- Federal Reserve Chairman Jerome Powell’s latest speech in Jackson Hole reinforced the Fed’s commitment to bringing down inflation. He was blunt in his expectation for households and businesses to feel “some pain” through their restrictive policies i.e higher rates.

- After 3 months of consecutive declines, the Conference Board’s Consumer Confidence Index rose in August indicating some renewed consumer optimism amid falling gas prices and expectations for lower inflation levels, which could support additional consumer spending in the short-term.

- Eurozone business activity, measured by the Purchasing Managers Index, continues to contract, indicating deteriorating conditions and increasing recession risk.

- Following early signs of cooling inflation and anticipating a less restrictive Fed, markets rallied from 6/17/22—8/16/22. Sectors that were the weakest in the 1st half of 2022, such as consumer discretionary & technology, were some of the strongest. The tech sector was up roughly 20% during this period.

- Despite the market’s rebound, homebuilders remain one of the worst performing sectors over the past 6 months. The S&P Homebuilders fund, ticker: XHB, is down –14.51% since the beginning of March. Existing home sales have declined for 6 straight months as higher mortgage rates pressure affordability.

- European stocks have come under more pressure this month relative to the U.S. and Emerging Markets, as their energy crisis looks set to remain a significant headwind for their economies.

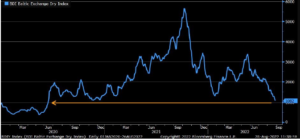

Along with falling commodity prices that began in June, shipping costs have also been declining. The Baltic Dry Index measures the average price for shipping bulk materials such as coal and steel. Prices have now reached the lowest point since the summer of 2020. This should help lower input prices for manufacturers and in turn, lower inflation. That’s positive, but one must also consider that the drop in prices is likely in part due to an overall drop in demand.

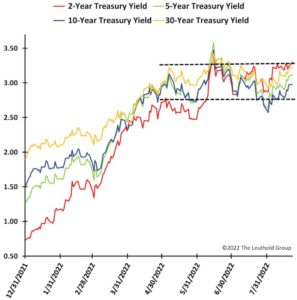

The Federal Reserve has been communicating plans for restrictive policies and higher interest rates for the majority of 2022. After rising significantly through the spring, bond yields have trended sideways, around 3%, for the last 4 months. Rates could rise higher if the Fed is forced to become more aggressive due to elevated inflation data, but the bond market appears to be forecasting that the Fed won’t be able to go much higher than current expectations.

The markets initially celebrated signs of inflation peaking; however, any anticipation that the Fed would consequently reduce the pace of rate hikes was dashed in Jerome Powell’s latest speech. Since then, the markets have come under renewed pressure and volatility has increased. It’s clear the Fed is willing to maintain restrictive policies, which could weaken the economy and potentially spark a recession, until they see inflation fully contained. It’s likely that broad inflation cools further through the remainder of the year and into 2023, but the question is if it will be quick enough and reach a point low enough to convince the Fed to stop raising rates. It should be a challenge to get back to the Fed’s 2% inflation target while wage growth and rising rent costs continue to be an upward force. Companies will need to keep navigating those changes in inflation. Their other challenge is that the effects of the rate hikes so far this year have likely not taken their full effect. The higher borrowing costs not only have the potential to curb business spending, but those higher borrowing costs also impact consumer demand, which has not yet materially slowed. If this happens, company profits may fall further, which could keep stock market volatility elevated. Other risks to the market that we are taking into account for portfolio positioning have largely remained the same; more persistent inflation, on-going conflict between Russia and Ukraine, and a global growth slowdown exacerbated by China’s COVID policies and resulting economic weakness.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.