Our current stock allocation is in an Under Weight position. This positioning between stocks and bonds is determined by technical risk signals. These signals may lead to changes in stock weightings within SFMG portfolios’ target allocations. Please note, this is not a specific allocation recommendation, as allocations may vary across individual client portfolios.

- The Consumer Price Index (CPI) inflation data released in April showed that inflation actually cooled in March, surprising to the downside. Markets didn’t react much to the release, with the understanding that any tariff related risks to rising inflation are not yet reflecting in the lagging data.

- Since April 2, U.S.-China trade tensions escalated with tit-for-tat tariffs—peaking at 145% from the U.S. and 125% from China. But by late April, both sides began easing: the U.S. exempted key electronics like smartphones and semiconductors, while China is considering lifting tariffs on medical gear, chemicals, and possibly plane leases. These moves signal a tentative de-escalation as economic pressure mounts. Still, the administration noted a trade deal could take 2-3 years.

- In contrast to the Federal Reserve holding their Fed Funds rate steady, the European Central Bank (ECB) cut interest rates for the 3rd time in 2025 in April, citing U.S. tariffs and slowing growth, and signaling more easing ahead. The ECB’s key interest rate for the Euro area is at the lowest since late 2022 as inflation fades and trade policy shifts weigh on confidence.

- The U.S. dollar has dropped to a three-year low (reached on April 21, 2025), with the Dollar Index down over 8% in 2025—its worst start to a year in four decades. The weakness could be stemming from a number of factors; expectations for a weaker U.S. economy, concerns around structural shifts happening in the global financial system as a result of tariff policy, and more recently questions surrounding central bank independence following threats of Jerome Powell being fired.

- Markets sharply reversed and surged after President Trump announced a 90-day pause on the Rose Garden reciprocal tariffs affecting several trading partners. The S&P 500 jumped 9.5% on 4/9/2025—its biggest one-day gain since October 2008.

- Credit markets are feeling the ripple effects of recent stock market volatility. High yield credit spreads—an indicator of perceived risk—widened to a 17-month high before easing slightly. Widening spreads mean investors are demanding more compensation for holding riskier debt. Meanwhile, investment-grade bond funds saw $9.8 billion in outflows in the first two weeks of April, the fourth largest on record, signaling a broad pullback from corporate debt.

Since the new tariffs took effect, U.S.-bound ocean shipments from China have plunged over 60%, according to Flexport. The Port of Los Angeles has seen 20 canceled Asian cargo ship calls for next month—triple last month’s number. Economists have warned this could lead to less inventory on store shelves, COVID-like shortages, price hikes, and looming layoffs in trucking, logistics, and retail as soon as May.

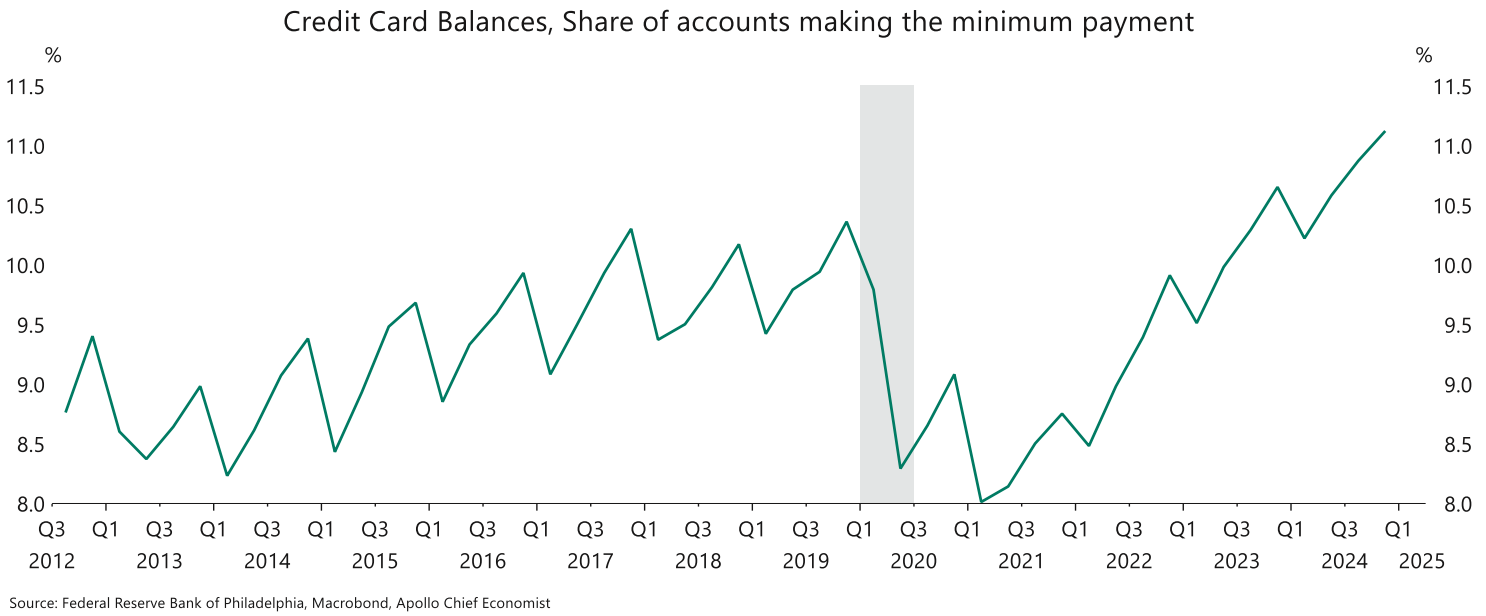

The latest data from the Federal Reserve Bank of Philadelphia, released this month, shows that 11.1% of active U.S. credit card accounts made only minimum payments in the fourth quarter of 2024—the highest level in 12 years, up from 10.9% in the third quarter. The share of accounts 90 days past due also reached a record high. Despite a strong labor market, inflation remained a significant strain on consumer finances heading into 2025. This trend will be important to monitor in the coming months. Increased financial stress on consumers—particularly those at higher income levels—poses a risk to economic growth.

Markets are navigating a rapidly shifting landscape following “Liberation Day” and the recent 90-day pause in tariff escalation. While the temporary halt has calmed markets somewhat—boosting stocks and lowering yields—many uncertainties remain. Investors are looking for clearer direction from the administration and stronger signals from economic data. Despite a softening in tone from the White House toward China and the Fed, U.S. businesses continue to face supply chain disruptions, uncertain demand, and questions around capital allocation. Negotiations with countries like Japan, Korea, and India show progress, but the China relationship remains the most critical and complex. China has warned other nations against making trade deals that undermine its interests, potentially complicating the U.S.’s ability to make the desired trade deals. While this all gets hashed out however, risks of inflation and slower growth i.e. ‘stagflation’ continue to weigh on sentiment. Geopolitical tensions, evolving trade dynamics, and policy shifts will likely fuel continued market volatility. And unlike previous shocks to markets, the Federal Reserve’s willingness to cut rates preemptively to insulate markets is questionable. The recent market rally is welcomed and some of the trade war de-escalation offers some hope. But we are proceeding with caution and are not convinced this bounce is an ‘all clear’ signal. Average tariffs are expected to remain 3–5 times higher than early 2025 levels unless all tariffs are removed.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.