Our current stock allocation is in a Slightly Over Weight position. This allocation of stocks vs. bonds is driven by many variables we monitor, including our risk signals. These signals may lead to a shift in stock weightings in SFMG portfolios’ target allocations. This is not meant to be a specific allocation recommendation as this may vary across client portfolios.

- U.S. Gross Domestic Product (GDP) grew at a 4.9% annual rate in the 3rd quarter; a significant increase from 2.1% and 2.2% in the 1st and 2nd quarters, respectively. The rise was a result of acceleration in consumer spending, private inventory investment, and federal government spending. Growth is expected to slow going forward.

- U.S. business output improved in October as the manufacturing sector emerged from a five-month contraction, driven by increased new orders as measured by the S&P Global flash U.S. Composite Purchasing Managers Index.

- Personal Consumption Expenditures (PCE) rose 0.7% in September, the 3rd largest gain of the year and above consensus estimates. Inflation trends have likely not yet slowed enough to expect the Federal Reserve to reverse its restrictive interest rate policy.

- Interest rates continued to climb through October, which pressured stock prices further. The S&P 500 was down –10.28% from 7/31/23-10/27/23, officially entering into a ‘correction’ period. This is defined as being down –10% or more from a recent high. Still, the S&P 500 is up roughly 15% from the low just over a year ago on 10/12/22.

- A flight to safety has bolstered interest in gold, with prices crossing above $2,000/ounce for the first time since August. Although gold prices can benefit from stock market volatility, higher interest rates have kept gold’s upside limited for the past 6 months as investments that now generate higher yields become more attractive alternatives.

- In September, the percentage of subprime auto borrowers who were at least 60 days overdue on their loans reached 6.11%, the highest level in records dating back to 1994, as reported by Fitch Ratings. The trend shows that not all areas of the economy are able to manage higher inflation and borrowing costs.

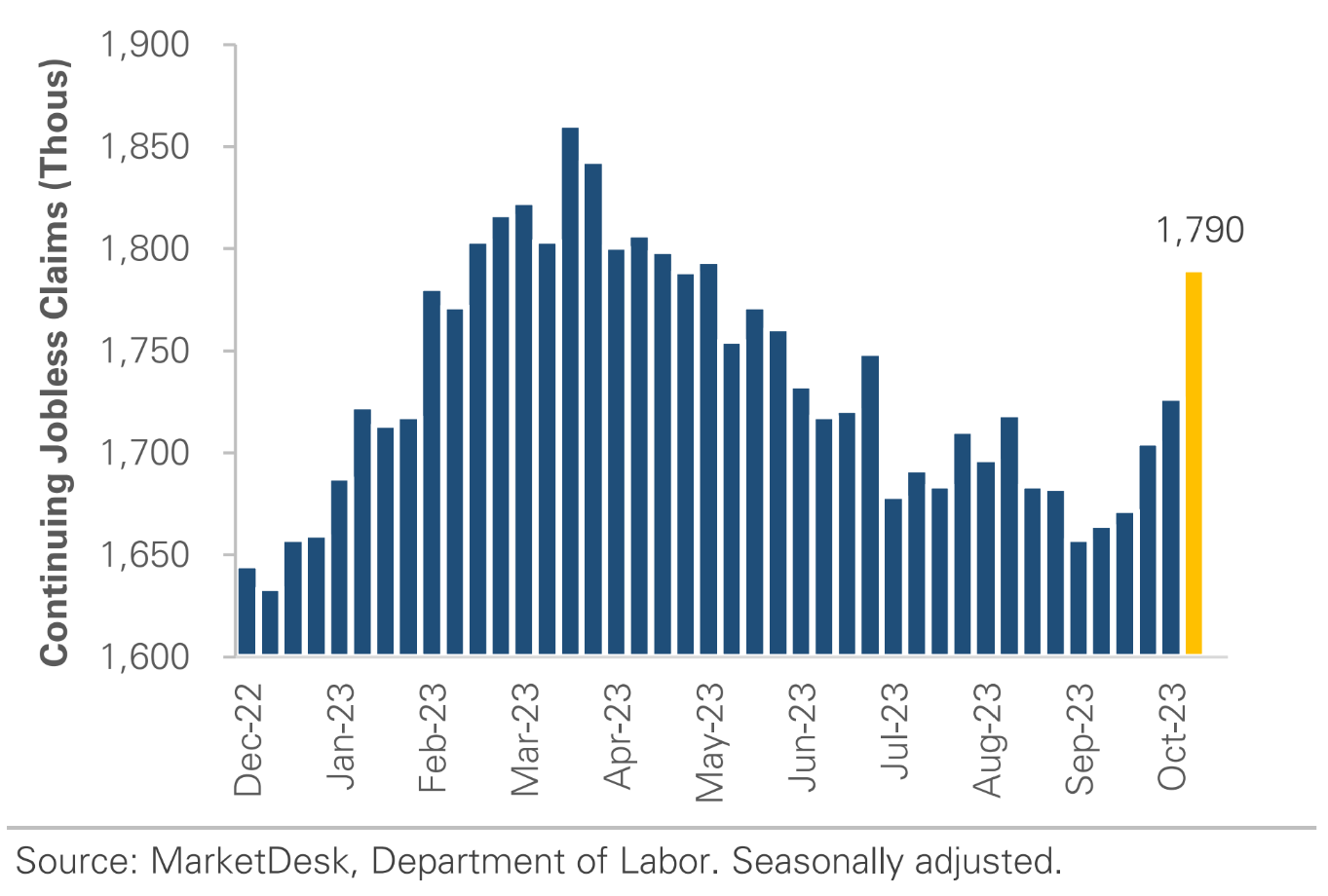

Initial jobless claims dropped recently, staying historically low. However, continuing jobless claims increased over the past month. This divergence points to two labor trends we’re watching. First, low initial claims indicate companies are retaining workers. Second, the rise in continuing claims implies longer job searches, contributing to increased unemployment. The concern is that if conditions worsen, companies may stop retaining workers, potentially pushing unemployment above 4%.

