- U.S. Initial jobless claims (claims for unemployment insurance) have fallen in 6 of the past 7 weeks and have recently fallen to the lowest level since April. While the Fed’s efforts to slow the economy should eventually weaken the labor market, there is a lag to the impact and for now employment remains strong

- The Conference Board’s Leading Economic Index fell 0.3% in August, the 6th consecutive monthly decline. This composite of different economic indicators is forecasting more weakness in growth ahead and raises expectations for a recession.

- The Bank of England initiated a 65 billion pound bond buying program in an effort to regain financial stability following the steep drop in the pound and spike in yields following the UK government’s new tax cut and stimulus plan.

- The energy sector remains volatile as oil prices dipped below $80 per barrel in September from a highpoint of over $120 this year, on declining demand expectations. Natural gas prices have dropped as well despite the ongoing European supply constraints stemming from the Russia-Ukraine war.

- Hong Kong’s Hang Seng Index hit its lowest level since 2011 this month and is down ~-27% year-to-date. Many foreign equity markets are faring worse than the U.S. as we see rates rise and growth slow on a global level.

- Rising mortgage rates have received a lot of attention, however a Bankrate.com survey showed the average credit card interest rate reached 17.96% in August, marking the highest level since 1996. The increase in credit card interest rates could be more detrimental for consumers especially as a credit usage picks up.

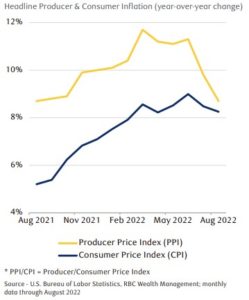

The Producer Price Index (PPI), which measures the prices paid to U.S. goods and services producers shows inflation from the manufacturer or service supplier’s perspective. Over the summer, PPI rose higher than the Consumer Price Index (CPI), which measures the change in prices of goods and services paid by consumers, and has since started to come down. Lower input costs could help corporate profit margins and may also lead to lower prices charged to consumers.

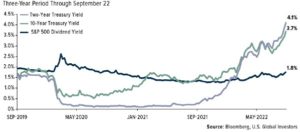

Bond prices have continued to fall following the Fed’s latest rate hikes. Falling prices results in rising yields. The yield on the 10-Year Treasury has climbed above 3.7%, the highest level since 2011, while the 2-Year Treasury is yielding over 4.1%, the highest level since 2007. Both moved decisively above the dividend yield of the S&P 500 in 2022 for the first time since early 2019, providing investors looking for income more solutions than low yielding equities.

The markets initially celebrated signs of inflation peaking; however, any anticipation that the Fed would consequently reduce the pace of rate hikes was dashed in Jerome Powell’s latest speech. Since then, the markets have come under renewed pressure and volatility has increased. It’s clear the Fed is willing to maintain restrictive policies, which could weaken the economy and potentially spark a recession, until they see inflation fully contained. It’s likely that broad inflation cools further through the remainder of the year and into 2023, but the question is if it will be quick enough and reach a point low enough to convince the Fed to stop raising rates. It should be a challenge to get back to the Fed’s 2% inflation target while wage growth and rising rent costs continue to be an upward force. Companies will need to keep navigating those changes in inflation. Their other challenge is that the effects of the rate hikes so far this year have likely not taken their full effect. The higher borrowing costs not only have the potential to curb business spending, but those higher borrowing costs also impact consumer demand, which has not yet materially slowed. If this happens, company profits may fall further, which could keep stock market volatility elevated. Other risks to the market that we are taking into account for portfolio positioning have largely remained the same; more persistent inflation, on-going conflict between Russia and Ukraine, and a global growth slowdown exacerbated by China’s COVID policies and resulting economic weakness.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.