Our current stock allocation remains in a Slightly Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Emergency borrowing by banks from the Federal Reserve declined for a third straight week. The total amount borrowed across three liquidity programs fell from $343.7 billion at the height of the bank solvency fears to $311.7 billion in the week of April 14th. We believe this indicates stress amongst banks is easing.

- U.S. Gross Domestic Product (GDP) rose by a 1.1% annualized rate in the first quarter of 2023. Although this shows growth has slowed from the 2.6% rate in the previous quarter, the consumer spending component of GDP remained robust.

- The Consumer Price Index (CPI), a key U.S. inflation measure, decelerated in March, however the “core” measure which excludes food and energy and more closely watched by the Federal Reserve, increased slightly from 5.5% to 5.6% compared to a year ago.

- Homebuilder stocks have been the top industry group for both the month of April and year-to-date, up 5.95% and 23.13% respectively (ticker: ITB). Although the housing market may face headwinds from higher mortgage rates, homebuilder confidence is rising due to persistent inventory shortages of existing homes.

- The average year-over-year decline in S&P 500 earnings for the first quarter so far, is better than expected. This is in part due to low expectations and will likely mark the 2nd consecutive quarter of negative earnings growth, constituting an official ‘earnings recession’. Still, after nearly a year of negatively revised earnings, growth is expected to turn positive in the latter half of the year.

- After peaking at 5.06% in February, the 2-Year Treasury yield remains near its post-bank failure lows of approximately 4% as investors weigh whether the Fed may cut rates later this year.

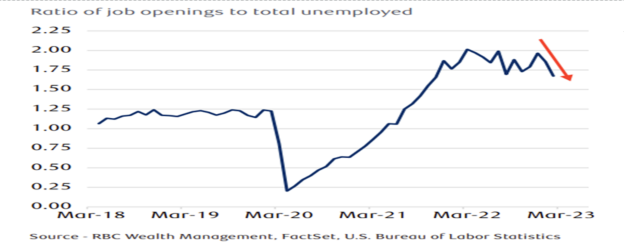

The monthly JOLTS report (Job Openings and Labor Turnover Survey) in March showed a drop in job openings from 10.8 million to 9.9 million. The upward trend in the number of job openings to unemployed appears to be declining. The strong labor market has been a key factor in the Fed’s reasoning to continue raising interest rates to bring down inflation. If the labor data continues to weaken throughout the year, the Fed may be more inclined to hike rates just one more time in May.

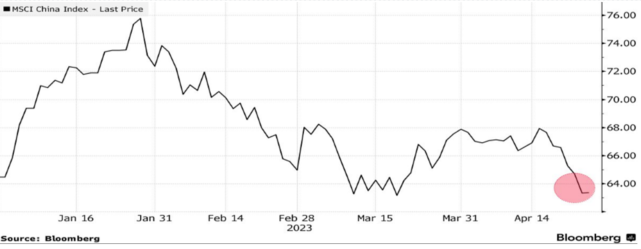

Despite China’s initial momentum from their economic reopening following COVID lockdowns in late 2022, Chinese stocks have been under pressure and given back a large portion of those gains. The MSCI China Index has returned roughly -4.8% in April and -15.53% since its peak this year on January 26th. Geopolitical uncertainty has been cited as the primary deterrent recently among traders.

Stock and bond markets are still grappling with whether a recession will materialize and if so, how bad it will be, as well as what the Fed’s reaction will be in the face of slowing growth and choppy inflation data. The S&P 500 declined 25.4% from peak to trough in 2022 as interest rates rose and earnings forecasts declined meaningfully in the latter half of the year. There may be some more downside revisions to come, but if the economy remains more resilient than investors expect, the negative revisions may be mostly complete. Economic data so far is pointing to a slow down, but not a severe recession, so that’s likely filtering into market expectations for improved earnings going forward and supporting stocks. Interest rate movement has slowed down following the sharp movements through March in the wake of the banking sector volatility. More specifically, rates are broadly lower than where they were at the beginning of March, indicating the bond market does not believe the Fed will hike much more and that economic growth and inflation will continue to slow. Our thought is that the tighter credit conditions created by cautious banks give the Fed some flexibility. The banks may help with the Fed’s goal of slowing growth and bringing down inflation, thus less need for more rate hikes. The lack of volatility and stock market movement in recent weeks has been encouraging, so some optimism is warranted, however we remain mindful of the potential for downside catalysts and may increase defensive positioning if needed.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.