Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- U.S. economic growth grew at a 2.3% annual rate in the 4th quarter of 2024, down from 3.1% in the third quarter and below the 2.5% forecast. The main driver was consumer spending, rising 4.2%, the fastest in nearly two years, led by durable goods like vehicles. Some of this surge was likely due to consumers rushing purchases ahead of potential tariffs, suggesting spending may slow in the coming quarters.

- The Bank of Japan (BOJ) raised its policy rate by 0.25% to 0.5%, the highest since 2008. The move was widely anticipated as consumer prices, including food and energy, rose 3.6% year-over-year. BOJ members revised their inflation forecasts upward, all expecting inflation of at least 2%, reinforcing expectations of further rate hikes.

- U.S. consumer sentiment declined in January for the first time in six months, with the Michigan Consumer Sentiment Index falling to 71.1, down 2.9 points (-3.9%) from December’s 74.0 and 10% lower than a year ago. Concerns over unemployment and potential tariff-driven inflation contributed to the decline.

- DeepSeek, a newly launched large-language model (LLM), is disrupting the dominance of major tech firms by delivering comparable performance while using less advanced chips and operating at a lower cost. This sparked a sharp selloff in U.S. tech on 1/27/25, causing the NASDAQ to drop 3% and the S&P 500 to decline 1.5%.

- European equities have risen in 2025, with the EURO STOXX 50—the leading large-cap stock index for the Eurozone—hitting an all-time high on 1/30/25. European markets struggled in Q4 2024 amid concerns over potential U.S. trade policies under Donald Trump. However, investor sentiment has improved as no major trade measures have been imposed yet, aside from a push for the European Union to buy more U.S. oil and gas to avoid tariffs.

- Crude oil prices climbed over 10% to just above $80 per barrel through 1/15/25, partly driven by expectations that expanded U.S. sanctions on Russian oil would force buyers in India and China to seek alternative suppliers. However, since mid-January, crude prices have given back all of those gains and are now roughly at the same level as the start of the year, underscoring market uncertainty surrounding tariffs, sanctions, and the overall demand outlook.

