Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The S&P Global Flash US Manufacturing Purchasing Manager’s Index (PMI) indicated the first improvement in operating conditions amongst manufacturing firms surveyed in 9 months.

- Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred measure of inflation, recorded a 2.9% increase in core prices (excludes volatile food and energy inputs) over the past year. This marks the lowest year-over-year rise since March 2021.

- In December, The Conference Board’s Leading Economic Index (LEI) declined by 0.1%, which was smaller than the anticipated 0.3% decrease according to consensus estimates. This marks the 22nd consecutive month of decline for the index, however, this decline matches the smallest decrease in this sequence, suggesting a potential stabilization of conditions.

- The S&P 500 has continued to mark new all-time highs in January. The Russell 2000 small cap index has had a more difficult start to 2024. Interestingly, 1/19/24 was the first time ever the S&P 500 notched an all-time high while the Russell 2000 was in a bear market. The small cap index is still roughly 20% below its all time high in late 2021.

- Meanwhile, the Asian Pacific stock market has been in more of a downtrend this year, primarily weighed down by the Hang Seng Index (down –9.16% year-to-date). The downturn in Chinese equities intensified following weak economic data showing persistent deflation, while their property crisis persists.

- After declining over 5% in the fourth quarter of 2023, the U.S. Dollar has regained some ground. The Dollar has risen just over 2% in January as stronger than expected economic data in the U.S. reduces expectations that the Fed will begin cutting rates in March.

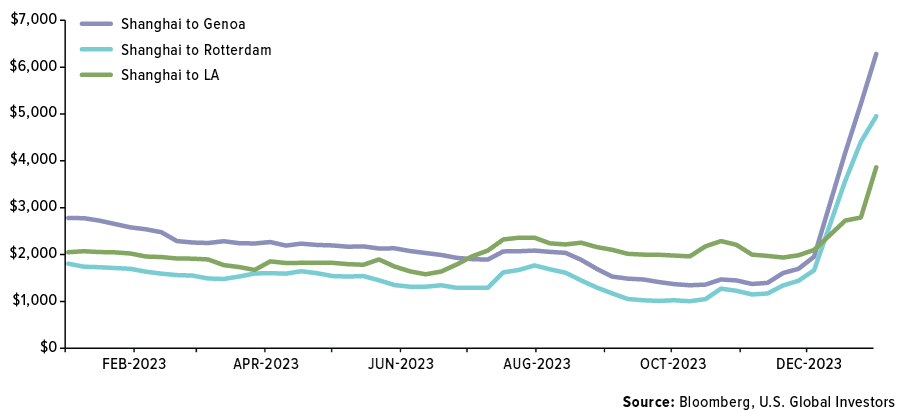

Container shipping rates between Asia, Europe, and the United States are increasing due to reduced capacity stemming from conflict in the Red Sea. Spot rates for a 40-foot container from Asia to northern Europe have surged over 173% since mid-December. Still, the rates are well below the levels seen during the pandemic. Most companies shouldn’t bear the full impact of the spot rate since shipping costs are often governed by long-term contracts, but even firms with long-term contracts may encounter increased expenses due to diversions and higher insurance costs.

