- Retail sales figures in the U.S. showed an 8.3% increase in October compared to the same time last year. Although higher prices (i.e. inflation) are in part contributing to the overall dollars spent, there was also an increase in the underlying units purchased, implying consumers are buying more as well.

- There continues to be a risk of a strike among railroad unions in the U.S. over labor contract disputes. If an agreement is not reached, a strike could take effect as early as December 9th, causing supply chain complications and potentially raising the costs to transport goods, adding to inflation pressures.

- After a short-lived rise in optimism in August and September, the Conference Board’s Consumer Confidence Index has fallen the past two months, hitting a 4-month low. The weakened confidence among consumers could weigh on future spending growth.

- Oil prices have been declining through most of November on reports that OPEC may increase production, despite the group refuting those claims. Less optimism around China’s easing of lockdowns is also weighing on demand expectations.

- Cryptocurrencies have come under pressure this month amid the collapse of crypto trading exchange, FTX. Other companies, such as BlockFi, have filed for bankruptcy in FTX’s wake, sparking contagion concerns across the crypto marketplace.

- The U.S. Dollar declined roughly 2% on 11/10/22, the largest single day drop since 2009. The most recent Consumer Price Index report, which showed some easing of inflation pressures, led markets to lower expectations around rate hikes from the Fed. This appeared to be the main driver of the Dollar’s decline.

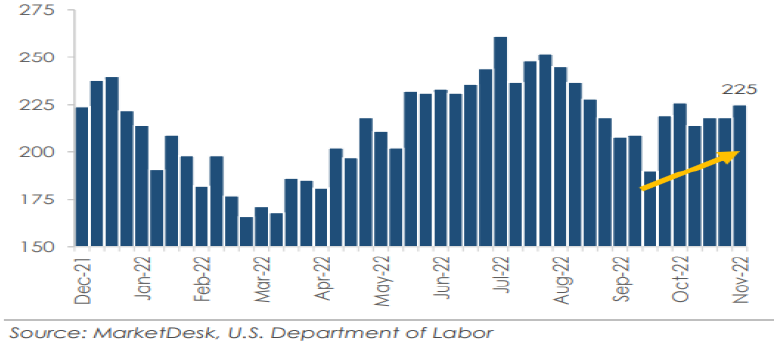

Since hitting a low point in September, initial jobless claims, a proxy for layoffs, have been rising. There have been some high-profile layoffs in the tech sector, which will likely add to this trend in claims, but the overall level is still close to the 2019 pre-pandemic weekly average of 218,400. The labor market is cooling, but has not yet weakened to levels historically seen in recessions.

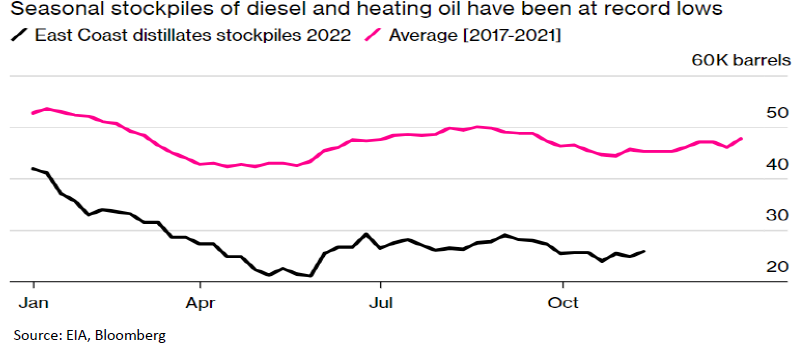

Although the price of crude oil has come down, prices for byproducts such as diesel fuel and heating oil have not. Stockpiles of these products are near record lows. Weak overall investment into the fossil fuel sector as well as the shutdown of plants through the pandemic have kept refining activity suppressed. Commodity prices have broadly declined, which should help with overall inflation levels; however, the cost for heat and transportation for many may be increasing for sometime.

Various pieces of inflation data over the past month have come in better than expected and provided some evidence that price pressures may be easing. This has driven much of the S&P 500’s rally that started on 10/13/22. The index has risen just over 10% from that point through 11/29/22. The rally has stalled in the latter half of November though as commentary from Fed officials has largely poured cold water on hopes that the market may see a ‘pivot’ from their aggressive stance on hiking rates. If the trend in moderating inflation continues, the market will likely continue to try and anticipate the end of the hiking cycle; however, a single month does not define a trend, thus we remain cautious and still question the sustainability of the rally. Outside of the resilient labor market, overall economic activity has been moderating. The S&P Global Flash U.S. Composite PMI showed services activity continued to contract for the fifth straight month in November, while manufacturing activity has started to contract for the first time since June of 2020. The S&P Global report showed rising rates and inflation were cutting into disposable incomes, weakening overall demand. That dynamic may be more likely to continue as consumer savings rates have deteriorated significantly, and in turn, consumers have fueled recent spending with increased credit usage, which can only last for so long. Banks have already begun to tighten their lending standards compared to the first half of 2022. If consumers pull back their spending further, economic growth and corporate earnings should become increasingly challenged and keep the uncertainty in the markets elevated.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.