Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Federal Reserve chairman Jerome Powell’s commentary after the latest Federal Open Market Committee meeting indicated they are at the end of the hiking cycle. Market projections are anticipating up to seven rate cuts by the end of January 2025. Traders are speculating that the initial adjustment may happen in March.

- Consumer confidence picked up in December, which may bode well for continued spending in 2024. The Conference Board’s Consumer Confidence Index surged 9.7 points, reaching 110.7—its highest in five months. Despite the improved sentiment, it’s important to note that overall consumer confidence remains below pre-pandemic levels.

- The conflict between Israel and Hamas is now impacting global shipping activity in the Red Sea. The Iran-backed Houthi rebels have carried out multiple attacks on merchant container vessels and oil tankers in the Bab el-Mandeb strait region. This strait is a crucial route for about 12% of global goods trade.

- Interest rates continued to fall in December, extending the downward trend that began in October. As markets digest Fed chair Powell’s commentary this month and anticipate 2024 rate cuts, the yield on the 10-year treasury fell below 4%.

- In response to lower rates, the stock market broadly rallied. The S&P 500 is now within 1% of the all-time highs set on January 3rd, 2022 while the Dow Jones Industrial Average already notched new all-time highs this month. Interest rate sensitive sectors such as Real Estate have performed well too. The Real Estate Select Sector SPDR® Fund (ticker: XLRE) is up 5.64% in December, compared to the S&P 500’s 3.59%.

- Despite the European Central bank appearing less optimistic about rate cuts, European stocks have gotten a boost as well. The STOXX Europe 600 Index has gained over 4% this month as yields decline globally.

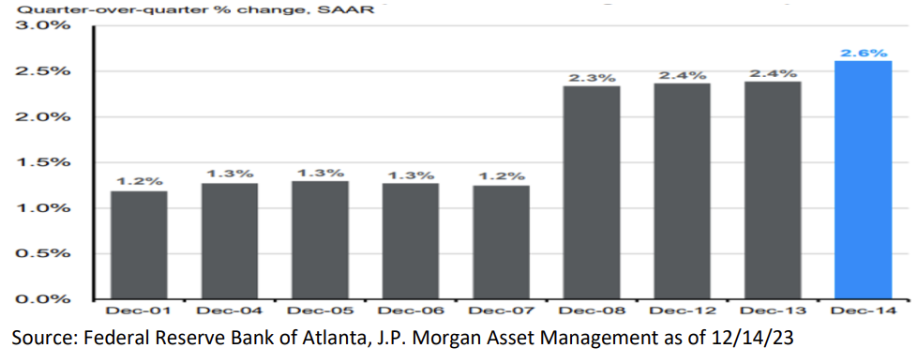

Early estimates of U.S. economic growth for the fourth quarter have been revised higher in December following November’s retail sales report, which exceeded expectations. The Atlanta Fed’s GDPNow model projecting a 2.6% quarter-over-quarter growth, up from the previous estimate of 1.2%. This follows a weak retail sales report in October and is pushing back on the notion that the consumer is in bad shape. Though many believe the spending is still a sugar-high driven by pandemic savings that should be fully exhausted soon.

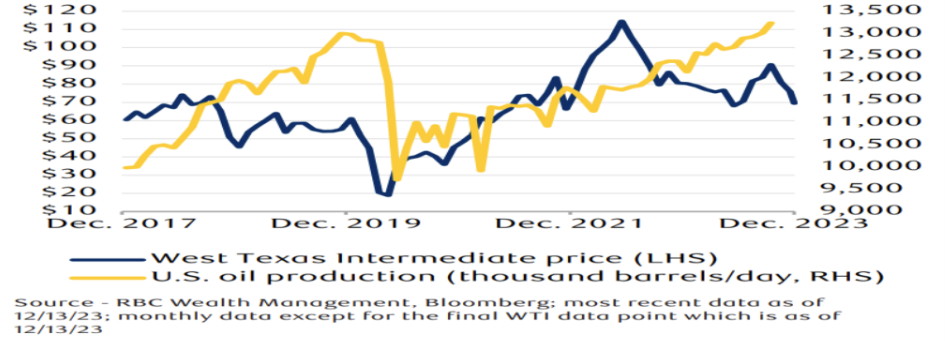

Oil prices are set for a fourth consecutive weekly decline due to surging U.S. production, which has reached a record-breaking 13.2 million barrels per day, surpassing pre-pandemic levels. West Texas Intermediate (WTI) crude, which peaked at nearly $94/barrel in late September, has dropped to just above $70/barrel. In response, OPEC+ members recently announced voluntary Q1 2024 production cuts, aiming to bolster prices. The effectiveness of these cuts in off-setting U.S. production remains uncertain.

Since 2021, members of the Federal Reserve have consistently increased their projections for what the Fed funds rate will be by the end of 2024. However, a shift occurred in their mid-December meeting, indicating a belief that interest rates in 2024 will be lower than they previously anticipated at their September meeting. Despite this change in communication, it doesn’t imply that the inflation issues are resolved. Looking into 2024, there are inflationary risks from a recovering housing market, labor market strength, and wage growth, coupled with growth risks from the delayed impact of Fed hikes on consumers and businesses. Federal Reserve Bank of New York President John Williams, a key Federal Open Market Committee (FOMC) member, emphasized caution regarding market expectations of rate cuts, stating it’s premature to consider cuts as early as March of 2024. The key question is whether policy is adequately restrictive. Regardless, positive economic data and the accommodative FOMC meeting commentary from Jerome Powell fueled market optimism for a “soft landing.” Near-term market support is likely, but as we progress into 2024, the market path may become more turbulent, especially if growth slows more than expected or inflation remains too high above 2% for the Fed’s liking. As we approach more all-time highs though, we must also consider that more often than not, markets posting all-time highs is a positive indication for the next 12 months of returns.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.