Our current stock allocation is in an Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- Although unemployment still remains historically low, it has been trending higher. Since reaching a low of 3.4% in early 2023, unemployment has been rising and has now reached 4%, the highest in over two years. Notably, full-time employment growth has been declining for the past four months.

- French political turmoil is impacting European markets. President Macron has called for snap elections in July after his party lost to the far-right National Rally party. Markets fear Macron’s centrist party may fall to third place, giving the National Rally control of parliament and potentially shaking up how the France’s spending and budget deficits are managed.

- At the June Federal Open Market Committee (FOMC) meeting, the FOMC kept the target range for the federal funds rate unchanged at 5.25-5.50%. The Committee noted “modest progress towards the 2% inflation objective” in recent months, a shift from the persistent inflation seen earlier this year. However, the median fed funds rate forecast for 2024 was revised upward, now indicating just 25 basis points of cuts instead of the 75 basis points projected in March.

- At its peak on June 18th, NVIDIA briefly became the most valuable company in the world, as measured by its market capitalization (total dollar market value of a company’s outstanding shares of stock). It surpassed both Apple and Microsoft to take this spot. As of 6/18 NVIDIA had accounted for 33% of the S&P 500’s year-to-date gain of 15.8%.

- Oil prices rose following their largest weekly gain since early April, continuing a rally as traders analyzed economic data and demand trends from the U.S. and China. Brent crude traded above $82 a barrel, having increased by nearly 4% in early June.

- The S&P 500 achieved year-over-year EPS growth of approximately 6% in Q1 2024, surpassing consensus expectations for the fifth straight quarter. This positive headline figure is tempered however by recent disappointing economic growth data, a mixed consumer outlook, and increasing disparity among the Magnificent Seven companies.

