The U.S. stock market has shown enough strength to lead us to increase stock allocation to Slightly Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- U.S. policymakers addressed the stress in the banking system after the failure of Silicon Valley Bank and Signature Bank. The Federal Reserve and regulators pledged to ‘backstop’ all deposits including uninsured amounts at these banks and the Bank Term Funding Program (BTFP) was created; an emergency lending facility for banks vulnerable to loss of deposits in the wake of the high-profile bank failures.

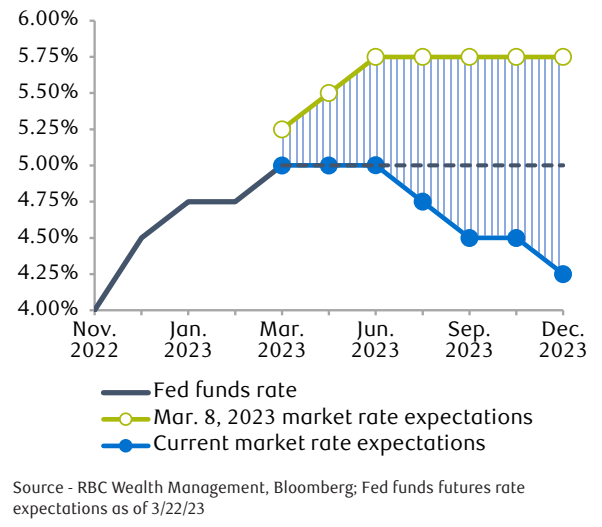

- The banking concerns did not deter the Fed from their battle against inflation and raising interest rates again. In the March Federal Open Market Committee (FOMC) meeting, the Fed raised rates 0.25% to a target range of 4.75% – 5.00%, a 16-year high.

- China and Brazil have struck a deal to trade and engage in other financial transactions in their own currencies rather than the U.S. Dollar. The move raises further questions around the future of the U.S. Dollar as the unrivaled global reserve currency.

- The S&P Bank Index has fallen 22.32% in March following the Silicon Valley Bank news and contagion fears. The bulk of the volatility took place over just 3 trading days, ending March 13th once the Fed stepped in with their deposit backstop and lending program. Since then, prices have stabilized but not yet recovered as uncertainty lingers.

- Oil prices declined roughly 17% from 3/6—3/17 as fears picked up that a banking crisis would accelerate a global recession and energy demand would wane. Oil has since recovered over half the losses as contagion concerns eased and supply/demand dynamics took hold. The closure of a major pipeline in Iraq has had an impact on overall supply levels.

- The technology sector has been a benefactor of the recent volatility, which was accompanied by falling bond yields. Demand for safety in treasuries rose, which pushed interest rates lower. Higher rates have weighed on Tech companies, so this shift has made Tech the top performing sector in March.

The market’s expectations of when the Fed will begin cutting interest rates have changed dramatically following the banking turmoil. In March, markets were not pricing in any rate cuts in 2023, but now expect multiple cuts before year-end. We believe that may be premature and barring the evolution of a larger banking crisis, the Fed will likely be more focused on the path of inflation to determine when to cut rates.

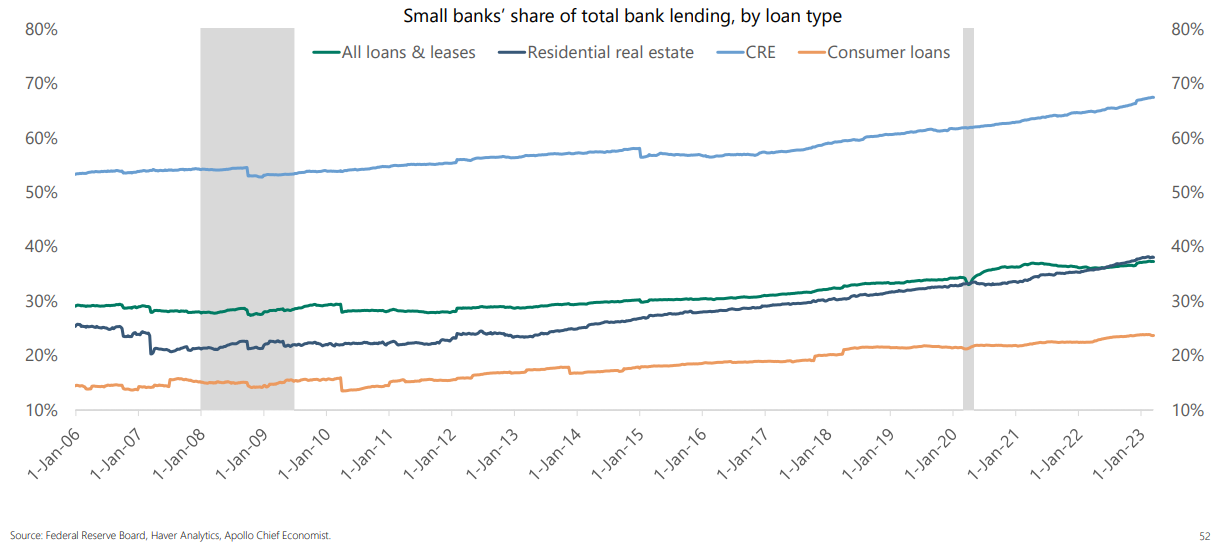

Roughly 70% of all commercial real estate (CRE) loans are owned by small banks. Areas of commercial real estate, particularly office, have seen declines in value as interest rates have risen and work-from-home trends weigh on demand. When it comes time to refinance these loans, banks may be facing additional losses. Real estate owners may also need to source financing elsewhere as small banks may be less willing or able to originate new loans, which could be an opportunity for other private lenders.

The past month has been tumultuous with multiple bank failures and shakeups in the U.S. and abroad (e.g. Credit Suisse), as well as historic moves in interest rates. The knock-on effects of all of this are not fully known and will take time to play out. One item that seems likely however is a continuation of tighter lending standards among banks. Less access to credit should have a negative impact on growth and spending, but in turn should also serve to reduce some inflationary pressure. Both of which have the markets anticipating a less aggressive Fed, which may explain the resiliency in the stock market. The S&P 500 has now posted three consecutive weekly gains and is higher than when the banking issues began. Whether rates cuts happen this year or not will be up for debate, but for now the uptrend in stocks that began in October appears to still be in tact. The biggest threat to that in our view continues to be inflation. If price pressures don’t trend lower through the remainder of the year, the Fed may not have the ability to ease their hiking policy. We remain cautiously optimistic, but are wary of the headwinds that could pick up as a result of a weakened banking system and the volatility that may be associated with the upcoming U.S. debt ceiling decision.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.