- U.S. Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge, showed that inflation reaccelerated in January. The price index rose 0.6%, the biggest jump since last June and three times the previous month’s gain.

- The Federal Reserve raised rates 0.25% in its latest meeting, as expected, bringing the Fed Funds target range to 4.50-4.75%. The recent strength in economic and inflation data, however, have led to markets assigning a higher probability of more rate hikes in the coming months than previously expected.

- Social security payments got the largest inflation adjustment in decades, up 8.7% in January. This likely contributed to some of the resiliency in consumer spending to start the year, following a subpar December.

- Interest rates have risen through February as hotter than expected inflation data have markets pricing in the possibility of a 0.50% rate hike in future Fed meetings and little chance of rate cuts in 2023. The 2-year treasury has risen from 4.10% to 4.80% this month.

- The volatility in interest rates has spilled into the stock market and reversed some of the upward progress made, particularly in higher growth areas like the tech sector. Although the NASDAQ Index is still up roughly 10% year-to-date as of 2/27, this tech heavy index has lost 6.5% since rates began to rise on February 2nd.

- Used car prices are on the rise again, bucking the trend of price declines in 2022. The Manheim Used Vehicle Value Index shows prices rising 4.1% in the first half of February. Supply chains have improved, but a continued undersupply of computer chips for new cars has weakened production at a time when dealer have pulled back on inventory levels.

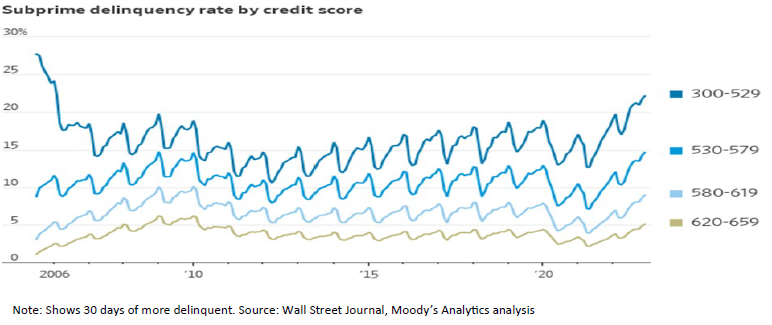

Early signs of cracks in the consumer credit markets are emerging as levels of missed car payments rise. Borrowers with lower credit scores in particular are seeing the highest level of delinquencies since 2010. For those that had to finance car purchases during the height of the pandemic when used car prices spiked due to shortages, the relatively larger loan sizes may now be weighing on consumers’ budgets.

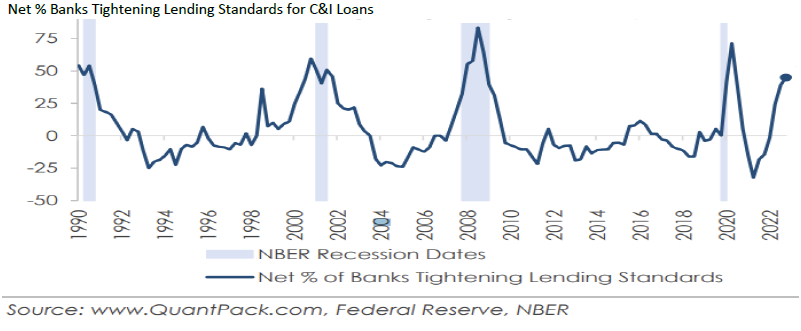

Banks have been tightening their lending standards for commercial and industrial (C&I) loans in anticipation for a more dour economic environment. In the first quarter of this year, a net 44.8% of banks stated they were tightening their lending standards versus 24.2% in the 3rd quarter of 2022. The increased difficulty for households and businesses to obtain credit should weigh on spending and economic momentum.

The stock market trend and overall sentiment since October of 2022 has undoubtedly been positive. The S&P 500 has risen 11.33% since the October lows (10/12/22 through 2/27/23), even after factoring in the –4.65% pullback this month. However, there is still much work to be done in recouping the 2022 downturn. The S&P 500 is approximately 17% below the market high from January 2022. February has illustrated that the uncertainties around interest rates and inflation, which drove declines in 2022, are still lingering and pressuring stock prices. The latest, but certainly not new, concern driving markets is that in response to continued strength in the labor market, service sector, and a choppy decline in inflation, the Fed will be more forceful in attempts to tame inflation and potentially overtighten. Meaning hiking rates more than expected and leaving rates higher for longer. This would increase chances of a deeper recession and expectations for further weakness in corporate earnings. Part of the recent market pressure may also be a function of ‘too much, too fast’ in pricing in the more optimistic scenario of a quick decline in inflation. Despite this month’s data indicating price pressures are still elevating in certain areas of the economy, the broader trend in inflation does appear to be lower. Valuations for stocks, particularly U.S. large caps, have gotten stretched following the rally of the past few months though, given earnings estimates have at best remained stable. Thus, a pause in the rally seems warranted as the interest rate environment and how the Fed will be reacting to data continues to shake out. Our belief is that the Fed potentially hiking an extra 0.25-0.50% versus previous expectations should not drive a 20-30% worst-case scenario drawdown that some headlines have been calling for. That would likely be driven by inflation spiking meaningfully higher, which we will be watching in terms of needing to revisit a more defensive positioning for portfolios. Until then, our focus remains on looking for other opportunities where valuations appear to be attractive as we recovery from the bear market lows.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.