What is the Medicare Open Enrollment Period?

Medicare’s Open Enrollment Period — which runs from October 15 through December 7 — is your annual opportunity to switch your current Medicare health and prescription drug plans to ones that better suit your needs. Just in time for Open Enrollment, 2023 Medicare premiums, deductibles, and other costs have been announced, and surprisingly, some of these costs are lower than they were last year.

What to consider?

Start by reviewing any materials your plan has sent you. Look at the coverage offered, the costs, and the network of providers, which may be different than last year. Maybe your health has changed, or you anticipate needing medical care, or new or pricier prescription drugs. If your current plan doesn’t meet your health-care needs or fit your budget, you can make changes. But if you’re satisfied with what you currently have, you don’t need to do anything. The coverage you have will continue.

During Open Enrollment, you can:

- Switch from Original Medicare to a Medicare Advantage Plan

- Switch from a Medicare Advantage Plan to Original Medicare

- Change from one Medicare Advantage Plan to a different Medicare Advantage Plan

- Change from a Medicare Advantage Plan that offers prescription drug coverage to a Medicare Advantage Plan that doesn’t offer prescription drug coverage

- Switch from a Medicare Advantage Plan that doesn’t offer prescription drug coverage to a Medicare Advantage Plan that does offer prescription drug coverage

- Join a Medicare prescription drug plan (Part D)

- Switch from one Part D plan to another Part D plan

- Drop your Part D coverage altogether

Any changes made during Open Enrollment are effective as of January 1, 2023.

What should you do?

Now is a good time to review your current Medicare plan. As part of the evaluation, you may want to consider several factors. For instance, are you satisfied with the coverage and level of care you are receiving with your current plan? Are your premium costs or out-of-pocket expenses too high? Has your health changed, or do you anticipate needing medical care or treatment, or maybe you are on new or pricier prescription drugs?

Open Enrollment Period is the time to determine whether your current plan will cover your treatment and what your potential out-of-pocket costs may be. If your current plan does not meet your healthcare needs or fit within your budget, you can switch to a plan that may work better for you.

Be sure to also consider how these changes impact your eligibility for a Medicare Supplement Plan as medical underwriting may be required.

Medicare Part B (Medical Insurance) costs for 2023

Most people with Medicare who receive Social Security benefits will pay the standard monthly Part B premium of $164.90 in 2023. This premium is $5.20 lower than it was in 2022 due to lower-than-projected spending for a new drug, Aduhelm, and other Part B items and services.1

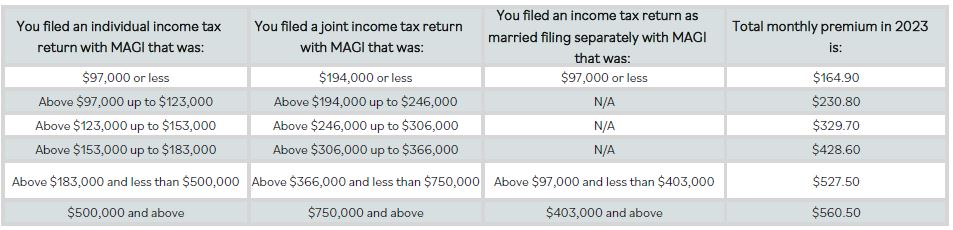

People with higher incomes may pay more than the standard premium. If your modified adjusted gross income (MAGI) as reported on your federal income tax return from two years ago (2021) is above a certain amount, you’ll pay the standard premium amount and an Income-Related Monthly Adjustment Amount (IRMAA), which is an extra charge added to your premium, as shown in the following table.

People with higher incomes may also pay a higher premium for a Medicare Part D prescription drug plan, because an IRMAA will be added to the Part D basic premium based on the same income limits in the table above. Part D premiums vary, but the average basic monthly premium for 2023 is projected to be $31.50 (down from $32.08 in 2022).

