Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Fed held rates at 4.25%-4.5% and trimmed its 2025 growth forecast to 1.7%, while raising inflation to 2.7% and unemployment to 4.4%. Chair Powell’s dovish remarks reassured markets, calling tariff-driven inflation transitory. He stated the economy remains strong despite rising recession odds.

- Still, there are signs of economic softening. Although the latest U.S. Durable Goods report (a measure new orders for big-ticket items like cars, appliances, and machinery) surprised to the upside, a closely watched component of the report which measures only nondefense capital goods orders ex-aircraft (core business orders), fell 0.3%, its first decline in four months.

- On March 26th, President Trump imposed a 25% tariff on imported light vehicles, including those from Mexico and Canada, effective April 3, with key auto components facing duties by May 3. Trump called the tariffs permanent, aiming to spur U.S. reindustrialization. Additionally, the administration is calling April 2nd, “Liberation Day”, and will be when they unveil their reciprocal tariffs plans.

- The S&P 500 entered correction territory (defined as a decline of 10% or greater) after closing -10.13% from its all-time high on 2/19/25 to the recent low on 3/13/25. This decline was rapid and marked only the seventh instance since 1952 when the index dropped more than 10% from a record high in less than a four-week period.

- Germany, the eurozone’s largest economy, approved its biggest fiscal spending increase in decades, featuring a €500 billion infrastructure fund. The resulting positive sentiment for Eurozone growth helped keep European equities positive for the month. The iShares MSCI Eurozone ETF (ticker: EZU) is up 2.88% in March as of 3/30/25.

- While the stock prices of auto manufacturers have been declining due to expectations for higher prices and thus less demand for new cars, auto parts companies like Auto Zone and O’Reilly Automotive made all-time highs in March. If tariffs on materials for new car production drive up consumer prices, drivers may keep their older vehicles longer, benefiting the aftermarket industry.

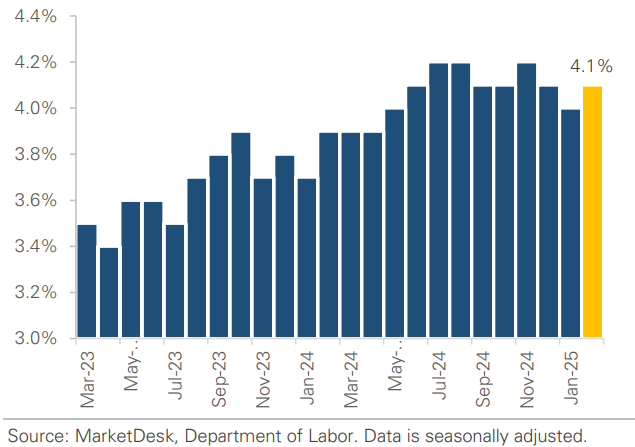

The labor market softened in February as the unemployment rate edged up by 0.1% to 4.1%, with reentrants to the workforce accounting for more than half of the increase. Job growth reached 151K, driven primarily by the healthcare sector, though January’s gains were revised down from 143K to 125K. Markets reacted negatively to the report, especially following January’s slowdown, with government job cuts related to DOGE not expected to be reflected in the data until next month.

Copper prices have surged in the U.S. after reports suggested that the Trump administration may impose 25% tariffs on copper imports in the coming weeks. Traders have rushed to stockpile the metal ahead of expected announcements happening on April 2nd. This has also created a large price gap on copper traded on the U.S. exchange (Comex – black line) and the London exchange (LME – red line).

Several economic indicators in the first quarter of 2025 have weakened, and U.S. Gross Domestic Product (GDP) growth for the quarter is now expected to slow. Inflation remains elevated, labor markets are softening, and both consumer and business spending are showing signs of strain. These concerns have kept market volatility high in March. While some of these weaknesses may stem from tariff-related uncertainty, part of it could also reflect the natural business cycle. The current expansion has lasted 58 months, close to the historical average of 60 months since 1933. This doesn’t necessarily indicate an imminent recession, but we remain mindful that more than just policy headwinds may be at play. This year’s approximately 9% market decline, the largest in 18 months—follows a smaller pullback in December. Although some investors have grown accustomed to relatively smooth market conditions, declines of this magnitude are a normal part of long-term market trends. Given the uncertainty and potential for further weakness, whether driven by politics or the business cycle, we continue to favor high-quality stocks with stable cash flows and lower debt levels. These defensive characteristics have helped provide some protection against recent volatility.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.