- U.S. Retail Sales rose 3.8% in January, a strong reversal from December’s reading of –2.5%, as the effects of the Omicron variant fade. Improvement in employment and wage growth trends may also be contributing to the ongoing strength in consumer spending.

- Small business optimism, however, has struggled, declining to the lowest level since February 2021. The survey indicates that business owners are still feeling the pressures of a tight labor market and an inflationary environment.

- Pending home sales fell –5.7% in January, the largest drop since April 2020, as increasing mortgage rates, higher home prices, and lower inventories slow purchases.

- Oil prices climbed above $100 per barrel for the first time since 2014, driven recently by Russia’s invasion of Ukraine and the potential for supply disruptions. Russia is also a key producer of other commodities such as metals and grains. As a result, prices for aluminum, nickel, wheat, and corn all surged.

- The U.S. 10–year Treasury yield rose above 2% in February for the first time since August 2019 following strong inflation data. But investors purchasing more ‘safe-haven’ bonds following the conflict overseas has pushed rates back towards the 1.9% level.

- Defensive sectors such as Consumer Staples, Utilities, and Healthcare all outperformed the S&P 500 over the past two weeks as the market volatility picked up.

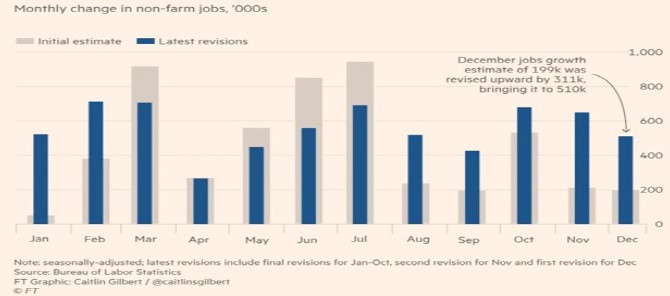

Although labor market data in 2022 has been strong, initial estimates of job growth in the final months of 2021 were subpar. However, as more data gets collected each month, initial estimates get revised. Figures for November and December were both revised significantly higher, indicating even more employment strength. This further bolsters the case for the Federal Reserve to shift focus from supporting the labor market to combating inflation.

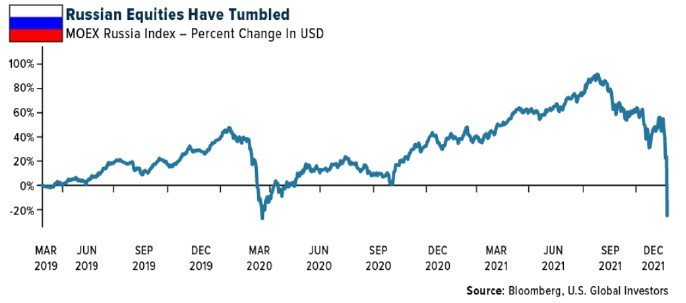

Unsurprisingly, Russian stocks have been hit hard as war breaks out throughout Ukraine. The MOEX Russia Index, which tracks Russia’s 50 largest companies, was down over –50% from its October record highs this month. The index fell –33% in a single day when Russian forces invaded Ukraine on 2/24/22. Downward pressure could worsen depending on how additional sanctions and restrictions get imposed over the coming weeks.

The events taking place in Russia and Ukraine have grabbed the market’s attention and driven volatility levels higher. How the situation evolves is uncertain and, barring a quick resolution, likely to continue to result in choppiness throughout a number of different markets including commodities, stocks, and bonds. Focus has also begun to shift back towards the Federal Reserve in trying to determine how they will react; specifically, if the market volatility and recent events will result in any change to the pace of raising rates and adjustments to monetary policy. In determining whether a 0.25% or a 0.50% rate hike in March is appropriate, the Fed will have to weigh the benefits of keeping rates lower to support economic growth and equity markets versus trying to fight inflation. The energy supply disruptions abroad add another wrinkle to the decision which has boosted prices for oil and other commodities, and has the potential to fuel inflation figures even further. Regardless of the Fed’s decision on the initial hike, the key will be how the economy and corporate earnings hold up through the entirety of the central bank’s cycle of removing accommodative policy. Although consumer spending and corporate profit margins have remained encouraging, it will be important to see some normalization in prices, which continues to be largely dependent on resolutions to supply chain issues.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.