Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Economic growth in the U.S. expanded at a 2.8% annualized rate in Q2, significantly surpassing the consensus estimate of 2.0%. This growth marks an acceleration from the 1.4% rate in the previous quarter, driven by increased consumer spending and inventory restocking. While the economy is growing near its trend pace, the buildup in inventories could pose a drag on third quarter growth as companies work to reduce their stock.

- Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred gauge of inflation, eased modestly in June to a 2.5% year-over-year rate, down from 2.6% in the previous month. After rising earlier this year, inflation appears to be returning to a more stable path, approaching its lowest level since February 2021.

- In the wake of elevated mortgage rates and low inventory of homes for sale, existing home sales continued to decline last month, reaching their lowest level since December 2023 and nearing 2010 levels. This marks the fourth consecutive decline, even as the median price rose to a record high. Additionally, new home sales fell to a seven-month low in June.

- U.S. tech stocks (measured by The Technology Select Sector SPDR Fund, ticker: XLK) have fallen for three straight weeks in July. Second quarter earnings season delivered mixed results, highlighted by disappointing numbers for two of the Magnificent Seven stocks, Tesla and Alphabet (parent company of Google). Investors may be beginning to question whether big tech firms can deliver on their heavy Artificial Intelligence spending.

- Unrelated to earnings, cybersecurity company CrowdStrike (ticker: CRWD) has fallen over 30% following an incident on July 19th, where a faulty software update caused widespread issues and outages on Microsoft Windows computers. The result was major disruptions across a number of sectors including airlines, financial services companies, and hospitals.

- Natural gas prices have also dropped roughly 30% since June. Hurricane Beryl has shut down natural gas exports out of Texas, keeping supplies stranded in the U.S. Stockpiles are nearly 20% above normal levels for this time of the year, which is pressuring prices.

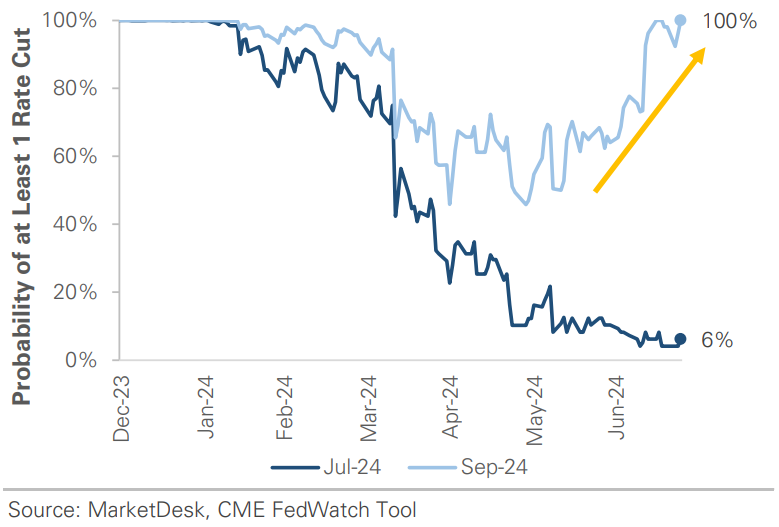

According to the CME Group’s FedWatch tool, which forecasts rate movements based on fed funds futures trading data, traders are fully expecting the Federal Reserve to cut its influential fed funds rate in September. This expectation has increased since earlier in the year, following several data releases indicating that inflation is moderating, and economic activity is slowing. That dynamic appears to be giving the Fed confidence that their two-year campaign of high interest rates is achieving its intended effect, and they now have some flexibility to ease the tightening.

