Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- President Donald Trump has indicated he may extend or shorten the July 9 deadline for imposing reciprocal tariffs, signaling flexibility and backing off the previously firm date as trade negotiations continue with key partners. In the meantime, 10% baseline tariffs on most goods remain in effect.

- The housing market continued to weaken as new home sales dropped 13.7% in May to a seasonally adjusted annual rate of 623,000 units. This is a seven-month low and the steepest monthly decline since 2022. Inventory also rose to a three-year high, indicating high mortgage rates and affordability pressures remain a significant issue for buyers.

- The Conference Board’s Consumer Confidence Index dropped by 5.4 points in June, falling to a lower-than-anticipated 93.0. After a brief increase last month, the index has returned to its downward trend, having declined in six of the past seven months. Although the current level still aligns with ongoing economic growth, the persistent weakening in consumer confidence poses a short-term risk to consumer spending.

- The stock market rally that began in April continued through June with both the S&P 500 and NASDAQ indices reaching new all-time highs on 6/27/25. The rally has been partly driven by renewed enthusiasm for artificial intelligence, optimism about U.S.-China trade agreements, and de-escalating tensions in the Middle East.

- Large tech names have once again generated most of the market’s momentum. While other areas of the U.S. market have participated in the recent rally, they have still lagged in 2025. For example, the Russell 2000, an index of smaller companies tracked by the iShares Russell 2000 ETF (ticker: IWM), remains negative year-to-date, down 2% and underperforming the S&P 500 by 7.5%.

- The 10-year Treasury yield declined in June, falling from 4.60% in May to 4.24% on 6/26/25, on softer economic data, including a downward revision to Q1 real Gross Domestic Product. This is keeping expectations for Federal Reserve rate cuts alive as investors anticipate the economy may need additional support.

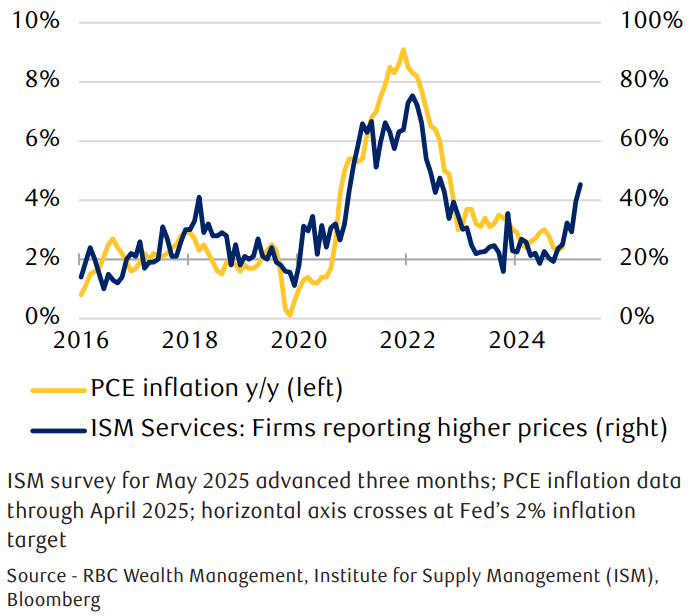

Inflation has remained mild after months of anticipation. Through May, the headline Consumer Price Index (CPI) rose at a 1.0% annualized rate over the past three months, and core inflation (excluding food and energy) was 1.7%, both below the Federal Reserve’s 2.0% target. Still, the Fed is focused on future risks, now projecting Personal Consumption Expenditures (PCE) inflation to reach 3.0% by year-end, up from 2.7% in March, due to expected tariff effects. Recent surveys show 45% of service-sector businesses reported higher prices, the most since January 2023, suggesting inflation pressures may build soon.

U.S. households stand out globally for their strong preference for stocks, with 49% of their assets invested in equities, far higher than Japan (13%), the UK and EU (10% each), and China (9%). As international markets outperform the U.S., it remains to be seen whether households in these regions will increase their exposure to equities.

The market’s year-to-date positive returns and ‘all-time high’ status mask the historic volatility experienced in March and April of this year. While the worst of the declines may now be in the rearview mirror, provided there’s no re-escalation of trade wars, continued economic softness means the market will need some good news in the second half of the year to sustain these elevated valuations. Will the Fed be able to keep things buoyed with rate cuts? Several Fed officials, including Governor Christopher Waller and Vice Chair Michelle Bowman, have recently signaled openness to a rate cut as soon as July if inflation remains low. Chair Jerome Powell has avoided specifying a timeline but confirmed that most committee members expect cuts later this year, potentially sooner if inflation declines or the labor market weakens. Meanwhile, President Trump has ramped up pressure on the Fed to lower rates and is reportedly considering replacing Powell, with speculation of a new appointment by fall. As previously noted, Powell being ousted could be a negative catalyst for markets, as it would be interpreted as a direct threat to the Fed’s autonomy. For now, inflation data appears to be giving the Fed an opening to cut, but the impact of tariffs should eventually make its way into inflation readings. The key question will be whether the Fed views any price increases as a one-time adjustment or the start of ongoing inflationary pressures.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.