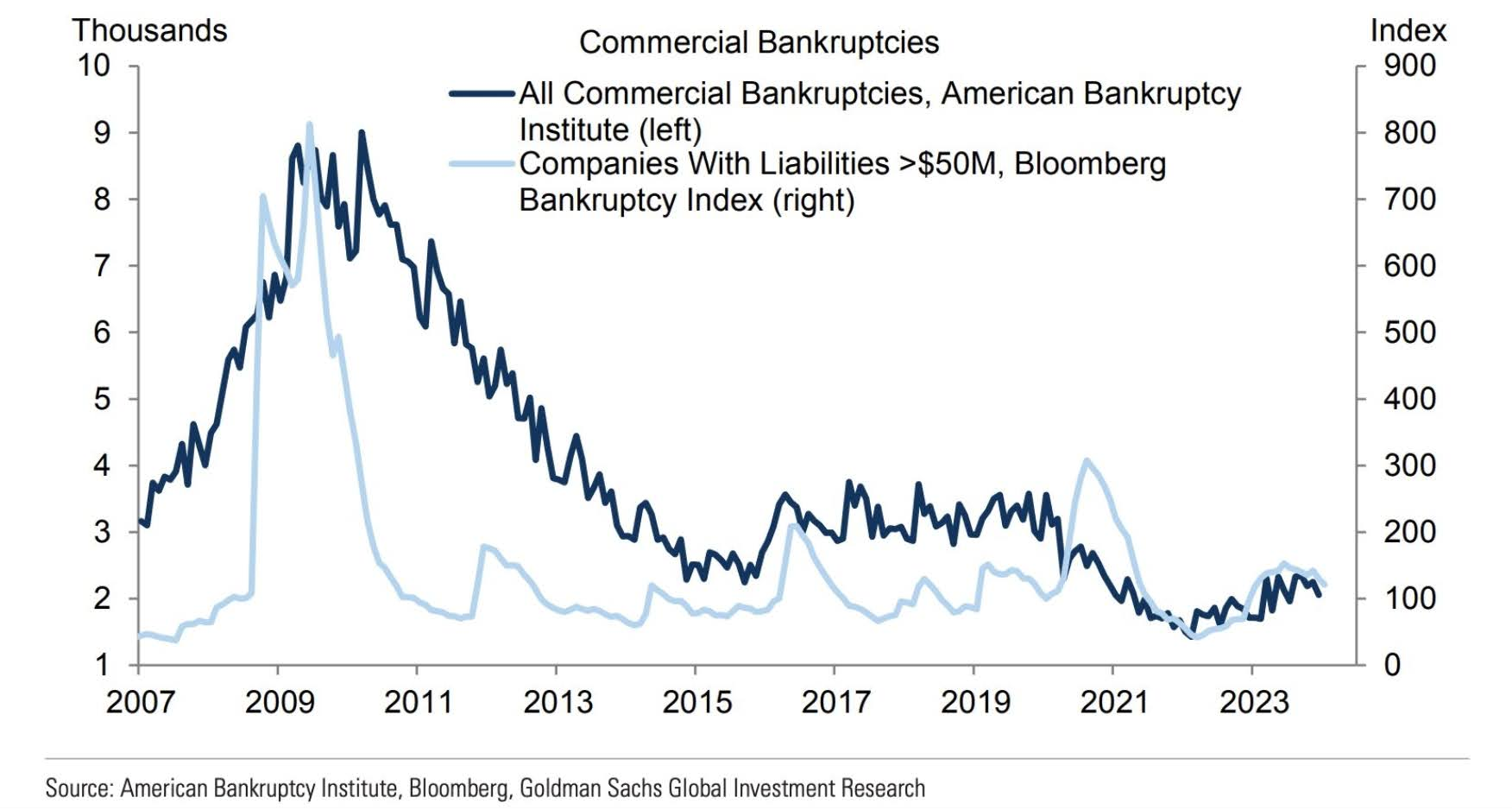

Commercial bankruptcies have risen in 2023, but remain below pre-pandemic levels. U.S. filings for bankruptcies rose 18% in 2023 as higher interest rates, depleted pandemic stimulus, and tougher lending standards from banks all weigh on business conditions. Filings dropped in 2021 as many companies that may have otherwise gone bankrupt sooner survived on government assistance and above average growth as the economy reopened. Although the interest rate and lending environment have become difficult, the rise in 2023 may also be partly a reversion to the average.

So far, fourth quarter earnings have been mostly better than expected, which has helped push the S&P 500 to all-time highs. However, underneath the hood, it’s important to note that some of the biggest earnings drivers to this point have been concentrated in a couple familiar sectors: technology and communication services. Those happen to be the sectors in which many of the heavy-weight companies that make up the ‘Magnificent 7’ reside. Markets have reverted back to their 2023 trend of being led by just these few mega-cap names. Although we are pleased with the rising market, we are mindful of what drove a large part of the gains over the past few months. Expectations for interest rate cuts by the Fed drove the 10-year Treasury yield from a high of 5% down to roughly 3.8% towards the end of 2023, which supported the market rebound. Some of that optimism has started to unwind as the 10-year yield crosses back above 4%. Recent comments from central bankers in the U.S. and Europe are suggesting a more cautious approach to rate cuts. Following stronger than expected releases of December U.S. retail sales, fourth quarter economic growth (GDP), and the lowest initial jobless claims (unemployment claims in the week ending 1/19/24) since September 2022, the market is now questioning if growth is too resilient for the Federal Reserve to begin cutting rates as soon as March. This could pour some cold water on market momentum in the near-term.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.