People with Medicare Part B must also satisfy an annual deductible before Original Medicare starts to pay. For 2023, this deductible is $226 (down from $233 in 2022).

*This premium applies to a new benefit that extends coverage for immunosuppressive drugs for people who qualify for Medicare coverage due to end-stage renal disease. Prior to 2023, Medicare coverage, including immunosuppressive drug coverage, ended 36 months after a successful kidney transplant. Beginning January 1, 2023, Medicare will offer a new benefit that will help continue to pay for immunosuppressive drugs beyond 36 months for people who don’t have other health coverage. It does not cover other items or services. Rates shown apply to people who file individual or joint tax returns. Premiums for beneficiaries filing as married filing separately are different.

Medicare Part A (Hospital Insurance) costs for 2023

- Part A deductible for inpatient hospitalization: $1,600 per benefit period (up from $1,556 in 2022)

- Part A premium for those who need to buy coverage: up to $506 per month (up from $499 in 2022) — most people don’t pay a premium for Medicare Part A

- Part A coinsurance: $400 per day for days 61 through 90, and $800 per “lifetime reserve day” after day 90, up to a 60-day lifetime maximum (up from $389 and $778 in 2022)

- Part A skilled nursing facility coinsurance: $200 for days 21 through 100 for each benefit period (up from $194.50 in 2022)

COVID-19 & Medicare

COVID-19-related items & services. Medicare covers several items and services related to COVID-19. FDA-authorized vaccines are administered free of charge. Be sure to bring your red, white and blue Medicare card with you when you get the vaccine so your health care provider or pharmacy can bill Medicare. Diagnostic tests check to see if you have COVID-19 and FDA-authorized antibody tests to see if you’ve developed an immune response to COVID are both covered through Medicare. FDA-authorized monoclonal antibody treatments can help fight the disease and keep you out of the hospital if you test positive and have mild to moderate symptoms. Through Medicare you should pay nothing for this treatment.

Part D late enrollment penalty

You can sign up for Part D coverage through Medicare with no penalty if you previously had “creditable” drug coverage. This refers to Medicare’s requirement to carry comparable coverage for at least 63 days in a row after your initial enrollment period. If you did not enroll in Part D at that time, and do not currently have a comparable drug program, you may have to pay a late enrollment penalty which is added to your monthly Part D premium for as long as you remain on Medicare.

Your initial enrollment period is the seven-month period that starts three months before you turn age 65 (including the month you turn age 65) and ends three months after the month you turn 65.

What’s Changing for 2023?

Transplants & Immunosuppressive Drugs If you only have Medicare because of End Stage Renal Disease (ESRD), your Medicare coverage, including immunosuppressive drug coverage, ends 36 months after a successful kidney transplant. Beginning January 1, 2023, Medicare will offer a new benefit that helps continue to pay for your immunosuppressive drugs beyond 36 months, if you don’t have other health coverage. This new benefit only covers your immunosuppressive drugs and no other items or services. It isn’t a substitute for full health coverage. You can sign up for this new benefit starting October 1, 2022. If you sign up by December 31, your coverage starts on January 1, 2023. To sign up, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0788.

Where can you get more information?

Determining what coverage you have now and comparing it to other Medicare plans can be confusing and complicated. If you have questions, reach out to your Medicare Supplement Provider or your SFMG Wealth Management Team for additional assistance with making these decisions.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the data is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity.

You can view more information on Medicare benefits in the Medicare & You 2023 Handbook and access a Medicare plan finder tool that allows you to compare health and drug coverage options at medicare.gov.

You can also call your State Health Insurance Assistance Program (SHIP) for free, personalized counseling. Visit shiptacenter.org or call the toll-free Medicare number 800-MEDICARE (800-633-4227) to find the phone number for your state.

Medicare Part C (Medicare Advantage) costs vary by plan, but the projected average premium for 2023 plans is $18 (down from $19.52 in 2022). You will also have to pay the Medicare Part B premium

1 The Centers for Medicare & Medicaid Services, 2022