- U.S. retail sales rose by 0.3% in November, the smallest gain in four months. In a typically strong month for spending, one reason behind weaker sales could be consumers having done holiday shopping early to get ahead of supply chain issues.

- The Federal Reserve announced in their December meeting that it will reduce it’s Quantitative Easing (QE) program and raise interest rates quicker than initially expected, citing inflationary pressures as well as further improvement in the labor market. The QE program is set to conclude by end of March 2022 and Fed officials see potential for up to 3 rate hikes next year.

- China on the other hand has cut 1-year loan rates this month for the first time since April 2020 to encourage borrowing amid a loss of economic momentum.

- Travel and leisure stocks can be a proxy for market fear related to COVID-19 and variants. The Invesco Dynamic Leisure and Entertainment ETF fell ~-23% as the Delta variant spread. After Omicron’s detection around mid-November, the fund’s drawdown was closer to -10% and has recouped most of its losses, indicating a belief the Omicron shouldn’t slow the economy as much as Delta.

- Lumber prices have spiked higher after a reprieve from the surge in the first half of 2021. Prices are up over 95% in the past month partly due to floods in Canada preventing exports, which account for 50% of the production used in the U.S., where the housing market and demand for lumber have remained strong.

- Hong Kong’s Hang Seng Index is on pace for its worst year since 2011, down ~-15% year-to-date, amid China’s regulatory actions.

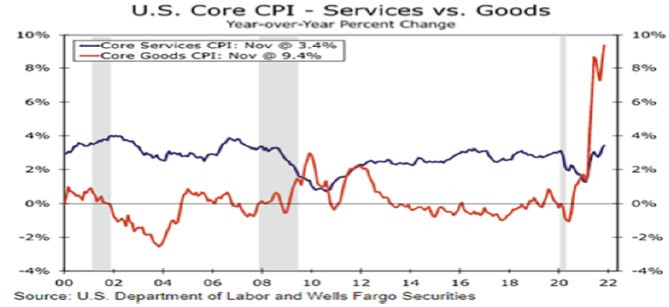

Surging inflation figures have been driven more by goods prices (e.g. cars, clothing) rather than the cost of services (e.g. travel, childcare). Initially, pent up demand was focused on goods given the ability to spend on services was more difficult through lockdowns. Rising goods prices have also been exacerbated by supply chain issues. Cost of services may not rise by the same magnitude, but should still see upward pressure as rent prices, considered a service, increase.

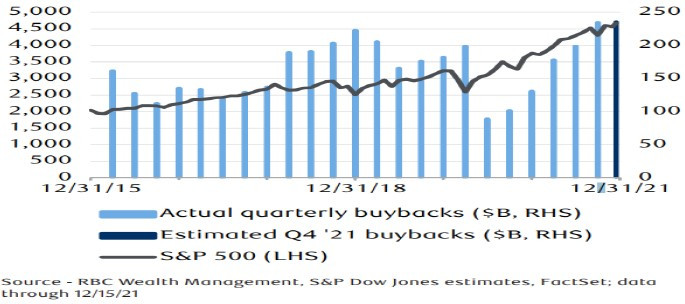

Corporate stock buybacks are on pace to reach all time highs this quarter and have been in line with pre-pandemic levels through 2021. Companies buying their own stock has been a tailwind for stock prices and may continue to do so in 2022 if the trend continues. If enacted, a 1% excise tax on share repurchases as a part of President Biden’s Build Back Better Act may have some influence on corporate decision making regarding buybacks, but likely not materially.

Several factors have recently contributed to easing Omicron fears and have helped the stock market rally into year-end. First, looking at the trajectory of cases in South Africa, Omicron has potentially peaked in that region, indicating that its high transmissibility could lead to a relatively short timeline for it to burn itself out. More importantly, symptoms related to this variant have continued to be less severe and resulted in fewer hospitalizations and deaths than previous variants. On the therapeutic front, another at-home antiviral pill designed to treat coronavirus infections has been granted emergency use authorization by the FDA. With multiple options now available that can potentially prevent severe cases and hospitalizations, sentiment around how the variants will impact the economy has improved. So far, the actions of the Federal Reserve haven’t derailed sentiment either. The markets have digested the removal of the Fed’s accommodative policies fairly well, especially considering the Fed’s shift in expectations from just 1 rate hike in 2022 to now 3 hikes. It’s possible the market is casting doubt on the Fed actually raising rates 3 times next year and in reality, there may only be 2 hikes. Or the stance may be that ultimately even with 3 rate hikes, monetary conditions are still very accommodative from a historical standpoint and shouldn’t be restrictive enough to significantly slow economic growth. Growth is expected to be above trend and inflation levels are expected to peak in 2022, which can be a positive environment for stocks. Still, with less support from central banks, the market trends will likely be more susceptible to higher levels of volatility if existing issues worsen or new catalysts appear.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.