Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- On February 13th, the New York Fed reported U.S. consumer debt delinquencies rose to 3.6% in the fourth quarter, the highest since 2020. Total household debt also hit a record $18 trillion. Despite the increase, delinquencies remain below the pre-pandemic average of 5%.

- The U.S. ISM Manufacturing PMI (survey indicator measuring manufacturing activity) rose to 50.9 in January, marking the first expansion in over two years. The increase was driven by a sharp rebound in new orders. However, like the spike in shipping activity we noted in late 2024, the surge in new orders may partly reflect pre-buying ahead of potential tariffs, as companies stockpiled inventory in anticipation of price increases or trade policy changes.

- U.S. retail sales dropped 0.9% month-over-month in January, missing expectations for no change in the rate of spending. Excluding autos and fuel, spending fell 0.54%, the largest decline since January 2024. The slowdown was broad-based and followed a surge in consumer spending late last year.

- As the earnings reporting season for the fourth quarter of last year comes to a close, the data show that 2024 ended on a high note. Fourth-quarter results have been strong, with 76% of S&P 500 companies surpassing consensus estimates and significant improvements in beat rates among mid-cap and small-cap stocks.

- Bond markets have reacted as well with the 10-year treasury yield experiencing another ~0.50% swing in less than 2 months. The 10-year treasury yield has declined to 4.26% as of 2/26/25 from the recent peak of 4.79% on 1/14/25 likely driven by general uncertainty around tariffs and the potential for slowing economic growth.

- While stocks are higher to begin the year, sector leadership has been decisively defensive. Driving the trend has been Consumer Staples and Health Care, two historically defensive areas of the market, are some of the top performing sectors year-to-date as of 2/26/25.

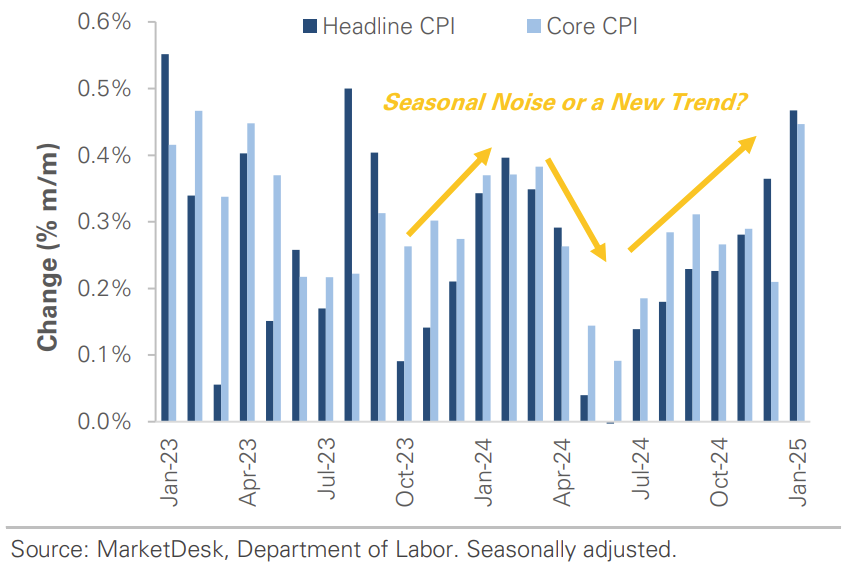

Inflation data, as measured by the Consumer Price Index (CPI) has been on the rise. Headline CPI measures overall consumer price inflation, including volatile food and energy prices, while Core CPI excludes these categories to provide a steadier view of underlying inflation trends. January CPI data came in higher than expected, which resulted in some market volatility. Investors are grappling with whether or not inflation is beginning to reaccelerate or if there if some seasonality/exogenous factors at play. Early-year price hikes are common, making seasonal adjustments challenging and can overstate inflation. Some believe hurricanes and wildfires also contributed to January’s increase.