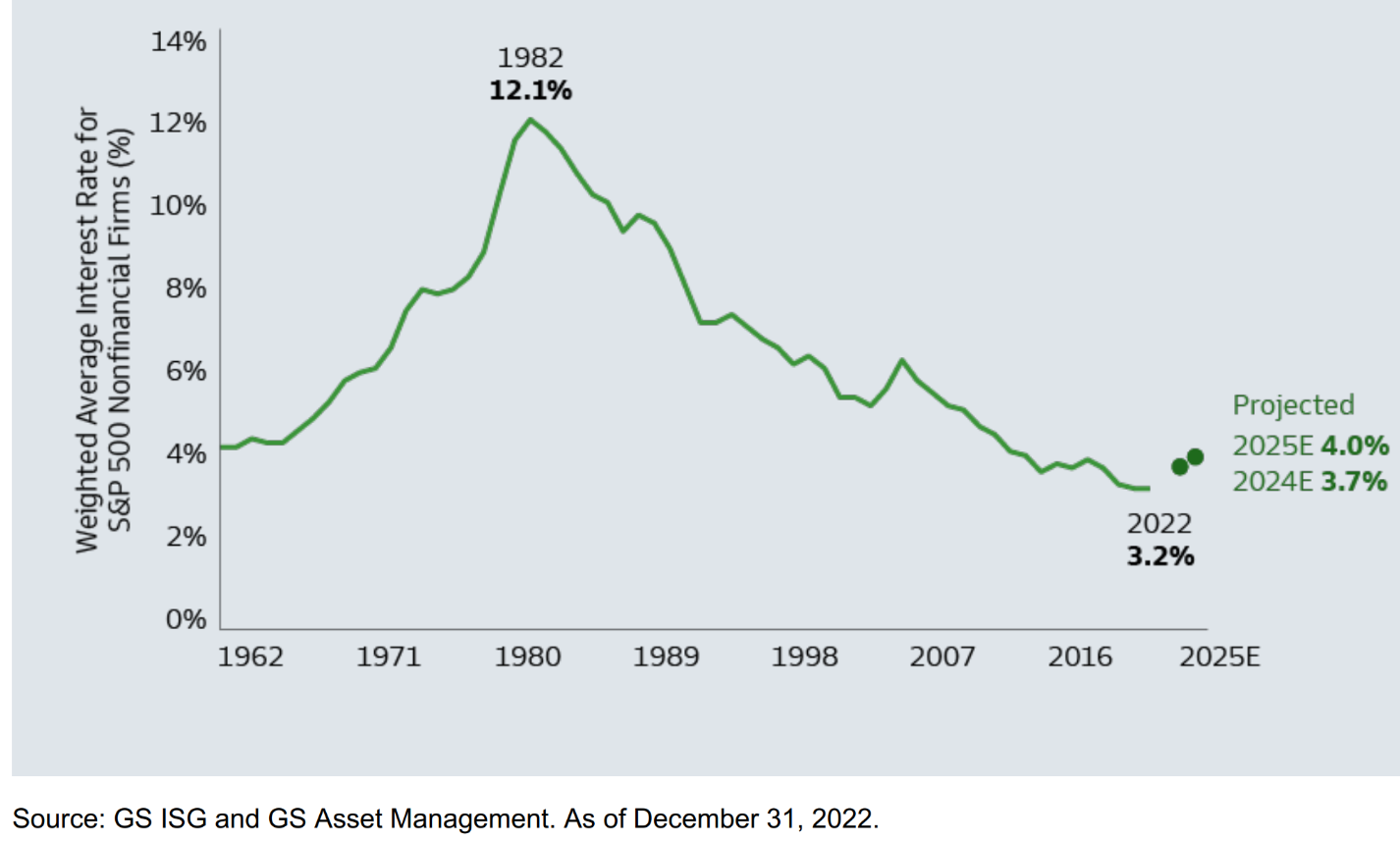

Although higher interest rates should be problematic for borrowers needing new financing or those needing to refinance their debt, many companies are well positioned to weather a storm. In the case of S&P 500 nonfinancial companies, 92% of their debt is at fixed rates, with a weighted average interest rate of just 3.2%. This may make a significant increase in defaults less likely.

Members of the Federal Reserve have started expressing opinions that, given the rise in longer-term interest rates, there may be less of a need for further hikes in the short-term Fed Funds rate. Markets currently indicate a 25-30% chance of another Fed hike in the next few months, but the consensus seems to suggest that if the Fed does continue hiking, it might just be one more increase. Supporting this argument are some initial signs of a potential weakening in the labor market. Alongside concerns about inflation, the robust labor market has played a pivotal role in the Fed’s aggressive hiking policy. Despite early indications of a softer job market though, there hasn’t been a significant drop in consumer spending. With spending in the economy remaining resilient, the threat of persistently high inflation lingers. Therefore, we anticipate that while the Fed may be at the end of their hiking cycle, they will likely maintain higher interest rates until inflation moves closer to their 2% target. While third-quarter earnings haven’t universally disappointed, weaker results from some major technology companies, which supported the market in the first half of the year, are now weighing on the S&P 500. Without the strength of these tech giants, the market may be in store for a period of higher volatility and consolidation following the rally that began just over a year ago. We are continuing to watch for strength in other areas of the market beyond tech, discretionary, and communications, to help determine if a resumption of the market rally is sustainable.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.