- The European Central Bank (ECB) surprised markets by hiking interest rates by 0.50% after initially signaling for just 0.25%. It was the ECB’S first hike since 2002 and it brought rates out of negative territory for the first time in 8 years.

- Weekly jobless claims in the U.S. have been ticking higher, an indication the Federal Reserve’s rate hikes are cooling down the economy. The 4-week average of unemployment claims rose to 214,000, the highest level this year and in line with pre-pandemic averages.

- The Fed’s preferred inflation measure, Personal Consumption Expenditures (PCE) Price Index, rose 6.8% y/y in June versus 6.3% in May, showing inflation continues to tick higher.

- Natural gas prices continue to rise due to high demand and supply constraints, in part from Russia’s reduced output. Russia has reduced gas flows to Europe through the Nord Stream 1 pipeline to 20% of capacity, citing maintenance issues.

- In bond markets, long-term rates have declined through July while shorter term rates remain higher amid Fed rate hikes. The 10-year treasury declined from over 3% to around 2.70%. 2-year treasuries sit at ~2.90% creating an inverted yield curve where short-term treasuries earn more than long-term treasuries.

- Big tech earnings so far have been relatively positive for the 2nd quarter, however several including Apple, Amazon, Google, and Microsoft have indicated a need for a slowdown in hiring.

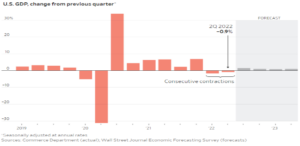

Gross Domestic Product (GDP) contracted -0.9% in the 2nd quarter, following a –1.6% decline in the first quarter. Two consecutive declines in GDP is a common definition of recession, however many dismiss the idea given last quarter’s decline was driven by abnormal levels of imports versus exports. Still, the 2nd quarter decline showed much weaker consumer & business spending.

The Euro has weakened significantly against the U.S. Dollar in 2022, nearing ’parity’ with the Dollar for the first time since 2002. The weaker Euro reflects a dim growth outlook in Europe as the region faces an energy crisis, high inflation, and its own set of supply chain issues that have been exacerbated by the ongoing war between Russia and Ukraine.

Following the latest GDP report showing a slowdown in economic growth, the questions around whether the U.S. is currently in a recession or the likelihood of entering one later on this year will remain for some time. The National Bureau of Economic Research (NBER) officially determines recession dates, but those official measures don’t usually happen until after the recession is over. Markets on the other hand will be attempting to price in the effects of a recession on companies in real-time. It’s expected that the length and severity of a recession will be driven primarily by how inflation continues to impact consumer spending in conjunction with how high interest rates ultimately get as the Fed attempts to rein in said inflation. If consumers face higher borrowing costs coupled with unrelenting inflation for too long, the chances for a more significant recession should increase. The heightened market volatility throughout the 2nd quarter reflect that and it can continue. While the recent rally just of over 8% in the S&P 500 since 7/14/22 is encouraging, we’ve seen 4 separate rallies of over 6% this year, only to be followed by more declines. So, we remain cautious and will be looking for more definitive signs of inflation moderating and/or signs of the markets potentially pricing in a post-recession, lower inflation environment ahead of time.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.