Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Prime Minister Justin Trudeau stated that Canada “will respond” if U.S. President-elect Donald Trump imposes new tariffs on Canadian imports, emphasizing that retaliatory measures proved effective when Trump introduced tariffs on Canadian steel and aluminum in 2018. Trump’s threat has highlighted Canada’s reliance on U.S. trade, with industries like oil and gas, primary metals, and motor vehicles particularly exposed. In 2023, nearly 77% of Canadian exports went to the U.S., accounting for 19% of Canada’s GDP.

- Driven by a surge in food prices, the Producer Price Index (PPI)—which measures the average change in prices received by producers for goods and services—rose by a larger-than-expected 0.4% in November, marking its biggest increase in five months. This reinforces expectations of slower Federal Reserve rate cuts in 2025.

- Housing starts in the U.S. fell 1.8% in November to an annual rate of 1.289 million units, the second-lowest level since June 2020. High mortgage rates and rising financing and regulatory costs continue to pressure construction. However, homebuilders are increasingly optimistic about potential sales growth and deregulation policies under the incoming Trump administration.

- According to Bank of America, U.S. container volumes increased by 15-20% year-over-year in November, reflecting unusually strong demand during the typically slow season. This surge was driven by pre-shipping activity ahead of tariffs and a potential U.S. East Coast port strike anticipated for January 15, 2025.

- Over the past 3 months, healthcare has been the worst performing sector in the marketplace, down -10.21% (9/17/24 – 12/17/24). Most recently, several large insurance providers are facing regulatory uncertainty as lawmakers unveiled a proposal to force insurers to sell off their ‘pharmacy-benefit manager’ segments.

- The U.S. Bond Market, as measured by the U.S. Aggregate Bond Index, has experienced a drawdown of roughly -19% since the end of July (7/31/20 – 12/18/24). Interest rates have risen significantly over this period, so the interest being received is higher now and offsets some of the price decline. Still, it remains notable that this 52-month drawdown is the longest drawdown period ever experienced by the index.

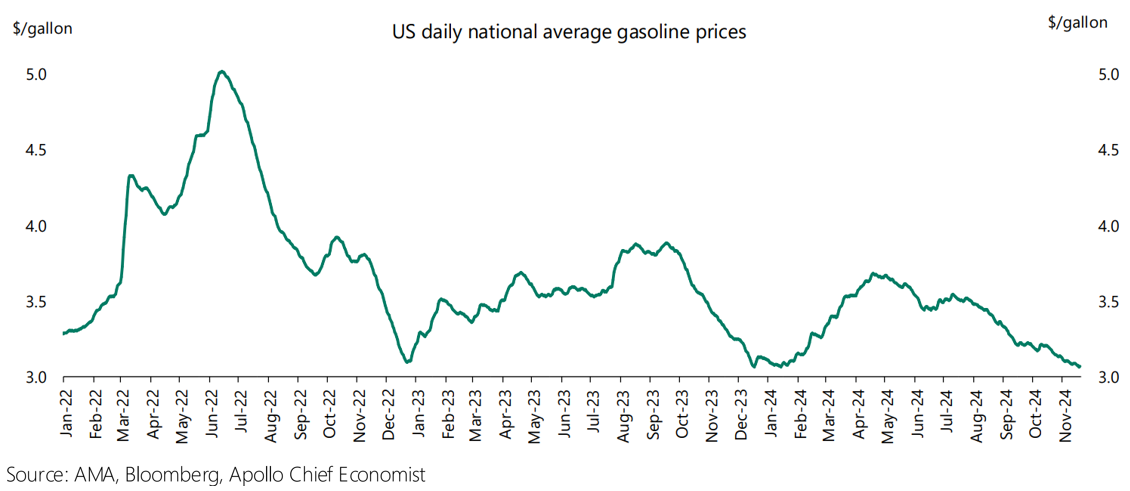

Gas prices at the pump continue to decline and should continue to provide an extra boost for consumer spending. Last month, average U.S. gasoline prices fell below $3 per gallon for the first time in over three years, hitting $2.97—the lowest since May 2021—according to GasBuddy.com. This drop is likely being driven by robust U.S. production (increasing supply), along with slower economic growth in China, which has reduced global demand.

