Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- U.S. economic growth expanded at an annualized rate of 1.6% in the first quarter, below the consensus estimate of 2.2%, and was the slowest growth rate in nearly two years. However, volatile components such as trade and inventories, which often fluctuate from one quarter to the next, weighed significantly on the data.

- The Federal Reserve’s preferred gauge of inflation, core Personal Consumption Expenditures (PCE), showed little change in March, reinforcing investors’ worries that persistent U.S. inflation could prompt the central bank to adopt a more cautious stance on policy easing in 2024. Core PCE rose by 2.8% year-over-year in March.

- German consumer confidence rose to the highest level since 2022 in a survey by research group GfK, indicating a potential turnaround in the economy. This mirrors an upbeat business sentiment index report released in April.

- Stocks encountered their first bout of volatility of 2024 in April, dropping 5.46% from March 28 to April 19. The decline was primarily fueled by robust consumer spending data, persistent reports of high inflation, and escalating tensions in the Middle East.

- Inflation figures coming in above consensus expectations have also led to the continuation of an uptrend in Treasury yields. Yields began rising steadily again in the beginning of 2024 but accelerated in April. The 10-year Treasury yield rose from 4.3% on 4/1 to a 2024 high of 4.70% on 4/25.

- Copper prices have surged to nearly $10,000 a ton in April, hitting a two-year high. Copper is used for a wide range of manufacturing and construction needs and viewed as a barometer of economic health. Resilient global growth has buoyed demand expectations, especially from China most recently.

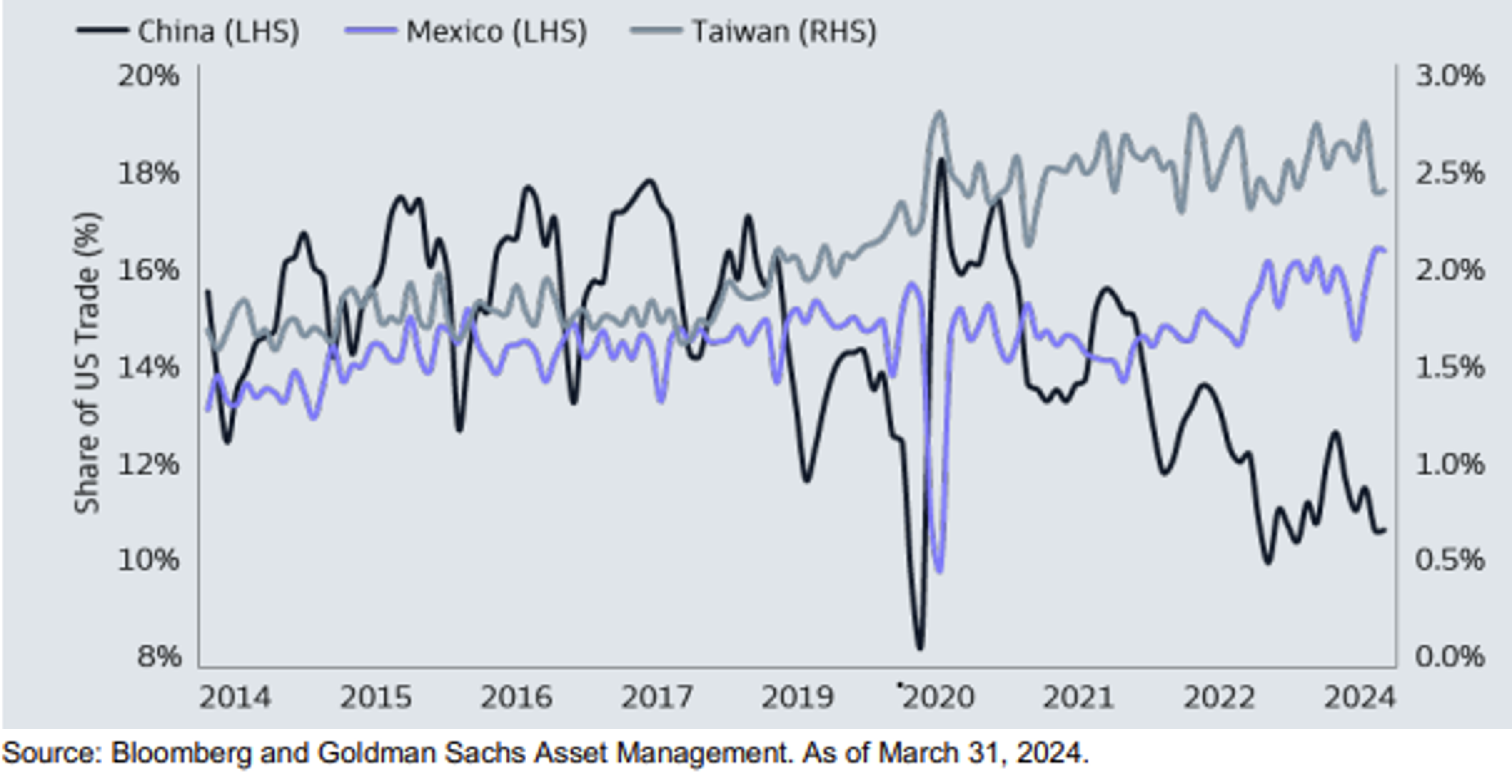

Growing geopolitical risks and the need for resilient supply chains have prompted major economies to rethink their approach in international trade. China has traditionally been the largest trading partner of the US, but recent tensions have shifted that dynamic. Trade partners such as Mexico and Taiwan are gaining importance, becoming vital contributors to economic growth. Emerging economies may continue to benefit from this trend.

High borrowing costs have wide-ranging effects on the economy and markets, but the impact on small-cap stocks is particularly pronounced. Smaller companies typically can have higher debt burdens and less financial reserves, making them more vulnerable to economic fluctuations and financing costs. The chart shows that as the 10-year Treasury yield traded higher in 2023, the Russell 2000 (an index of small-cap stocks) sold off. Small caps have continued to be challenged in 2024 as rates remain elevated.

Investors had been experiencing a period characterized by historically low downside volatility. Prior to the end of March 2024, the S&P 500 Index had not seen a 3% correction since October 27, 2023, marking the longest streak since the 308-day period ending on January 26, 2018. However, the release of stronger-than-expected data on jobs, manufacturing, and consumer spending suggests that inflation will remain persistent as economic growth remains robust. We believe this will be enough for the Federal Reserve to wait for further evidence before adjusting its target rate. As a result, coupled with ongoing conflicts abroad, both the 2-year and 10-year Treasury yields reached five-month highs, prompting volatility to resurface in the equity markets throughout April. While these factors have all contributed to the decline, we also believe this volatility can be viewed as a typical pullback following a strong rally. Since the peak in late March, the Communication Services and Energy sectors have shown the most resilience, while Real Estate, Health Care, Financials, Consumer Discretionary, and Information Technology have underperformed relative to the S&P 500. As earnings season for the first quarter is well on its way, we’re watching for consistent signs of any deterioration in forward guidance from companies. If earnings results can remain broadly upbeat and economic strength continues, then it’s possible the stock market rally can persist even throughout higher inflation and interest rates.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.