Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- The Federal Reserve reduced the federal funds rate by 0.50%, bringing it to a range of 4.75% to 5.00%. The central bank is projected to lower rates by a total of 1.00% by the end of the year, and an additional 1.00% is expected in 2025. Although a smaller rate cut had been widely anticipated, Fed Chair Jerome Powell opted for a larger reduction due to concerns about a slowing labor market and increased confidence that inflation is steadily moving toward their 2% target.

- Claims for unemployment insurance (aka initial jobless claims) hit the lowest point in 4 months in the final week of September, showing that the amount of people losing their jobs is not yet a concern. But while unemployment claims may be reassuring, recent surveys from the Conference Board, showed Americans are seeing fewer job openings. Respondents indicating that jobs are becoming hard to get vs being plentiful reached the worst level since March of 2021.

- The People’s Bank of China (PBoC), the nation’s central bank, unveiled a series of monetary stimulus measures this month, including interest rate cuts. The measures aim to boost the economy amid growing concerns over slowing macroeconomic indicators and weak investor confidence.

- Chinese stock prices got a jolt at the end of September, driven by stimulus news, though investors are questioning the sustainability. China has broadly been a drag on Emerging Market returns for most of this year, but Emerging Markets ex China, have still performed well. The iShares MSCI Emerging Markets ex China ETF (ticker: EMXC) has risen roughly 14% year-to-date as of 9/27/24.

- Since the Fed’s first interest rate hike in 2022, 30-Year fixed mortgage rates rose from just over 3% to nearly 8% towards the end of 2023. The declines from those peak levels have been slow but have recently picked up steam. After falling for 3 weeks in a row, mortgage rates are now near 6%, the lowest levels since February 2023.

- Gold prices have also hit record highs along with the S&P 500 this month, exceeding $2,600 per troy ounce. Higher interest rates typically make gold, which doesn’t offer a yield, less attractive to investors, so the rate cutting cycle by the Fed has helped boost demand. Gold also tends to garner more interest amid geopolitical and economic uncertainty.

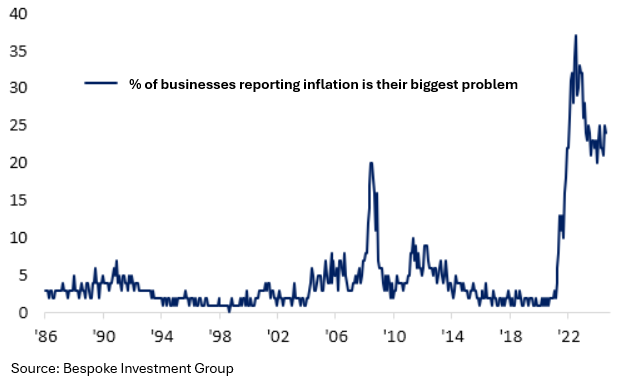

Although the Federal Reserve’s focus appears to have shifted to the labor market, inflation is not in the rear view. Despite inflation measures like the Consumer Price Index (CPI) peaking in 2022, prices are still rising in various areas of the economy. NFIB’s Small Business Economic Trends survey found that 24% of small business owners surveyed identified inflation as the most important business problem they faced in August. Although this is well below the highs near 35%, this is still significantly higher than the pre-COVID era.

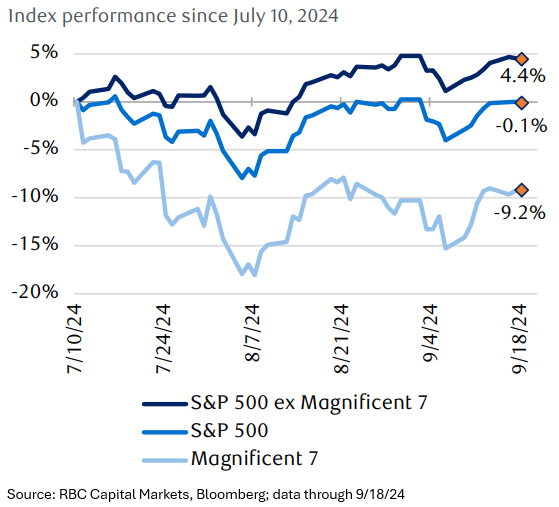

Stock market rotation continues as the “Magnificent 7” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) have lost some momentum in recent months. After driving over 62% of the S&P 500’s 2023 return and nearly 60% in early 2024, these stocks have taken a breather since their combined peak on 7/10/24. Meanwhile, Real Estate and Utilities—sectors likely to benefit from lower interest rates—have led returns since July, gaining 17.6% and 16.0% as of 9/18/24. As the Fed shifts to rate cuts, the rotation to other sectors may still be in its early stages.

Historically, September is known as one of the worst months for stocks. Since 1950, the average return in September is -0.7%, while other months have positive averages. This month consistently has negative returns across 5-, 10-, and 20-year periods. There are several thoughts as to why Septembers are usually weak, but despite some volatility early this month, the market bucked the trend. The S&P 500 rebounded and pushed to new all-time highs. Credit for the strength this month can be at least in part given to the Federal Reserve. Fed Reserve Chairman Jerome Powell opted for a 0.50% cut instead of only 0.25%. They are hoping that the larger interest rate cut will encourage employers to expand and hire and keep consumer spending up. In previous rate cut cycles, the Fed typically responded to crises by rapidly lowering rates. However, this time, the Fed appears to be cutting proactively from a position of strength, seeking to support the labor market before it faces potential challenges down the road. The optimistic view is that this will lead to the much discussed ‘soft landing’, helping the U.S. avoid a recession. Indeed, this is a very rare feat. The alternative view is that although the Fed is communicating they still believe the economy is strong, they may actually be anticipating a significant slowdown and recession and are cutting more aggressively in response to weakness they are seeing underneath the hood. In the coming months, economic data will take on greater significance, and the market may overreact to individual data points until a clear trend forms. Within six months, the data should reveal whether (1) rate cuts are boosting the economy or (2) the delayed effects of restrictive monetary policy pushing it into recession. We’ll be closely monitoring high-frequency data to help inform which scenario is playing out.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.