Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Third-quarter Gross Domestic Product (GDP) grew at an annualized rate of 2.8%, just below both the consensus estimate and the previous quarter’s 3.0% rate. This year’s growth has averaged 2.5%, aligning closely with the pre-pandemic average over the past four years. Third-quarter growth was supported primarily by robust consumer and government defense spending.

- Consumer prices rose unexpectedly in September, reflecting persistent price pressures across various sectors. The Consumer Price Index (CPI) climbed 0.2%in September, matching August’s data, but doubling expectations. Core prices were also up 0.3%, exceeding forecasts. Food prices contributed notably, rising 0.4%—the largest increase since January.

- Eurozone economic activity indicators have weakened since summer, prompting the European Central Bank (ECB) to continue its rate cuts, lowering the deposit rate by 0.25% to 3.25% this month. ECB President Christine Lagarde expects inflation to stay manageable and anticipates the eurozone will avoid a recession, though she cautioned that potential U.S. trade restrictions pose a downside risk.

- Third quarter earnings season has been led off by banks, which have broadly reported strong results. Markets are optimistic on the sector with net interest income expanding thanks to lower short-term (which banks typically pay interest on) and higher long-term interest rates (which banks typically lend and earn interest on). Financials have been the strongest performing sector in October, up 2.54% (ticker XLF).

- Oil prices have swung significantly in October, with the price of a barrel of Brent Crude Oil rising roughly 10% to start the month after an Iranian missile attack on 10/1/24, then falling -6% on 10/28/24 when Israel announced their response would not target Iran’s oil and nuclear facilities.

- Following along with higher Treasury yields, the U.S. Dollar has been on the rise, hitting a 3-month high in October, after declining steadily since July of this year. The strength appears to be primarily driven by economic data surprising to the upside.

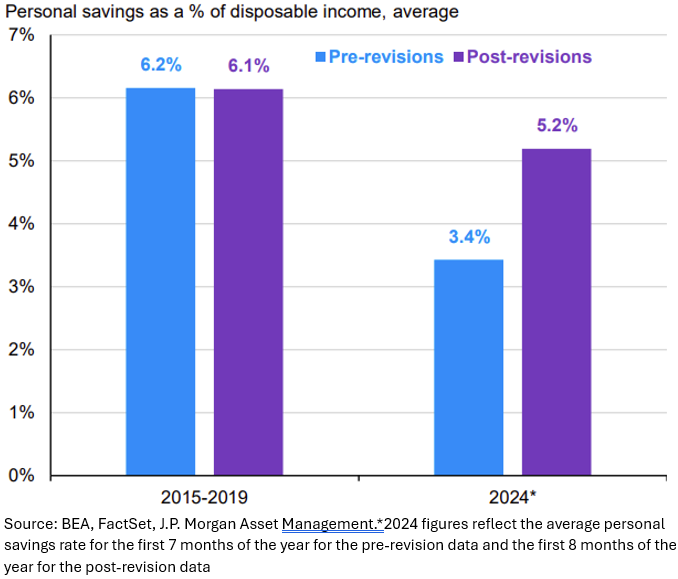

Despite a challenging year of economic uncertainties, U.S. consumer spending has remained strong. The average personal saving rate before the pandemic compared to 2024 rose from a pre-revision low of 3.4% to 5.2% post-revision—still below pre-pandemic averages but suggesting a stronger financial position for consumers than previously thought. However, spending remains strong among higher-income households while lower-income ones feel more strain. With real wage growth continuing for 17 months, consumer spending may be able to support a soft economic landing into next year.

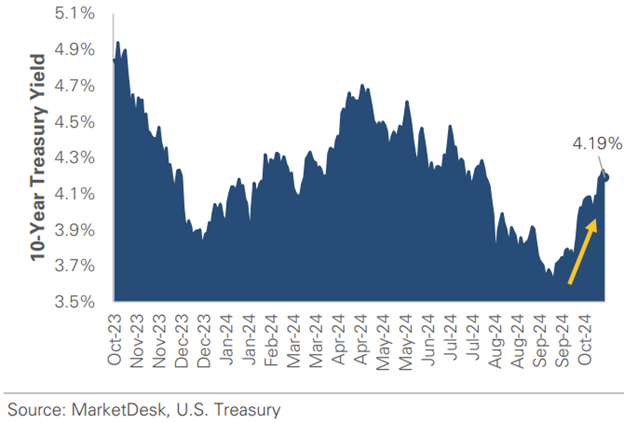

Although the Fed has started cutting rates, the 10-year Treasury yield climbed back to near 4.3% on 10/29/24, up from its September low of 3.63%. Stronger-than-expected economic data likely contributed to this increase, prompting market participants to raise growth expectations. Longer maturity treasuries such as the 10-year Treasury are typically more influenced by economic growth and inflation expectations. This shift has pushed bond yields higher and lowered projections for the amount of future Fed rate cuts.

So far, third-quarter earnings results look encouraging, with 68.6% of reports beating earnings-per-share (EPS) forecasts as of 10/28/24. The big tech companies still have the power to drive the market in either direction, but we’re focused on the results and forward guidance from the rest of the market. We continue to watch for EPS growth outside of the ‘Magnificent 7’ names as confirmation that the bull market is broadening and may become more sustainable. Beyond earnings, the rise in longer-term interest rates this past month is notable and can be attributed to several factors. Data suggests the economy is not yet close to tipping into a recession, which can reduce investor demand for fixed income. And if the economy remains strong while the Fed begins to cut short-term interest rates, the risk of inflation reaccelerating increases. Higher inflation expectations also typically make longer-maturity fixed income less attractive. Finally, as we approach the upcoming election, we view the federal deficit as a primary concern in the marketplace as it relates to interest rates. This issue is likely to persist regardless of which party wins and may be contributing to elevated long-term yields. Although a high fiscal deficit impacts the economy and interest rates in various ways, one straightforward reason for concern is the global perception of U.S. debt. While the U.S. government is generally seen as a low-risk borrower, a continuously rising deficit can create doubts about the government’s fiscal health and ability to manage its debt. As investors demand a higher “risk premium” for holding U.S. debt under these conditions, bond yields (interest rates on Treasuries) may rise, increasing borrowing costs throughout the economy. Although we expect any election-related volatility to be short-lived, we are monitoring potential catalysts that could prompt shifts in our positioning.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.