- Eurozone inflation in August hit 3%, the highest level in a decade as the economic recovery and supply chain issues result in higher prices. This prompted the European Central Bank to trim its bond purchasing program, but did not set any official end date to their accommodative monetary policies.

- China’s manufacturing activity slowed last month to the weakest level since February 2020. The slowdown was a result of strict measures meant to curb the spread of the Delta variant.

- U.S. debt ceiling and government shutdown issues are back. While a temporary U.S. government shutdown doesn’t usually impact markets, failure of Congress to raise or suspend the debt ceiling would result in the U.S. defaulting on debt and have significant negative implications for stock and bond prices.

- Interest rates have been rising and the 10-year Treasury yield is now above 1.50% for the first time since June. Upward pressure on yields has come from a variety of forces including global central banks making the case for raising interest rates to normalize monetary policy amid stronger economic data and inflation.

- Evergrande, China’s largest property developer, sparked market volatility as the company struggles to avoid defaulting on its massive debt burden. Although fears of a systemic crisis have subsided as the Chinese government steps in, a slowdown in the Chinese real estate market would dampen the recovering economy.

- The more interest rate sensitive sectors of the stock market such as Technology and Utilities have underperformed the S&P 500 by 1.85% and 1.22% respectively over the past week as rates jumped.

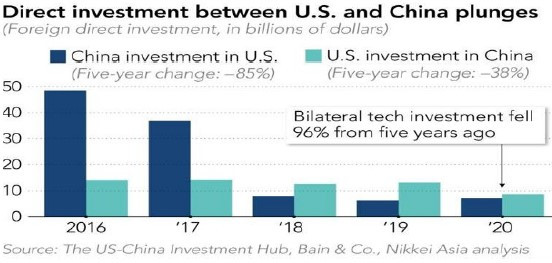

Tensions between the U.S. and China since 2016 have resulted in a steep decline in investment between the two countries as they separate their supply chains. A more challenging environment for Chinese companies trying to do business in the U.S. has led to a shift in operations towards areas like Europe and Africa. China’s investment in the U.S. has fallen 85% in the past 5 years and tech-sector investment has fallen 96%.

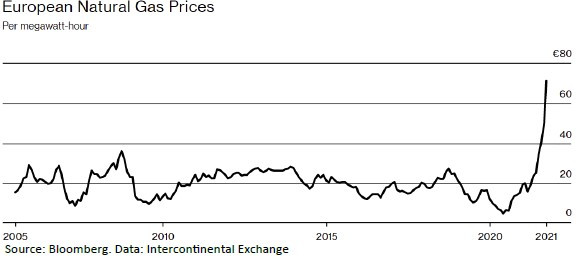

Prices for natural gas have soared as Europe faces a major supply shortage. New production from the main suppliers, Russia and Norway, have been constrained and with reserves already 25% below historic averages, the region is set to experience much higher costs for heating and electricity. Prices in the U.S. are surging too due to the overseas shortage. U.S. natural gas prices are above $6 per thermal unit for the first time since 2014.

September is generally a weak seasonal period for the stock market, but there have also been plenty of headlines highlighting the risks in the market as volatility picked up. Still, the S&P 500 is down less than 4% from its all time high on 9/2. Government shutdowns and the debt ceiling are top of mind and will likely continue to be over the next few weeks, keeping caution raised and bouts of volatility present. Ultimately, barring a U.S. default on treasury payments stemming from the debt ceiling not being raised, the markets should continue to be driven primarily by the macroeconomic environment. Economic data was weaker in the 3rd quarter, but with COVID cases looking to have peaked in the U.S., labor market improvements, consumer spending trends, and factory activity may resume their recoveries that began earlier this year. More importantly, if COVID-related restrictions that have been impacting supply chains ease, it should allow businesses to restock inventories. The process of repairing the supply chains and meeting the backlog of demand across the globe will take time and extend into 2022, keeping prices of certain goods and services elevated. But inflation has still not reached levels that would force the Federal Reserve to taper its asset purchases sooner than expected (still around year-end). Historically low interests rates should continue to provide a tailwind for stocks, but there will still be an emphasis on earnings growth. In order to keep the improving 2022 earnings per share estimates intact, 3rd quarter results will need to have minimal disappointments.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.