On December 23, 2022, Congress passed the Consolidated Appropriations Act of 2023. It includes what some call the SECURE Act 2.0

(Setting Every Community Up for Retirement Enhancement).

The following summary contains key provisions of the Act and does not include

all changes brought on by this act.

Changes to Required Minimum Distributions

Effective Immediately

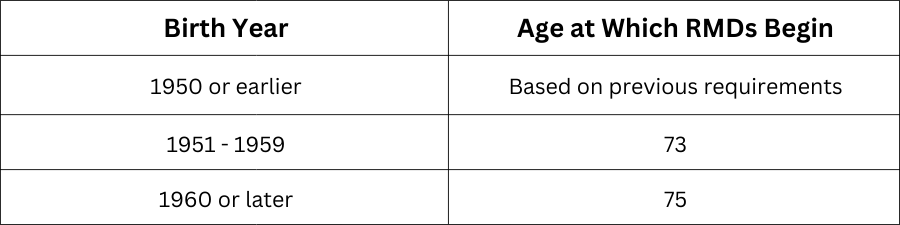

- Retirees will no longer have to take required minimum distributions (RMDs) from traditional IRAs or retirement plans by April 1 following the year in which they turn 72. The new law now requires RMDs to begin by April 1 following the chart below based on your birth year:

- Those that turned 72 in 2022 must still take their RMD by April 1, 2023, and this change does not impact individuals that are currently taking their RMDs.

- The penalty for missed RMDs decreased from 50% to 25%, or 10% if corrected in a timely manner (January 1 of the following year).

Roth Related Updates

Effective Immediately

- Sec. 601 allows the creation of Simple Roth IRAs and SEP Roth IRAs. It may take time for employers, custodians, and the IRS to implement the procedures and policies needed to make these contributions and for elections to be made.

- Employers will be able to make matching and/or non-elective contributions to employees’ Roth accounts that will be treated as taxable income to the employee. These contributions will also vest immediately.

Effective 2024

- RMDs for Roth accounts in qualified plans (Roth 401k plans, Roth 403b plans, Roth 457b, etc.) are eliminated. Those that have been taking RMDs from their Roth accounts should be able to stop taking them in 2024.

- For those that would like to make catch-up contributions to their employer retirement plan, individuals that make over $145,000 (indexed for inflation) of wages for the previous tax year with the same employer are forced to make Roth catch-up contributions to a qualified retirement plan. If their plan does not allow for Roth catch-up contributions, then no one will be allowed to make a catch-up contribution, regardless of wages. These restrictions only apply for high wage earners that contribute to qualified plans (401k, 403b, 457b plans).

- Individuals will be able to move 529 plan dollars to Roth IRAs with the conditions below:

- The Roth IRA must be in the name of the 529 plan beneficiary.

- The 529 plan must have been in place for 15 years or longer.

- 529 plan contributions within 5 years are ineligible to move to the Roth IRA.

- Rollovers are subject to the annual IRA contribution limits (this includes any “regular” contributions to IRAs but are not subject to the income limitations for “regular” Roth IRA contributions).

- $35,000 is the maximum that can be rolled over.

Additional Surviving Spouse Beneficiary Option for Retirement Accounts

- Effective 2024 – Surviving spouses will be eligible to elect to be treated as the deceased spouse for RMD purposes. This would impact the beginning date for taking inherited IRA RMDs.

IRA Catch-Up Contribution Updates

- Effective 2024 – IRA catch-up contributions will be inflation-adjusted in increments of $100.

- Effective 2025 – Participants of employer retirement plans and SIMPLE plans age 60 through 63 will be eligible to increase their catch-up contribution to the greater of $10,000 or 150% of regular catch-up contribution amount (indexed for inflation) in 2024.

Qualified Charitable Contributions (QCDs) Updates

- Effective 2024 – QCDs will be indexed for inflation from the current maximum annual limit of $100,000.

Retirement Plan – Additions to Emergency Access to Retirement Funds

- Effective 2024 – Emergency Savings Accounts linked to employer sponsored plans are created for eligible participants who are not “highly compensated” employees. Limitations apply to contributions and distributions.

- “Highly Compensated” is defined as either A) owning more than 5% of the business currently or in the year prior or B) earning $150k in 2023 and in the top 20% of company pay.

- Allows additional emergency access to retirement funds without the 10% penalty associated with withdrawing funds before age 59 ½. The effective date differs depending on the reason for withdrawing funds.

ABLE Account Update

- Effective 2026 – ABLE accounts can be established for individuals who become disabled prior to age 46 (previously age 26).

Solo 401k Deferral Changes

- Effective Immediately – Sole proprietors can establish solo 401k plans and fund them with deferrals for a previous tax year up to the individuals’ tax deadline (without extensions).

Final Thoughts

- The age extension for RMDs could serve as a benefit for you and your overall retirement plan by delaying when you are required to make taxable withdrawals from your retirement accounts. If you would like to explore your options around a QCD, your Wealth Management Team is here to help.

- The Roth-related updates could serve as a benefit with the opportunity to save after-tax dollars that grow tax-free without the income restrictions that come with Roth IRAs. The changes to catch-up contributions for high wage earners could potentially limit your ability to make catch-up contributions into employer plans if they do not offer a Roth option.

- The 529 plan to Roth IRA addition in this act may be a useful strategy for those that meet the necessary conditions to do so.

- The new surviving spouse beneficiary option for retirement accounts could prove beneficial for those that are older than their deceased spouse.