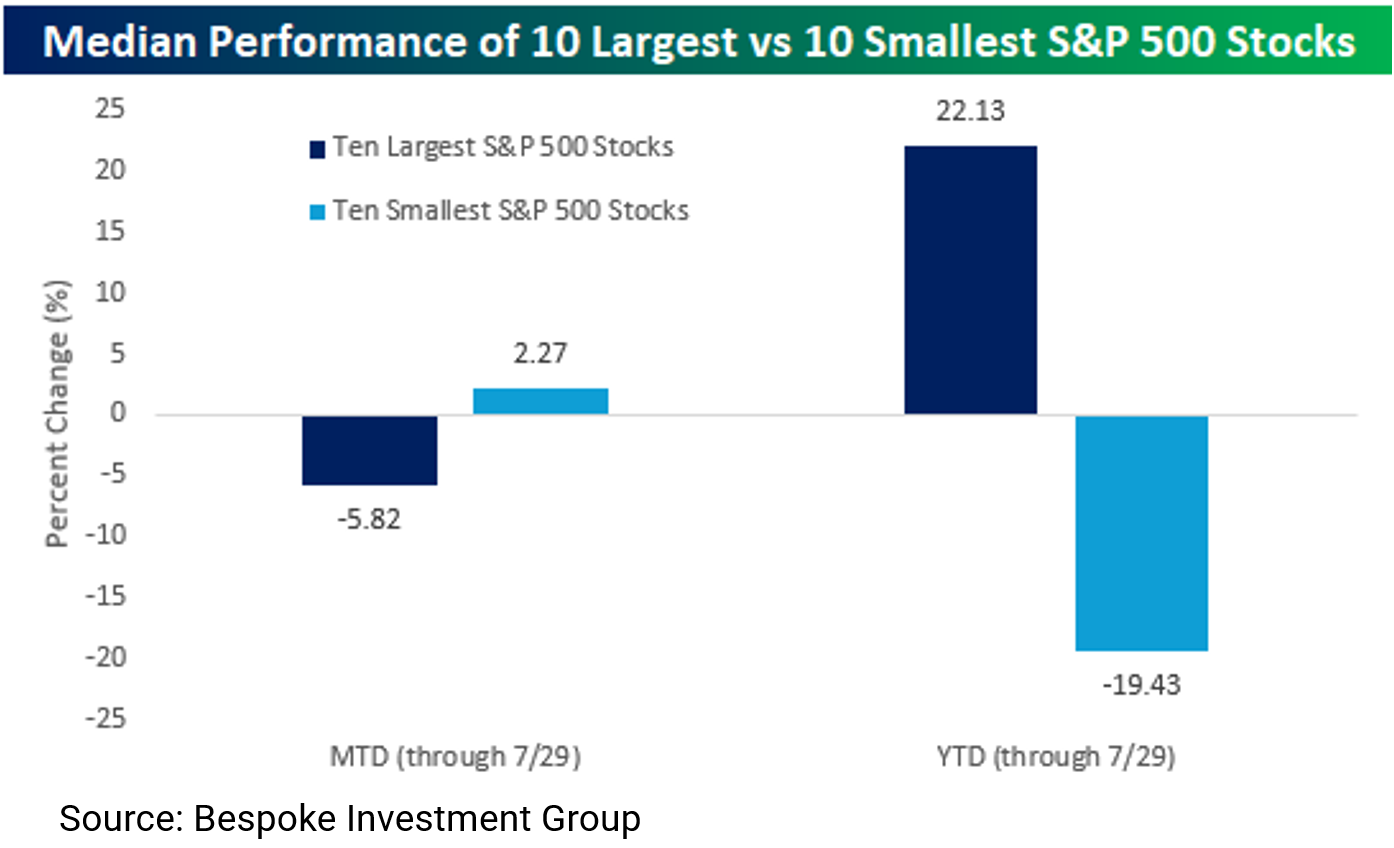

While the tech sector is down nearly 8% in July, most other sectors have produced positive results. The recent rotation from the largest tech stocks into other areas of the market, including smaller companies, has resulted in an 8% performance spread this month, favoring smaller companies. However, the performance gap for the year is still nearly 42% in favor of large tech companies. This suggests that if a broadening of market leadership beyond big tech is underway, there may still be plenty of room to run.

Strength in the big tech names has begun to falter for the second time this year. The declines across the sector have already exceeded the pullback in April. Following weakness so far in earnings season, many key names such as Apple, Amazon, and Meta have yet to release results. Disappointing results or future guidance from these companies, which have provided much of the returns for the S&P 500 this year, will likely keep volatility high. However, given the overall strength of returns this sector has seen over the last two years, we believe this type of moderation is healthy. Expectations for growth by many analysts have likely become a bit stretched. The dynamic we’ve experienced over the past month highlights the importance of diversification. We are encouraged by the performance of the ‘rest of the market’ during this bout of tech volatility. Much like the uneven economic recovery that’s taken place since the pandemic (e.g., strength shifting from manufacturing to the service sector), strength can shift across market segments too. If the rest of the market can keep the wind in its sales, investors who are diversified should remain somewhat insulated from a tech correction. The Fed cutting interest rates may provide that gust of wind.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.