- In the Fed’s last meeting of 2022, the fed funds rate was hiked by 0.50% to a target range of 4.25%-4.50%. This broke the streak of 4 consecutive 0.75% rate hikes. This puts the range for the Fed’s target interest rate at the highest level in 15 years.

- The latest Chinese economic data was worse than expected across numerous measures. Industrial output growth slowed to 2.2%, retail sales fell 5.9% compared to last year, and the jobless rate rose to 5.7%. Although China’s attempt to reopen the economy more by lifting zero-Covid policies should help, the expected increase in Covid cases could make the economic reversal a difficult transition.

- Inflation in the UK ticked lower in November, but unlike the U.S. where inflation has fallen quite a bit from its June peak, UK inflation remains significantly elevated. The latest 10.7% year-over-year level is just slightly below the 41-year high of 11.1% reached in October.

- Gold rallied nearly 12% from a low on 11/3 to a price of 1,825.50/oz on 12/13. The rally appeared to be sparked by declining inflation and treasury yields, as well as a broad based market rally driven by China lifting many of its Covid policies. The rally stalled however, when Fed Chair Jerome Powell indicated the central bank is not close to ending its rate hikes.

- Since the Fed’s latest 0.50% rate hike on 12/14, the S&P 500 has been under pressure. Although the size of the hike was largely expected, the ensuing rhetoric from Fed members has been that inflation has not come down enough to feel comfortable slowing its rate hike campaign. The S&P 500 is down 5.31% since 12/14 and down roughly 20% year-to-date.

- The Bank of Japan announced it would allow the yield on 10-year government bonds to rise from a previous cap of 0.25% up to 0.50%. This helped the Japanese Yen find some footing, after being in a downtrend since late October. The Yen has fallen approximately 10.5% since 10/20.

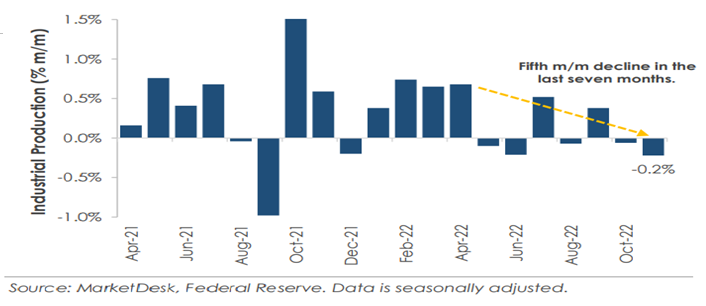

U.S. Industrial Production slowed by 0.2% in November; the fifth decline in the last seven months. Other measures, such as the ISM Manufacturing Index, show overall manufacturing activity contracting for the first time since May 2020. Interest rates appear to be having an impact on demand. The positive is that it appears prices are falling as a result of the weakened demand, which implies disinflation.

Higher interest rates throughout 2022 have had major implications for growth stocks (e.g. tech/consumer discretionary) vs value stocks (e.g. energy/financials). The value index lost 1.7% in 2022 through 12/16 compared to a 35.5% decline in growth stocks. Value stocks typically have a proven level of current earnings, while growth stocks are focused more on future earnings. So, higher interest rates mean investors discount those potential future earnings at a higher rate, leading to an underperformance across growth companies.

Most major central banks continue to make it clear they are focused on getting inflation back down to target levels. Despite November Consumer Price Index figures showing inflation heading in the right direction, the Fed indicated after their latest meeting they will keep rates elevated until they see more evidence that their 2% target is in sight. To feel confident that level is attainable, they need to see more balance in the labor market, specifically slowing wage growth. It seems counterintuitive that the Fed is looking for higher unemployment and slower wage growth; the logic is that both would lessen consumer demand and lead to lower prices and inflation. Beyond the labor market, leading economic indicators are pointing to more weakness ahead for the broader economy. The Leading Economic Index (LEI), published by the Conference Board, is based on 10 different economic measures and designed to show forward-looking changes in economic activity. The LEI has declined for 9 consecutive months. This level of consecutive declines has occurred 5 different times historically, and in each instance the economy was either heading into a recession or already in one. If the labor market continues to prove more resilient than expected, it could mean a more mild recession. Market volatility in 2023, barring an unforeseen catalyst, should still be dependent on the forces currently driving stock prices. Specifically, how quickly inflation recedes, how deep an economic contraction may become (mild vs severe recession), and how companies can navigate the higher inflation/interest rate environment to maintain earnings growth. Back to back years of negative returns for the S&P 500 are rare, but we remain cautious heading into 2023. The potential for further negative revisions to earnings is a likely headwind for the 1st quarter.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.