- As the U.S. labor market continues to recover, lawmakers have pushed forward in unwinding COVID-related benefit programs. Congress will not renew the enhanced unemployment benefits programs, which will now expire September 6th, and recently the Supreme Court lifted a federal ban on evictions.

- Fed Chairman Powell largely met market expectations at the Jackson Hole symposium, confirming the Central Bank’s asset purchases will be reduced later this year, but that rate hikes are still unlikely before 2023.

- Similar to the recent drop in consumer confidence in the U.S., Eurozone surveys measuring consumer and business confidence in the economy eased in August, following an all-time high in July.

- The S&P 500 volatility has remained muted all year, despite ongoing Delta concerns. In fact, there has not been a decline of more than 5% in all of 2021. The last pullback greater than 5% was in November 2020 as election volatility took hold.

- Bank of America reported that global equities had $23.9 billion of inflows the week-ended August 18, the most in nine weeks. U.S. equities specifically attracted $12.8 billion, which was also the largest in nine weeks.

- Interest rates have ticked higher in August, with the yield on the 10-Year Treasury up from 1.17% to as high as 1.36% intra-month. Yields have struggled to gain upside momentum as investors balance the Delta variant’s impact on the economic recovery, central bank actions, and weaker yields outside the U.S..

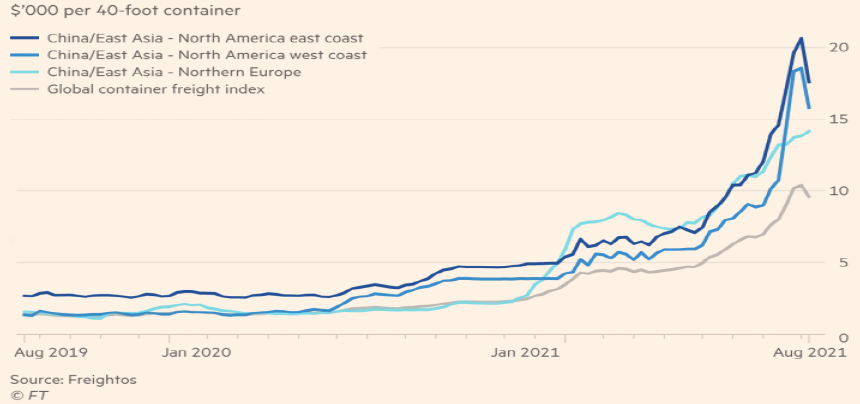

COVID outbreaks have forced some of the largest shipping ports in the world to partially or completely shut down, which is driving the surge in shipping costs and persistent bottlenecks impacting global supply chains. The longer these costs remain elevated, the more likely prices for consumers will rise to compensate. The worst may be behind major Chinese ports as Delta variant cases appear to have peaked in the region.’

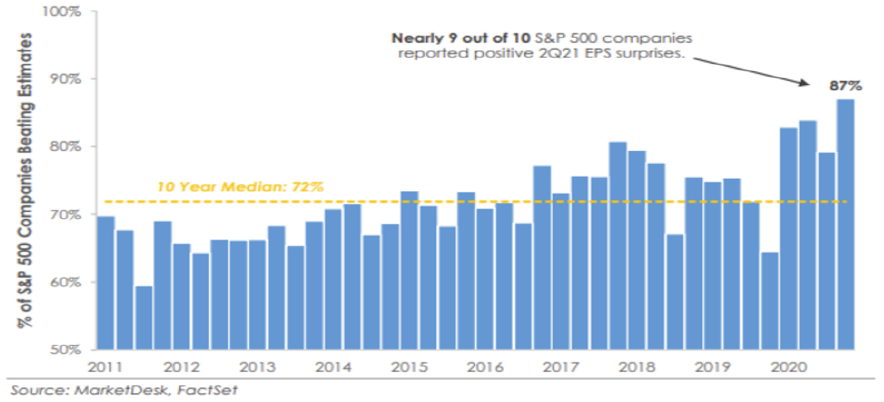

Company profits in the U.S. rose at an annual rate of +45% in the second quarter, making the argument for strong future gains in employment and business spending. Additionally, 87% of the companies that have reported earnings results have posted a positive earnings per share surprise, which is a decade high. As a result of the strong figures, earnings for 2022 have been revised higher.

Inflation remains top of mind for investors as prices for goods and services remain elevated. Earlier in the year, the major concern was a powerful and sustained rise in prices that would derail the economic recovery. Above average inflation could be tolerated provided economic reopenings continued to provide a strong tailwind for above average growth. In general, the acceleration in price pressures has not been strong enough to spook the markets, however, economic activity has been moderating. This has brought an unwelcomed term into the headlines—’stagflation’; a condition where economic growth slows or ‘stagnates’, the labor market is weak, but inflation levels are high. Beyond the immense challenges this poses for consumers, this type of economic environment poses headwinds for both stocks and bonds. The current situation is certainly unique in that supply chain issues are causing price spikes, but the labor market is still showing positive trends in its ongoing recovery. The trend is expected to continue if more people are incentivized to fill the record number of open jobs in the U.S. as expanded unemployment benefits expire. The Delta variant has been a hurdle in the normalization of global supply chains and all things being equal, weakened the economic recovery, but calls for stagflation seem premature. If COVID cases begin to peak once again and the labor market continues its trajectory, then consumer sentiment should improve and conditions should shift back in favor of stronger economic growth.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.