- U.S. Gross Domestic Product (GDP) increased in the 2nd quarter at a 6.5% annual rate. This was the largest increase since 2003, but still short of economists’ expectations of 8.5%. The increase was led by consumer and business spending.

- The Conference Board’s Consumer Confidence Index has remained strong and recently reached a 17-month high. Survey respondents indicated rising expectations for spending plans even though higher inflation was a concern.

- June retail sales in the U.S. surprised to the upside, rising 0.6% versus an expected decline of –0.4%. While consumer demand remains strong, the overall sales numbers are also being boosted by higher prices for consumer products.

- The price of West Texas Intermediate crude oil dropped to $66.47 per barrel in July, roughly 11% down from the intra-month high. Prices have largely recovered, but oversupply from producers coupled with weakening demand trends have raised caution.

- Trading volumes at some of the largest cryptocurrency exchanges fell more than 40% in June. The decline may be a result of government crackdowns on crypto activity.

- Chinese stock indices have been under pressure as government scrutiny increases. The Hong Kong Hang Seng Index has fallen nearly 20% since February. Recent developments include Beijing planning to force education companies to become ‘not for profit’ as well as data security oversight on tech firms such as Tencent.

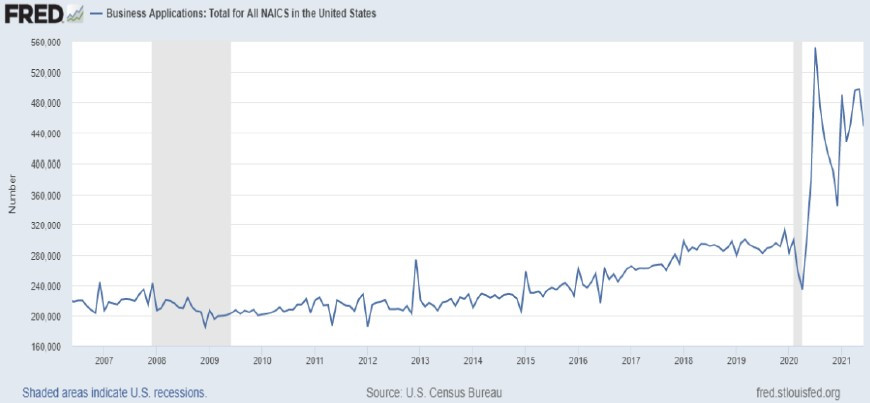

New business formations had been growing in the years leading up to the pandemic; however, business applications surged higher following the brief recession in 2020. The chart above shows that applications for new businesses have remained elevated through 2021. Economic disruptions can bring on innovation and opportunity. Low interest rates, technological advancements, and pent up consumer demand should prove to be a favorable environment for these new businesses.

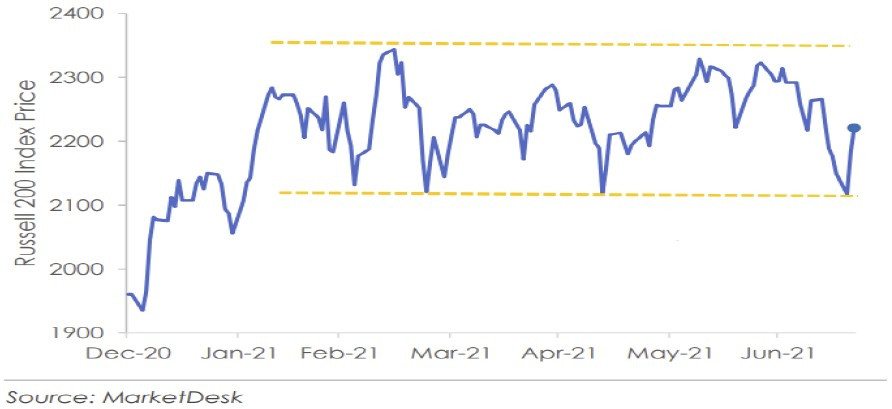

Small cap companies rallied significantly following the presidential election through the first quarter of 2021. Since then, small cap stocks have been largely rangebound. Smaller firms tend to be more labor intensive than larger companies (i.e. requiring more labor per unit of goods produced). Wage inflation has been a concern for companies lately, which could explain the lack of strength among small cap companies where rising wages could impact margins more. If wage pressures remain in check, small caps may reassert strength.

Earnings season has officially kicked off and as always will be a major focus for the next few weeks. CEO commentary on how inflation pressures may have impacted 2nd quarter results, as well as how they might impact future sales estimates, will be monitored closely. With elevated stock valuations, future earnings estimates being revised lower due to companies issuing cautionary tones on inflation or waning demand could spark volatility in the markets. Moreover, market breadth in the U.S. has been deteriorating. Since June, the number of stocks trading above their 50 day moving average has declined significantly, indicating once again the market is being moved higher mostly by large cap tech names. If earnings from these market leaders do not hold up, tech-heavy indices like the S&P 500 and NASDAQ would be more susceptible to price declines. Economic data and leading indicators still point to a strong expansion through the 2nd half of the year and so far the spread of the Delta variant within the U.S. is expected to have a minimal impact on the economic recovery. The Fed has continued to walk the line of tamping down sustained inflation concerns while maintaining their accommodative policy through the remainder of the year, which has also continued to support U.S. equity markets. Beyond the Fed, interest rates can continue to exert influence on stock prices. With the yield on the 10-year Treasury trading as low as 1.19% in July, rates look poised to climb higher if economic data surprises to the upside in coming months. Similar to the rise in rates earlier in the year, the pace of movement may be more important than the absolute level, especially if rates remain below 2% by year-end.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.