Our current stock allocation is in a Slightly Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The US Headline Consumer Price Index (CPI) dropped from 3.7% to 3.2%, below expectations, driven by lower energy prices. Core CPI also fell from 4.1% to 4.0%, below expectations, mainly due to lower auto prices. However, shelter costs, a major component, remained high, rising 6.7% from the previous year.

- Durable goods orders dropped 5.4% in October, marking the second biggest decline since April 2020. Orders excluding aircraft and defense purchases, considered a proxy for business investment, also declined for the second month in a row, indicating weaker business spending.

- China’s latest economic data showed some improvements, however there continues to be serious concern with their property market. Following the property developer Evergrande’s default, home prices across China continue to decline significantly.

- U.S. equities have risen sharply on the market’s belief the Federal Reserve hiking cycle is over. The S&P 500 has climbed over 10% since the low on 10/27. Still the index is over 5% lower than the all-time high notched on 1/3/2022.

- The recent decline in interest rates has relieved some pressure on mortgage rates as well. The average 30-year mortgage is roughly 7.66%, down from a high of 8.45% in October. Lower mortgage rates helped homebuilder stocks surge as well in November. The S&P 500 Homebuilder Index is up 15.6% in November.

- The price of a WTI Crude Oil barrel hit a 2023 high on 9/27/23 of $93.68. Through October and November, prices have fallen into a bear market (a decline of over 20%). Fears of weakening global demand have pressured prices, but this should also help ease inflation.

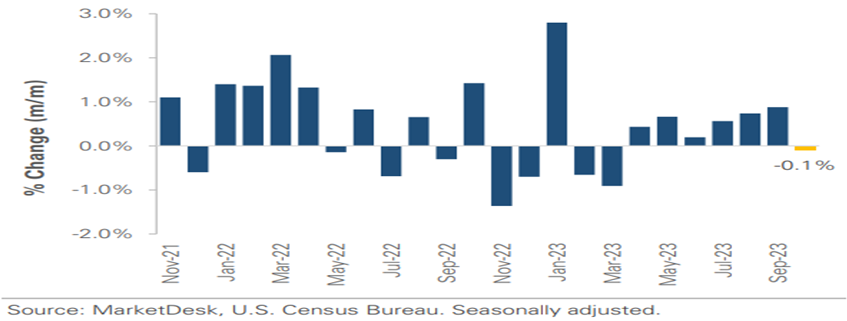

Slowing income growth, interest rates, and declining excess savings could be starting to restrain consumer spending. October saw a 0.1% month-over-month decline in total retail sales. Holiday shopping will be important to watch. Adobe Analytics found U.S. online sales on Black Friday were up 7.5% compared to a year ago. This could mean October’s spending decline will be short-lived, but the report also recorded shoppers opting for ‘Buy Now, Pay Later’ payment methods was up 47% from year, a concerning trend.

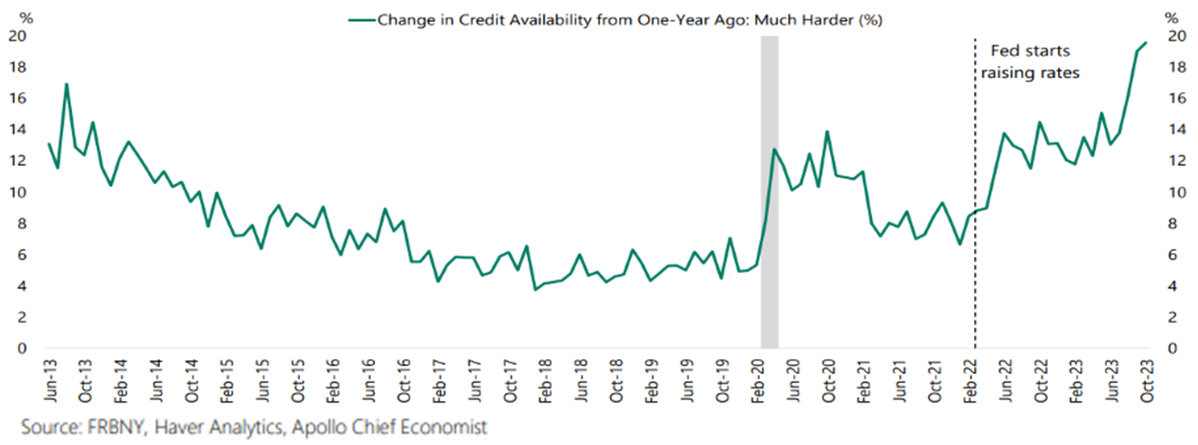

The New York Fed’s recent household survey reveals a record-high proportion of consumers expressing that obtaining credit has become significantly more challenging. As pandemic savings dwindle further and access to credit becomes difficult, it should lead to slower consumer spending and economic growth in 2024. The positive side of the coin would be that a pullback in demand could help ease inflation pressures in the service sector.

Markets have embraced the narrative that inflation is moving lower and consumer spending is slowing enough to help ease inflation, but not enough to lead to a recession given the ongoing strength in the labor market. The Secured Overnight Financing Rate (SOFR) Futures market, which reflects expectations for the Fed Funds rate, indicates the market is now anticipating several rate cuts by this time next year. This seems overly optimistic. Several factors such as elevated fiscal spending and ongoing worker strikes could make the decline in inflation much bumpier and drawn out than the latest rally might imply and consequently keep the Fed from aggressively cutting rates in 2024. Congress approved trillions of dollars in spending aimed at infrastructure investment, manufacturing incentives, and green energy promotion. However, only a portion of these funds has been utilized and will eventually flow into the economy. And the continuing strikes should have an impact on rising wages, solidifying the prospect of future wage inflation across various industries. These themes could keep inflation above the Fed’s 2% target. Beyond inflation, the lagged effects of the Fed’s hiking cycle have yet to be fully felt, even if the hiking cycle is over. As this continues to filter through the economy, it will be a balancing act to achieve the ‘soft landing’ that the Fed is attempting to orchestrate. We respect the market’s momentum heading into December, a period of seasonality that is historically positive for stocks. This could last through year-end, at which point 2024 may provide some surprises for markets, leading to tempered expectations for rate cuts without a recession.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.