve raised interest rates for the first time since December 2018 to a range of 0.25% – 0.50%. Their median expectation of seven 0.25% rate hikes in 2022 was also more than the markets were expecting.

- Negotiations between Russia and Ukraine have been hot and cold, but have trended in a positive direction more recently. Still, Russian officials are not confirming any sort of formal ceasefire, which has hampered optimism.

- Germany, which relies on Russia for more than 50% of its natural gas has been seeking alternative energy suppliers and has entered into a long-term agreement with Qatar for supply of liquefied natural gas.

- The S&P 500 hit a year-to-date low on 3/14/22, down 12.44%, then experienced its strongest weekly gain since November 2020, rising 6.2% in the 3rd week of March. Still, the index is not yet in positive territory for the year.

- European stocks also rallied despite additional headwinds from Russia’s invasion of Ukraine. The Stoxx 600, an index of European stocks, dropped 10.6% from before Russia’s invasion on February 24th to the low point on March 7th. The index has recovered the losses and is above its pre-invasion level.

- Interest rate volatility, as measured by the MOVE index, spiked significantly as interest rates notched another leg higher this month. The yield on the 10-Year Treasury hit 2.48% on 3/25/22.

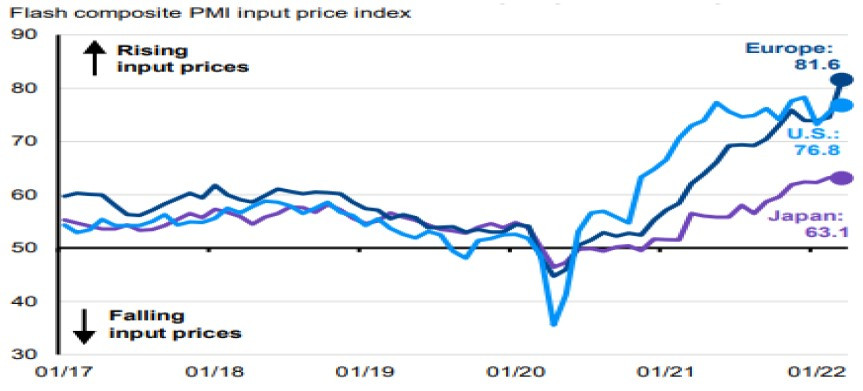

Manufacturing data across the globe showed strength following the continued relaxation of COVID restrictions. But surging energy costs along with further constrained supply chains exacerbated by the Russia/Ukraine conflict were also consistent in the reports. European input prices rose 9.5% in March, the fastest monthly jump ever. The rise in prices may ultimately be passed on to consumers, however, manufacturing activity is still consistent with above-average growth.

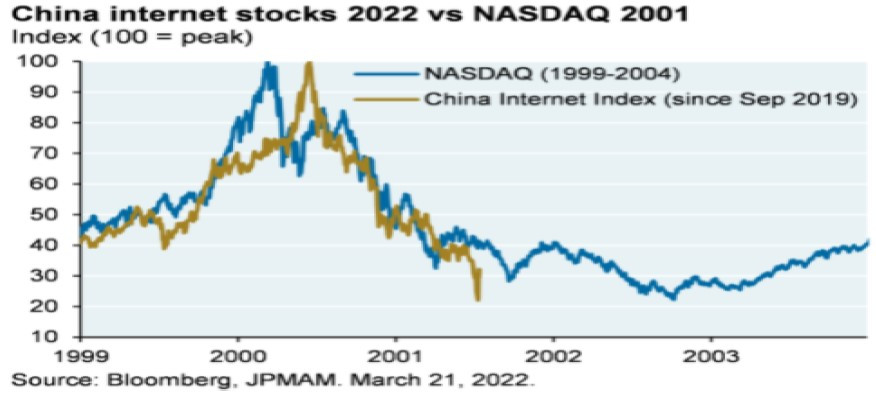

Chinese tech stocks have sold off dramatically since February 2021 amid China’s regulatory crackdown and the U.S. Securities & Exchange Commission’s initiative to delist Chinese stocks. The chart above puts the selloff in perspective relative to the U.S. Tech Bubble from 1999-2004. This month, Chinese policy makers announced their intention to keep their markets stable, support tech companies, and ease regulation. This spurred a 40+% rally in Chinese tech names.

The current objective of the Federal Reserve continues to be to tame inflation without sparking a reversal in economic growth and ultimately a recession. The recent geopolitical events will make that more challenging as rising food and energy costs may dampen consumer spending and hinder economic activity. Inflation may still begin to ease in the latter half of the year, but this continues to be dependent on improvement in supply chains and moderation in energy prices. China’s zero-tolerance Covid-19 policy, locking down Shanghai most recently, will continue to challenge China’s exports activity. And without a resolution between Russia and Ukraine, their lack of exports of an array of commodities will continue to impact prices globally. Within the U.S., the bond market and interest rates have been a major focus, specifically an inversion of the yield curve. This is when yields on shorter-term treasuries are higher than longer-term treasuries. This dynamic historically reflects expectations for slowing growth and can be used as a recessionary indicator. The 2-Year and 10-Year Treasury yields inverted briefly on 3/29/2022 for the first time since 2019. However, it’s important to note that based on previous inversions, a recession takes on average 6-24 months to materialize, following a yield curve inversion. Additionally, the S&P 500 has on average posted positive returns in the 12 months following an inversion. We do not view a yield curve inversion as a signal to get out of the market, but rather as a sign that a higher level of caution may be warranted in months ahead. Although leading economic indicators remain constructive, geopolitical uncertainty, high inflation, and a less accommodative Fed are headwinds that must be monitored.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.