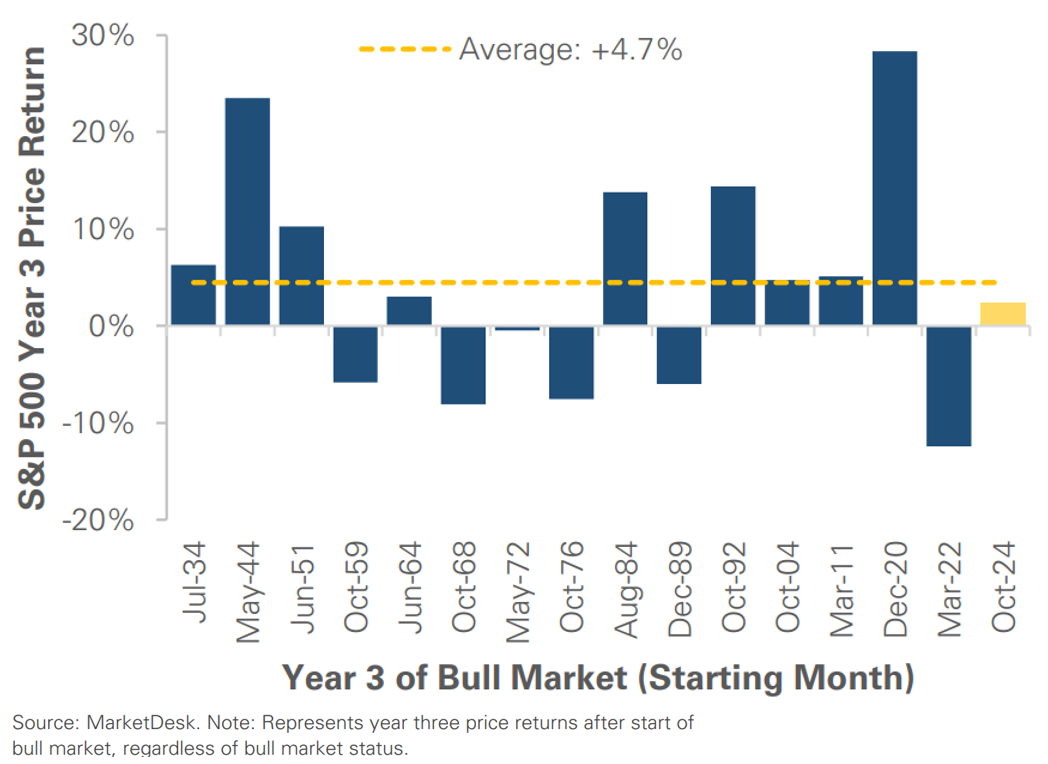

The S&P 500 is entering the third year of a bull market that began in October 2022. Over its first two years (October 2022 to October 2024), the index delivered a cumulative return of +61%, closely aligning with the historical average of +61.9% for the first two years of the 15 bull markets since 1932. While this includes instances when the bull market had ended before year 3, the chart above shows that year 3 can typically be a turning point and demonstrates the potential for dispersion. The average year three return is +4.6%. We believe this underscores the need for diversification outside the S&P 500, which trades at historically high valuations.

So far this December, a ‘Santa Claus Rally’ has yet to materialize. The S&P 500 is down nearly -3% this month, and virtually all sectors have negative month-to-date returns. The yearlong rally hit a roadblock following the latest Federal Open Market Committee (FOMC) meeting on December 18, 2024. Although the Fed did cut rates one more time by 0.25%, Fed Chairman Jerome Powell deemed the decision a ‘closer call’ than previous cuts and signaled to the market to expect just two cuts in 2025 (down from 4 at their meeting in September). As a result, the S&P 500 experienced its worst single day decline since August 5th and the yield on the 10-year Treasury once again rose back above 4.5%. The Fed is having to consider higher inflationary risks following above-trend economic growth in the 2nd and 3rd quarters, along with expectations for continued federal spending and the potential inflationary policies of the incoming administration. If interest rates remain higher than expected for a longer period of time, investors will need to reconsider the historically high valuations across many areas of the stock market currently. For the time being though, surveys show that consumers and businesses are extremely optimistic about the economy. The current bull market, which started in October 2022, is now in its third year, and we expect investors to shift their focus on fundamentals as the bull market matures. 2025 is shaping up to be a year where companies will need to materially deliver on earnings expectations to justify their high prices.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.