Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Federal Open Market Committee (FOMC) maintained the federal funds rate range at 5.25–5.50% at its March meeting. They reaffirmed their forecast of three rate cuts in 2024. Due to surprising inflation reports in January and February, the Fed has adopted a more cautious approach. Markets now anticipate the first cut in June or July.

- The Leading Economic Index (LEI) rose by 0.1% in February, marking its first increase in two years. Although the LEI remains 6.3% lower than a year ago, the negative trend has eased. The Conference Board no longer predicts a recession for this year but anticipates slower economic growth in the second half of 2024.

- The Bank of Japan raised interest rates to a range of 0.0% to 0.1%, making it the last central bank to end its negative interest rate policy, which has been in place since 2016.

- Stocks have continued their uptrend, hitting new all-time highs in March. Although headlines earlier in the year pointed to just a few sectors like Tech driving the gains, leadership has broadened. In March, the Materials, Energy, and Utilities sectors have been top performers, all outpacing the S&P 500.

- The price of gold also hit an all-time high in March. The SPDR Gold Trust (ticker: GLD) is up 7.61% compared to the S&P 500’s 10.39%. High levels of gold purchases by global central banks and some moderation in the rise in U.S. rates (higher rates can make gold less attractive) have helped the price of gold rally.

- U.S. gasoline futures prices rose to a six-month high due to disruptions at Russian oil refineries and declining U.S. fuel reserves. Recent Ukrainian drone attacks on Russian refineries have also heightened geopolitical risks, causing markets to price in further supply constraints.

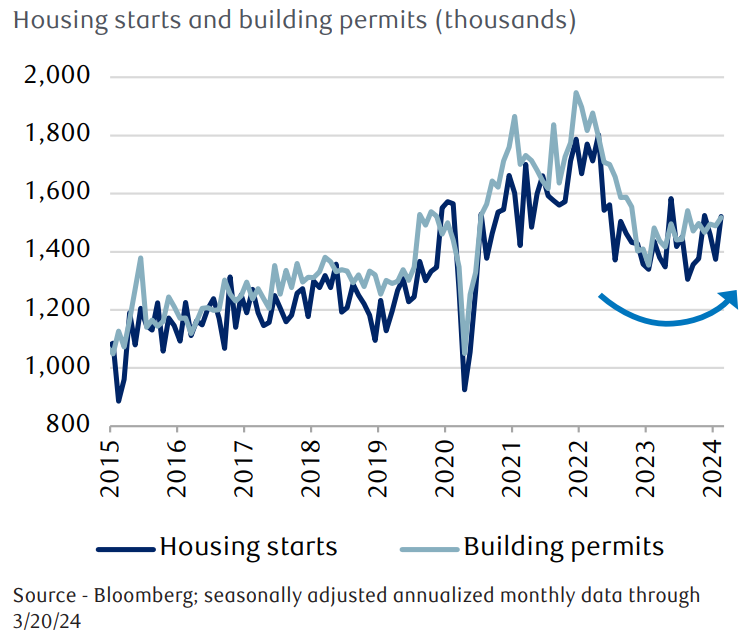

U.S. housing starts and building permits exceeded expectations in February. After a 12.3% decline in January due to cold weather hindering new construction, housing starts rebounded, rising 10.7%—the largest month-over-month increase since May 2023. The acceleration suggests improved sentiment within the housing market, which had been subdued over the past two years due to rising mortgage rates and elevated prices.

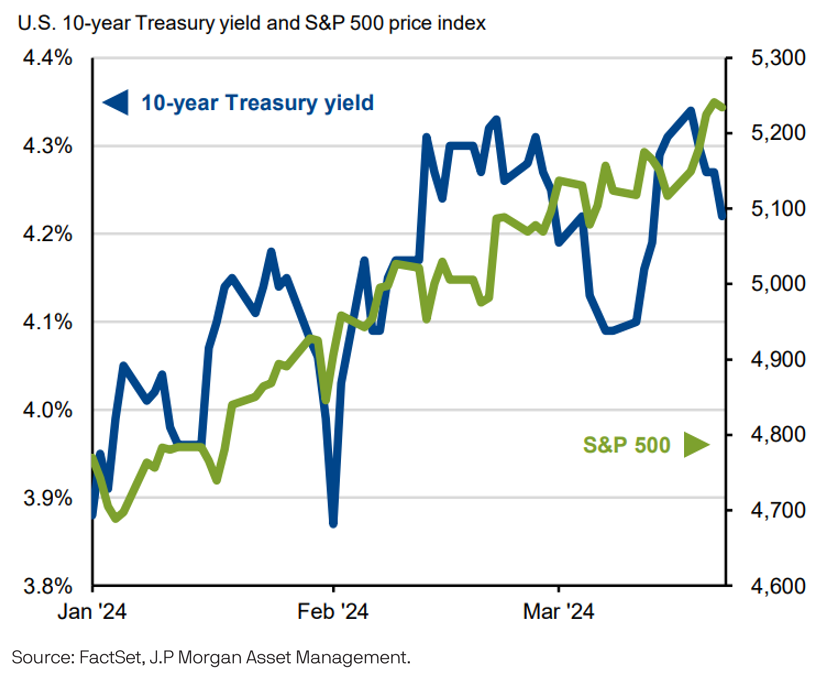

U.S. 10-Year Treasury yields have been on the rise all year and consistently above 4% since February. Interest rate levels can be driven by multiple factors: expectations for monetary policy, inflation and economic growth. Rising yields were a headwind for stocks in 2022 as investors braced for higher inflation. But now stocks have been rising in tandem with rates, suggesting markets expect more resilient economic growth and moderating inflation in the future.

The S&P 500 has closed out the first quarter with solid gains and just marked its 5th straight monthly gain. Currently, the markets appear much more focused on resilient economic growth than concerns over inflation potentially reaccelerating. The recent Federal Open Market Committee details indicated the Fed is on the same page for now. The Fed raised their forecast for 2024 economic growth from 1.4% to 2.1%. And despite the inflation data moving in the wrong direction in the first couple of months of the year, the Fed contends those increases may be mostly seasonal. They expect inflation to continue to trend lower, leaving up to 3 rate cuts on the table in 2024. Markets have been able to digest a reset of rate cut expectations from 6 to now 3, but there’s still room for disappointment, and we believe it’s unlikely that the market can remain impervious to volatility if hotter than expected inflation data continues and forces the Fed to keep rates elevated. Recently, some Fed officials like Christopher Waller have been more blunt in their statements that they need to see more data before considering cuts. We have given the market momentum the benefit of the doubt, but we continue to monitor shifts in market sentiment around monetary policy and inflation. If economic growth stalls, inflation picks up, or market sentiment sours due to interest rates remaining too restrictive for too long, we believe volatility will be highest in the most overvalued areas of the market. This is when we believe positions where we have exposure to companies outside the U.S., as well as non-Tech sectors such as energy, industrials, and basic materials can provide insulation. And like some of these areas proved in March, they have the ability to perform well if the momentum in the S&P 500 takes a breather.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.