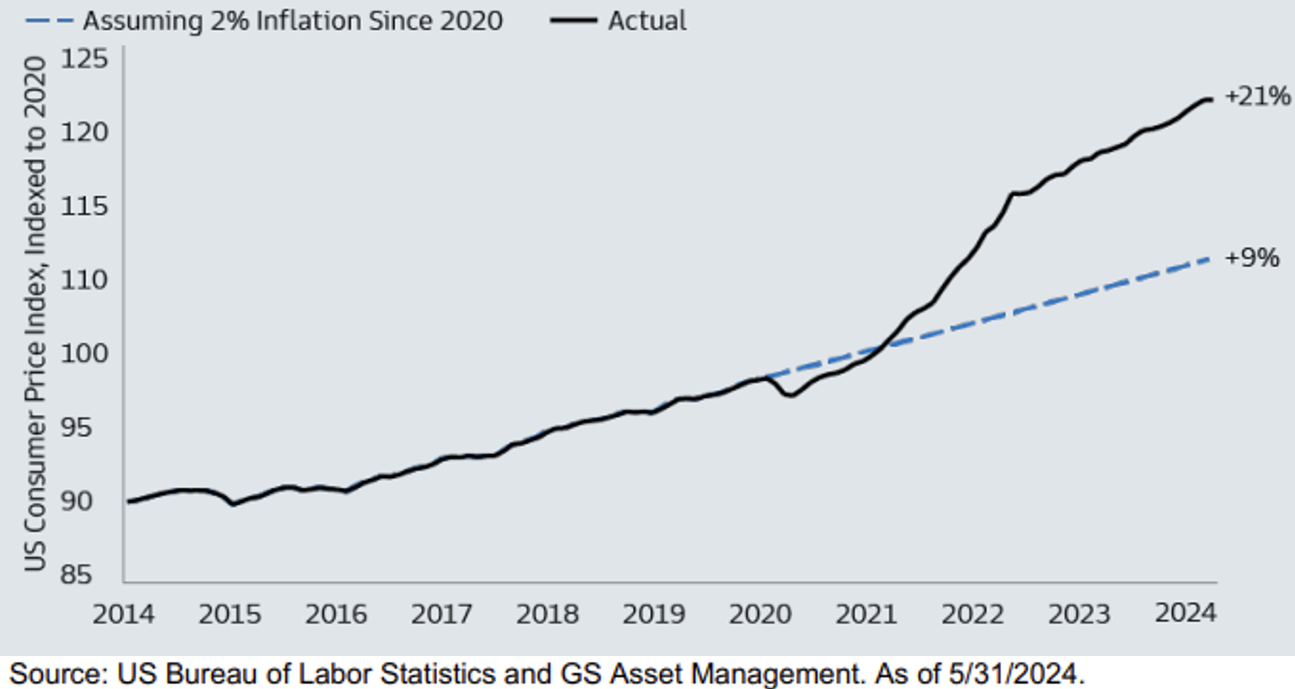

Many consumers are still grappling with the impact of higher prices following the inflation spike in 2021. If inflation had stayed at a 2% trend since 2020, prices would have risen by 9%, instead of the 21% increase reflected in CPI data. Even with disinflation progressing this year, a return to 2% may not provide the relief many consumers hope for. Persistently higher prices might become the new norm that consumers need to adapt to.

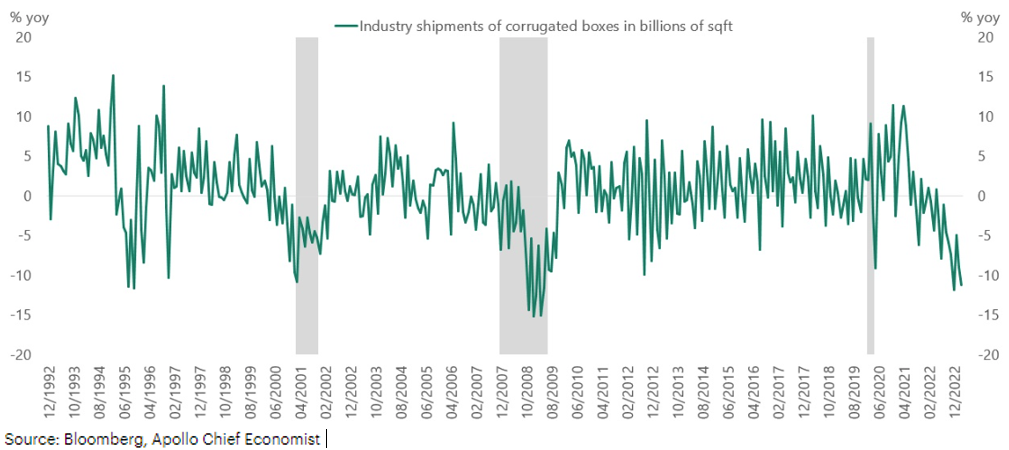

An interesting potential leading indicator of strength or weakness in sale of goods is the total shipments of corrugated boxes (effectively cardboard boxes more suited for transportation). Sales and shipments of these types of boxes that in theory would be used for businesses to ship their own goods for purchase, have been slowing over the past year, indicating a slowdown in the goods part of the economy.

Economic activity remained resilient for the most part through the second quarter. Early estimates of second quarter Gross Domestic Product (GDP) from the Federal Reserve Bank of Atlanta show a solid 2.7 percent annualized rate, driven by strength in consumer spending on services. However, as consumers no longer have excess pandemic-related savings and face rising levels of credit card debt, we expect the pace of spending to normalize. Signs of moderating consumer strength include recent weakness in retail sales and a tempering labor market. As we enter the second half of the year, we will be assessing whether the recent downtick in spending and uptick in unemployment are becoming bigger trends that could weigh on the narrative of a soft landing for the economy. Meanwhile, markets have remained focused on earnings growth, which indicates businesses are weathering higher rates and persistent inflation. Better-than-expected earnings results have kept overall market volatility low. While not all areas of the market have been as strong as some of the artificial intelligence names and the mega-cap technology sector, other sectors are still participating in the rally or at least experiencing stable prices, which does not suggest expectations of a recession. Election drama outside of the U.S., in countries like India, Mexico, and France, has kept international markets on edge. However, much like our domestic outlook, the volatility driven by election results is typically short-lived.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.