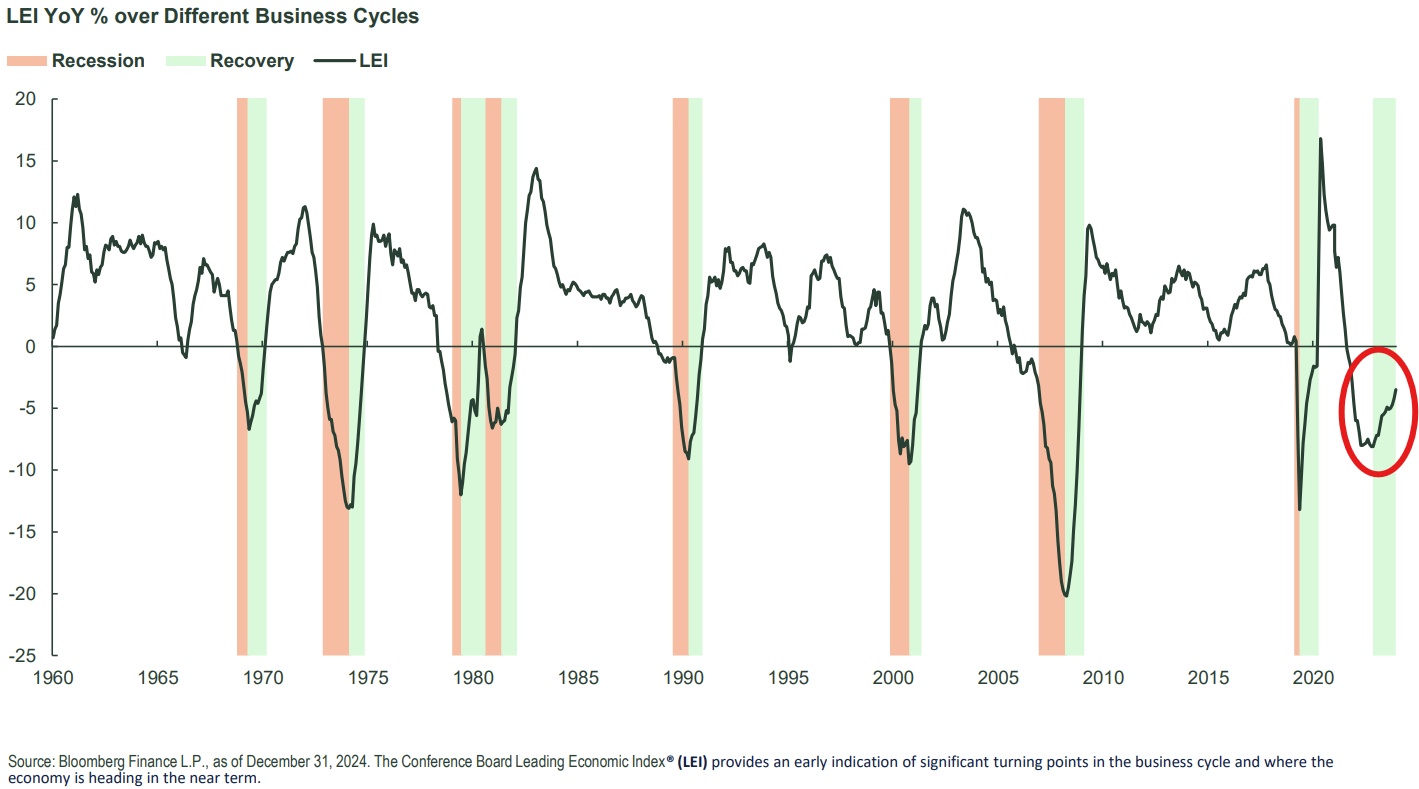

The Conference Board’s Leading Economic Index (LEI) tracks key indicators to predict U.S. economic trends. A rise signals growth, while a decline may indicate a slowdown. After a multi-year decline, the year-over-year trend has begun to turn higher, reflecting slower declines and improvements in some component indicators. Manufacturing, a major component, has seen a pickup in activity over the past couple of months. While manufacturing is less impactful on overall gross domestic product (GDP) than the non-manufacturing service sector, its turnaround could still have implications for inflation rebounding in this part of the economy.

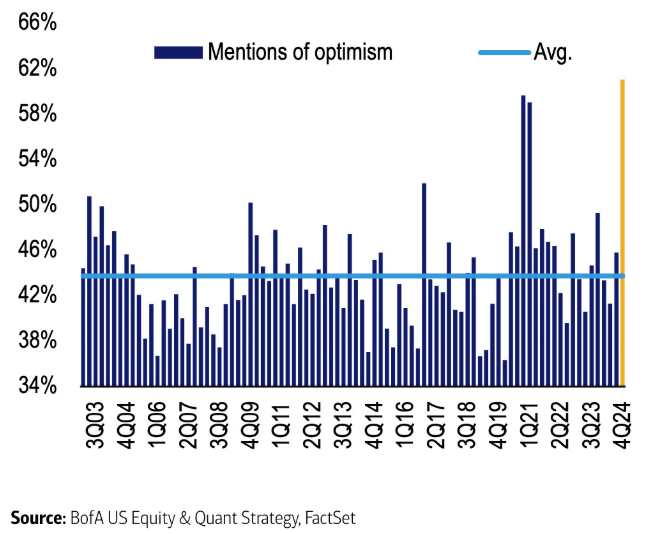

So far, throughout the Q4 2024 earnings season (as of 1/24/25), a record-high 61% of S&P 500 companies have mentioned “optimism” or “optimistic” in their earnings calls. The optimism across sectors likely stems from different factors, including artificial intelligence spending, continued economic strength, or resilient consumer demand. However, we remain cautious about excessive bullish exuberance influencing earnings forecasts. Overly optimistic earnings estimates for 2025 could set expectations too high, increasing the likelihood of disappointments.

The Federal Reserve kept rates unchanged at 4.25%-4.50% in its January meeting, ending a three-meeting streak of cuts. Fed Chair Jerome Powell signaled a cautious approach, emphasizing the need for further progress on inflation before resuming cuts and acknowledging a stronger-than-expected labor market. While Powell reaffirmed that policy remains restrictive, he maintained a dovish stance, leading to minimal market reaction. Bond yields initially rose, and equities wavered before recovering. Market expectations for easing shifted slightly, with no rate cut now expected until summer, though uncertainty remains high, given that the trend of falling inflation has largely stalled over the past six months. If inflation remains persistent and economic growth stays strong, the Fed may be unable to cut rates and could even consider hiking if inflation accelerates. Given elevated market valuations, even small surprises could trigger volatility. The brief bout of volatility caused by the release of DeepSeek on January 27 also illustrated the benefits of diversification. The selloff was highly concentrated in big tech and AI-linked areas such as semiconductors, data centers, and power companies, while most other non-tech sectors significantly outperformed. Notably, the S&P 500 Equal Weight Index outpaced the S&P 500 by the most in a single day since July 2024. This highlights the risk of disruption and the vulnerability of portfolios that are overly concentrated in these specific areas. The return gap between high-flying tech stocks and the rest of the market remains significant, with potential for resolution either through continued volatility bringing some tech names back down to earth or through a broadening of market leadership to other sectors.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.