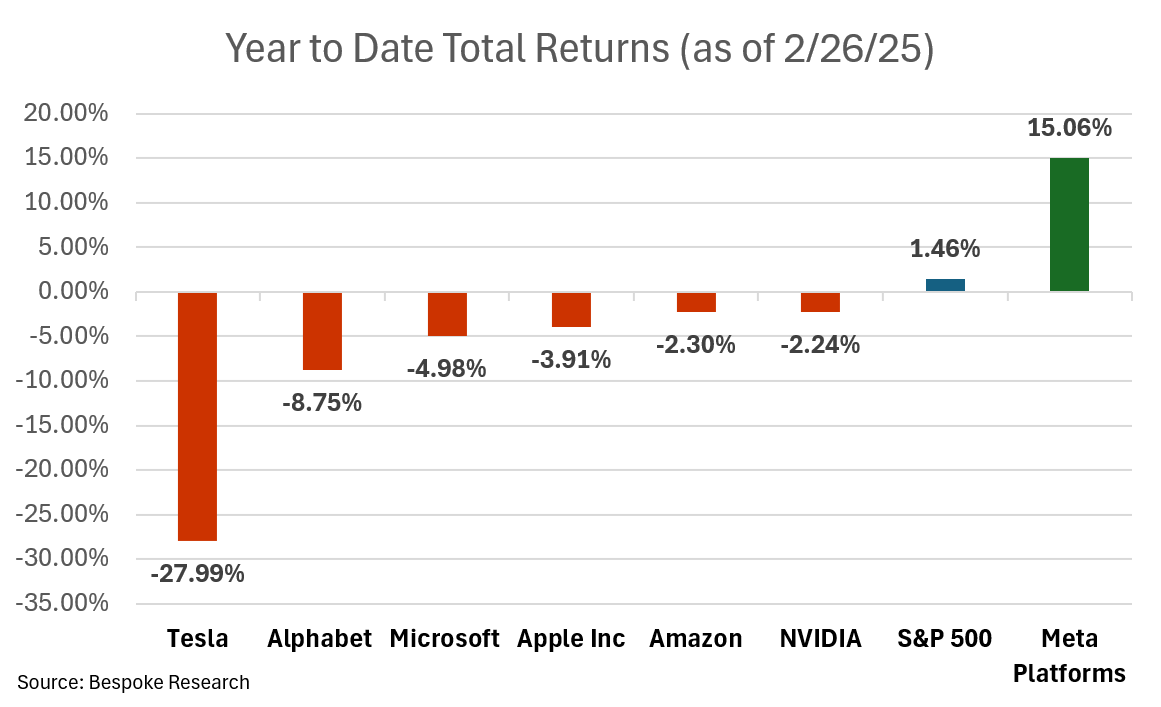

So far in 2025, the “Magnificent 7″—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla—have had mixed performance. Year-to-date as of 2/26/25, only Meta has outpaced the S&P 500, gaining roughly 15% compared to the S&P 500 up just 1.46%. Several of these mega-cap tech stocks have faced pressure in recent weeks due to concerns over slowing earnings growth and the evolving economics of artificial intelligence. Tesla’s recent decline has been more dramatic amid slowing sales, particularly in Europe.

The uncertainty surrounding policy—ranging from tariffs and government layoffs to immigration and shifting global alliances—appears to be weighing on sentiment. Small business surveys indicate plans to scale back capital spending and hiring, while consumer spending outlooks are weakening. Financial markets have also responded, with momentum in stocks slowing and Treasury yields retreating, possibly reflecting investor expectations of economic softening. Another key driver of market unease is the shift from globalization to a more fragmented global economy. This transition is structurally increasing inflation, as higher costs for imports, domestic production, and labor reduce competition and push prices up. While globalization previously helped keep inflation in check, deglobalization is now sustaining higher inflation and interest rates for the foreseeable future. This environment may lead to undesirable outcomes. Businesses and households are more likely to delay major investments due to uncertainty, while consumers, fearing rising prices, may stockpile certain goods. The former slows economic growth, while the latter fuels inflation. We anticipate continued market volatility until policies become clearer and investors gain a better understanding of their long-term impact on companies and earnings.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.