- U.S. Gross Domestic Product declined by –1.4% in the first quarter, the first contraction since 2020. The decline was driven by supply chain issues, where imports were strong, but exports lagged significantly. Consumer and business spending was still robust and the expectation is for a return to positive growth in the second quarter.

- Existing home sales fell –2.7% in March as the rising 30-year mortgage rate now exceeds 5%. The higher rates coupled with still record high home prices is weighing on sales.

- Surging energy costs in Europe have brought inflation levels to a record high of 7.4% in March. This continues to be driven more by the region’s reliance on Russian energy.

- The U.S. Dollar has recently reached its highest level since 2002. The strength is being driven by numerous factors. Global currencies have weakened on increasing economic concerns, the Dollar is still seen as a ‘safe-haven’ and has benefited from the market volatility, and lastly higher yields have resulted in demand for treasuries which must be purchased in dollars.

- Chinese stocks rallied in March, spurred by government promises of stimulus, however the Chinese CSI 300 index still reversed course in April, falling on China’s strict COVID lockdown policies, which will weigh on economic growth.

- The S&P 500 fell in April, reaching low points hit in March and putting the index back into a correction (a decline >10%).

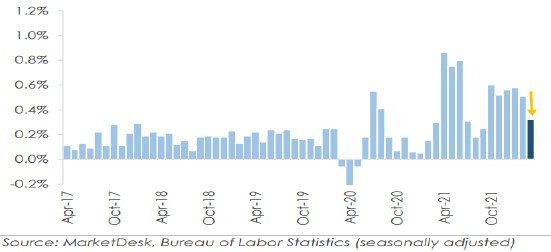

U.S. inflation continues to remain very elevated, but beyond energy costs, the data is showing some relief. Core inflation in March, which excludes food and energy prices, was weaker than expected due to a –6.5% drop in used vehicle prices. With March data likely reflecting most of the initial energy impact from Russia & Ukraine, it’s possible U.S. inflation figures may be close to peaking even when accounting for energy prices.

Within the U.S., the amount of oil rigs coming online for drilling is pushing back towards pre-pandemic levels and with oil prices still over $100/barrel, the highest levels since 2014, energy companies have benefitted. The robust drilling activity should bring more supply to the market and help relieve some price pressures, provided additional demand does not pick up meaningfully.

Despite the contraction in U.S. growth to start 2022, the underlying components within the Gross Domestic Profit (GDP) report help provide some confidence that we shouldn’t see an imminent recession (indicated by two consecutive quarters of negative GDP growth). Consumer spending, which accounts for roughly 70% of U.S. growth, rose by 2.7%, indicating strong demand even with inflation figures hitting 40-year highs. Business spending showed strength as well. Still, markets have remained volatile for a number of reasons. The ongoing war in Russia/Ukraine along with China’s zero-tolerance COVID policies should continue to exacerbate supply chain issues and commodity prices which will be a headwind for global growth. Within the U.S., growth is poised to hold up a bit better than abroad, but caution is still warranted as the Federal Reserve has embarked on an aggressive path of interest rate hikes. First quarter earnings releases are ongoing and have been good for the most part. But there have been some high profile earnings misses along with wary future guidance from corporate management relating to inflation, interest rates and global macro uncertainties. Stock prices are likely to remain under pressure until there is some positive resolution to those main headwinds. Until then, a focus on high quality companies and assets less sensitive to higher interest rates should provide some insulation from the volatility.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.